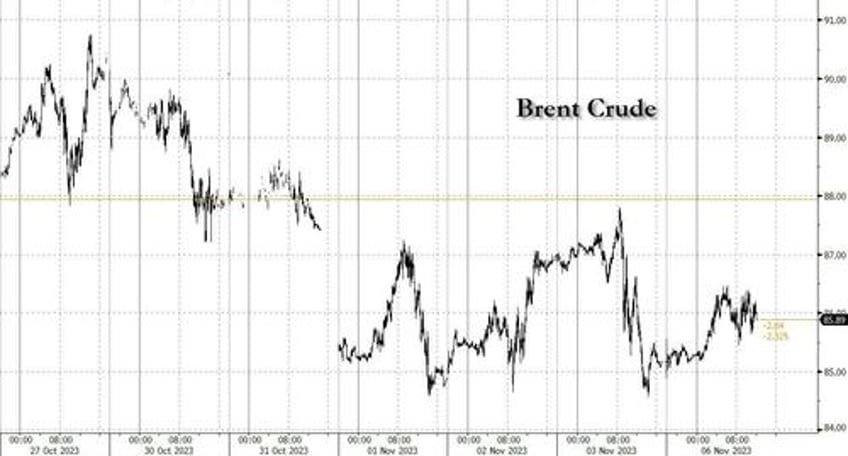

Saudi Arabia and Russia have confirmed they will extend their voluntary production and export cuts until the end of the year in a largely expected move to keep a lid on a solid portion of global supply, OilPrice reported. The news helped reverse some of oil's sharp losses from last week.

"This additional voluntary cut comes to reinforce the precautionary efforts made by OPEC+ countries with the aim of supporting the stability and balance of oil markets," Reuters quoted a statement from the Saudi energy ministry as saying.

Saudi Arabia has been producing around 9 million barrels daily, effecting a voluntary reduction of some 1 million bpd. Russia, for its part, has undertaken to reduce exports by 300,000 bpd and production by half a million barrels daily.

"The additional voluntary cut is intended to strengthen the measures taken by OPEC+ countries to maintain the stability and balance of oil markets," Deputy Prime Minister Alexander Novak said on Sunday.

Commenting on the Saudi and Russian updates, ING’s Warren Patterson and Ewa Manthey noted that this extension was expected but the market would be interested in whether the two would extend the cuts further into 2024. This might suggest the current extension was unlikely to have any immediate effect on prices but an extension into 2024 might move the benchmarks.

“Our oil balance shows that the market will be in surplus in 1Q24, which may be enough to convince the Saudis and Russians to continue with cuts through the seasonally weaker demand period of Q1,” the analysts wrote.

But the more significant part of the Saudi statement was the kingdom’s pledge to consider extending its supply cutback beyond December, according to Bloomberg's Grant Smith. Riyadh said a decision would be taken next month, but the upcoming OPEC+ meeting on Nov. 26 and its concluding press conference would be an optimal platform to maximize attention.

Many oil-watchers believe the Saudis will continue the measures for at least another month, and possibly much longer, as fuel demand growth is forecast to slow drastically. Eurasia Group says Riyadh has little choice but to keep going if it wants to avoid a renewed surplus and price slide. UBS is also predicting a continuation.

OPEC+ delegates say that, for the time being, the Saudis are keeping their cards close to their chest, though as Nov. 26 gets closer the kingdom’s intentions — or at least the market’s consensus expectation — will probably become clearer. Confirmation of extension would likely give crude a few dollars of lift.