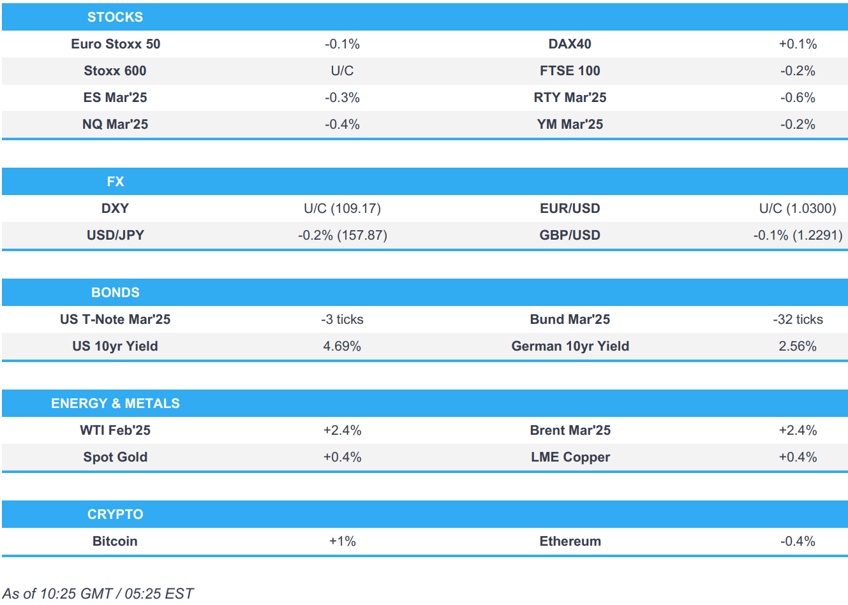

- European bourses trade choppy, US futures edge lower ahead of the US NFP report.

- USD eyes NFP, JPY boosted by BoJ source report, GBP unable to recoup lost ground.

- Fixed income a touch lower ahead of US jobs data, Gilts continue to underperform.

- Crude soars on geopolitical updates, Industrial commodities bolstered by Chinese commentary.

- Looking ahead, US & Canadian Jobs, US UoM Survey, Chinese M2 Money Supply, FDI, Loan Growth, Earnings from Tilray, Delta Air, Walgreens Boots Alliance & Constellation Brands.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses opened with a slight negative bias, continuing the mostly subdued mood in APAC trade overnight. Since, trade has been choppy, briefly climbing into positive territory before once again dipping lower.

- European sectors hold a slight negative bias, and with the breadth of the market fairly narrow. Basic Resources tops the pile, propped by the continued strength in metals prices. Telecoms follows behind, with Media completing the top 3. Retail is underperforming today, hampered by post-earning losses in Sainsbury’s.

- US equity futures are modestly in the red, as cash trade returns from holiday on account of the US Day of Mourning for President Carter. The highlight of the day is the US jobs data for December. The pace of payroll growth is expected to ease, in keeping with the Fed’s view that it is “cooling gradually”.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly steady vs. peers after advances in the JPY dragged DXY lower (see JPY section for details). Attention today is on the December US jobs report which is expected to see a slowdown in jobs growth to 160k from 227k and the unemployment rate hold steady at 4.2%. For now, DXY is tucked within yesterday's 108.94-109.37 range with focus to the upside on the current YTD peak at 109.57.

- EUR is flat vs. the USD with fresh EZ-specific drivers on the light side and a 25bps rate cut by the ECB later this month near-enough fully priced by the market. EUR/USD has pivoted around the 1.03 mark in early trade in a 1.0282-1.0311 range.

- JPY the best performer across the majors following source reporting via Bloomberg suggesting that the BoJ is still mulling its rate decision for January and is mulling raising its inflation forecasts on account of JPY softening. As it stands, odds of a 25bps hike for the 24th January meeting are seen as a near coin-flip. The source reporting knocked USD/JPY back below the 158 mark with a current session trough at 157.63 which is just a touch above yesterday's 157.57 base.

- GBP is unable to launch much of a recovery vs. the USD as traders remain wary over the UK's fiscal position and recent rise in yields. On which, reporting via The Times suggests that UK Chancellor Reeves is planning a significant speech on growth in January and has asked ministers to draft concrete measures to bolster activity and to "cease anti-growth measures"; details remain light at this stage. For now, Cable has stabilised above yesterday's 1.2239 low.

- Antipodeans are both at the foot of the G10 leaderboard. AUD/USD failed to capitalise on the upside overnight triggered by news that the PBoC is to temporarily halt bond purchases and has returned to a 0.61 handle but is thus far managing to hold above yesterday's 0.6171 base which was the lowest level since October 2022.

- CAD is a touch softer vs. the Greenback in the run up to the Canadian and US labour market reports. For now, USD/CAD sits just above the 1.44 mark with focus on the 2024, multi-year peak at 1.4467.

- PBoC set USD/CNY mid-point at 7.1891 vs exp. 7.3138 (prev. 7.1886).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer, but lifting back towards the unchanged mark as the European risk tone deteriorates a touch. The benchmark came under modest pressure on the BoJ sources (see JGB section) this morning but otherwise action has been relatively minimal thus far as participants return from the Federal Holiday; in a slim 108-02+ to 108-09 band. The main event today is December’s jobs report, where the pace of payroll growth is seen easing for the month.

- JGBs are softer, hit by a Bloomberg sources piece that the BoJ is said to be considering increasing the inflation forecast for FY25 and intends to wait until the very last moment before deciding on increasing rates. An article which weighed on fixed generally and pushed JGBs below the 141.00 handle to a 140.84 session trough.

- Gilts gapped lower by 28 ticks and then slipped a touch further to an 89.53 base and has remained in proximity to the trough since. While pressured, the benchmark is comfortably above Thursday’s 89.00 contract low but significantly shy of the 92.02 open from Monday.

- Bunds are in the red, with general fixed price action. Though, as the European risk tone deteriorates, EGBs have lifted off lows with Bunds attempting to return to the upper-end of a 131.07-131.37 band.

- OATs are the relative EGBs outperformer after a Politico piece on Thursday around potential pension reforms as a way of getting support from left-wing parties.

- Click for a detailed summary

COMMODITIES

- Overall, an upbeat Friday thus far for the crude oil complex on the back of some jawboning from China in early hours coupled with geopolitical updates. Significant upside was seen following reports that Israeli Defence Minister Katz said he has ordered the IDF to present him with a plan "for the complete defeat of Hamas in Gaza,". Brent Mar sits at the upper end of a USD 77.03-78.65/bbl.

- Firm trade across precious metals but to varying degrees. Palladium outperforms alongside a strong performance in the Auto stocks, whilst gold and silver are underpinned by the softer Dollar and recent geopolitical updates.

- The base metal complex hold an upward bias amid broader strength in industrial commodities following commentary from China ahead of next week's GDP release. 3M LME copper found resistance at USD 9,150.00/t to trade in a current USD 9,098.50-9,150.00/t parameter.

- Shanghai Warehouse Stocks: Aluminium -11.07k/T (prev. -7.9k/T), via the exchange.

- India's Gas Exchange exec. says they intend to launch 3-6month gas contracts.

- Slovakian PM Fico says Russian President Putin guaranteed Russia will meet its gas supply commitments. Says he spoke to Russian President Putin about the gas contract which Gazprom must deliver gas to Slovakia; says some Russian gas can be delivered through the southern corridor.

- Click for a detailed summary

NOTABLE DATA RECAP

- Norwegian Core Inflation YY (Dec) 2.7% vs. Exp. 2.8% (Prev. 3.0%); Consumer Price Index YY 2.2% vs. Exp. 2.5% (Prev. 2.4%)

- Swiss Unemployment Rate Adj (Dec) 2.6% vs. Exp. 2.6% (Prev. 2.6%)

- French Consumer Spending MM (Nov) 0.3% vs. Exp. 0.2% (Prev. -0.4%, Rev. -0.3%)

- Italian Retail Sales NSA YY (Nov) 1.1% (Prev. 2.6%); Retail Sales SA MM (Nov) -0.4% (Prev. -0.5%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is, according to The Times, planning a significant speech on growth in January and has asked ministers to draft concrete measures to bolster activity and to "cease anti-growth measures".

NOTABLE US HEADLINES

- US President Biden said the federal government will cover 100% of the disaster response costs for 180 days for California and noted that three major fires are still burning, while he added Congress will have to step up when they ask for more help on LA fires and that they will go back to Congress for more help on this.

- Russian Kremlin says a meeting with Russian President Putin and US President-Elect Trump is being set up; no details yet.

GEOPOLITICS

MIDDLE EAST

- Israeli Defence Minister Katz says he has ordered the IDF to present him with a plan "for the complete defeat of Hamas in Gaza," if there is no hostage deal by the time incoming US president Trump takes office (Jan 20th), according to ToI journalist.

- US President Biden said they are making progress on a Gaza deal and he is still hopeful there will be a prisoner exchange.

RUSSIA-UKRAINE

- US President-elect Trump said Russian President Putin wants to meet and 'we' are setting it up.

- Japan is to impose additional sanctions against Russia-related individuals and entities.

- French President Macron said he and UK PM Starmer reaffirmed commitment to supporting Ukraine, while they also discussed the situation in the Middle East and the UK-EU relationship.

OTHER

- Venezuelan opposition leader Maria Corina Machado was arrested after leaving a march in her first public appearance in months but was later freed after a brief detention, while a White House spokesperson said the US calls for the right of Venezuela’s Machado to speak freely and for President Maduro and representatives to cease harassment of the opposition.

CRYPTO

- Bitcoin is a little firmer today and has climbed back above USD 94k; Ethereum resides just shy of USD 3.3k.

- US Senate eyes crypto subcommittee as Trump considers pro-crypto Summer Mersinger as CFTC chair ahead of inauguration, according to Cointelegraph.

APAC TRADE

- APAC stocks were mostly subdued in the absence of a lead from Wall St owing to the National Day of Mourning and as participants braced for US jobs data.

- ASX 200 was dragged lower by weakness in financials and consumer stocks, while Australian Household Spending data disappointed.

- Nikkei 225 retreated with heavy losses seen in index heavyweight Fast Retailing, despite a jump in Q1 profit, as its China operations suffered a decline in revenue and a sharp contraction in profits, while the better-than-expected Household Spending from Japan did little to spur risk appetite.

- Hang Seng and Shanghai Comp conformed to the downbeat mood but with further downside stemmed after the announcement that the PBoC and China's FX regulator will hold a briefing on financial support for the economy on January 14th, while heavy losses were seen in property developer Sunac China after it received a liquidation petition in Hong Kong.

NOTABLE ASIA-PAC HEADLINES

- BoJ said to be mulling the rate decision for January, according to Bloomberg sources; mulls upgrading core-core inflation forecasts for FY24 and FY25; said to be mulling raising inflation forecast amid JPY; no decision made on raising rates. Intends to wait until the very last moment before deciding on increasing rates.

- Chinese Finance Ministry official says will firmly ban new hidden debt and speed up the reform and transformation of LGFVs. Will extend policies of reducing social insurance rates and one-off employment subsidies for some people in 2025. Will roll out new measures to boost employment in sectors including culture, tourism and foreign trade.

- PBoC is to temporarily suspend purchases of government bonds in the market during January and may resume government bond trading depending on supply and demand, while the decision was made due to short supply of treasury bonds.

- China's Vice Finance Minister says can expect more proactive fiscal policy in 2025, in terms of its strength, efficiency, and timing. Adds, fiscal policy has abundant policy room and tools. Will speed up fiscal spending in a bid to formulate actual spending and drive up more social investment. In front of new conditions and problems both domestically and externally, fiscal policy has abundant policy room and tools. Has relatively big room for the raising of debt and the deficit. To step up coordinated efforts between fiscal and monetary policy in 2025.

- Chinese economist warned against aggressive easing bets and said should avoid over-interpretation of moderately loose monetary policy in China, according to PBoC-backed Financial News.

DATA RECAP

- Japanese All Household Spending MM (Nov) 0.4% vs. Exp. -0.9% (Prev. 2.9%)

- Japanese All Household Spending YY (Nov) -0.4% vs. Exp. -0.6% (Prev. -1.3%)

- Australian Household Spending MM (Nov) 0.4% vs Exp. 0.7% (Prev. 0.8%)

- Australian Household Spending YY (Nov) 2.4% vs Exp. 2.5% (Prev. 2.8%)