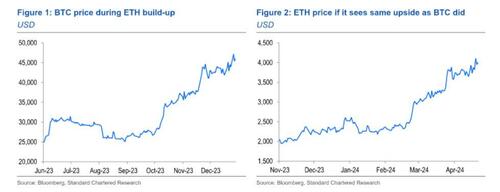

Many crypto skeptics laughed over a month ago when, back on February 5, Standard Chartered analyst Geoff Kendrick predicted that Ether would hit $4,000 by May, around the time the Ethereum ETF was approved....

... but they weren't laughing when we got there just one month later.

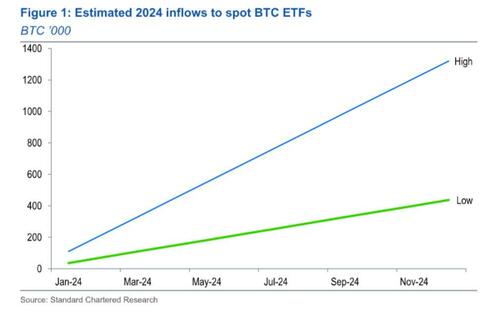

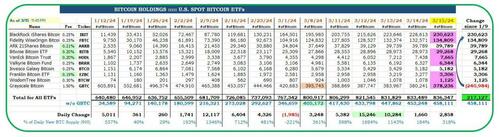

They also laughed when back in January, Kendrick laid out his "high" case for bitcoin ETF accumulation - one which would justify a 2024 year-end price of $100,000 - as hitting 400,000 in early April, on their way to 1.32 million "coins" at year-end (or just 437,000 in the low case).

Fast forward to today - it's not even April yet - and already the nine new ETFs have accumulated a whopping 458,000 bitcoin, after net buying virtually every single day since the SEC authorized bitcoin ETFs.

Bottom line: of all sellside analysts, Kendrick has proven time and again to be one of the most accurate, which is why latest research notes - one on bitcoin, and on ether - published earlier today, should be required reading for anyone following the crypto sector.

In his first note, available to pro subs in the usual place, the Standard Chartered analyst writes that his latest forecast is for the price of bitcoin - now beyond the upcoming halving - to end 2024 around USD150k (up from a long held USD100k view). Then, "in 2025 bitcoin will overshoot to a cycle high of $250k before ultimately settling around $200k which will then be the new midpoint of a higher trading range. At that time vol will fall, and so will the rate of ascent of bitcoin."

How/why will we get there?

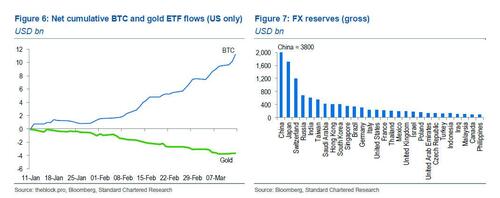

Taking a deserved victory lap, Kendrick writes that "ETF inflows have been almost exactly as I had predicted, huge, but much greater than others had expected." Indeed, the ytd inflows are bang in the middle of his previous high/low forecast range discussed here, and so suggest we end up somewhere around $75BN of inflows. At that point, the gold ETF story suggests we will be around $200k and that we then trade sideways in a higher trading rage (ie. The ETF inflows are a one-off re-rating higher).

Kendrick also notes that "a gold v BTC portfolio optimization suggests we should be around 80%/20% rather than the current 91%/9% spilt. Again that points to the USD200k level as being ‘correct’." He explains why below:

The total market cap of all above-ground gold is currently around USD 14.8tn (212,582 tonnes based on World Gold Council data, at the 15 March price of USD 2,160 per ounce). For BTC, the current price gives a market cap of USD 1.4tn – a split of 91% for gold to 9% for BTC. Assuming the gold price stays unchanged, the BTC price would need to increase to USD 190,000 in order for BTC’s share to rise to the 20% indicated by our portfolio optimisation. Again, this is close to our estimated BTC price level of USD 200,000 based on ETF inflows.

The analysis focuses some more on comps to the gold market, before turning to another potential source of bitcoin price upside: FX reserves, i.e., "another large sticky (potential) cash pool, which could follow in the footsteps of new US pension money." Specifically, Kendrick says that US and EU sanctions on Russia’s reserves "have structurally increased the appeal of non-standard reserve assets for FX reserve managers. The most obvious beneficiaries of this are gold and the CNY, but digital assets could also benefit" (as they already have in El Salvador where Nayib Bukele has previously purchased over 5,600 bitcoin). If they do, expect the largest and most liquid assets – such as Bitcoin – to receive most of the inflows. Which is why, the Standard Chartered analysts sees "a rising likelihood that large reserve managers (Figure 7) may announce BTC buying in 2024."

That pretty much covers the bullish bitcoin case; now what about Ethereum?

Well, a couple points here. First of all, recall that in recent years, Wall Street has traditionally held ethereum, due to its smart contract nature and flexible architecture in much higher regard than bitcoin. None other than Goldman Sachs said, three years ago when it initiated coverage on the crypto sector, that bitcoin is a good asset, and "ironically" will be used as the "scarce resource" to make PoS systems work "instead of natural resources", but while bitcoin may end up being a one-trick pony (if quite valuable) it is the new blockchain platforms - like Ethereum - that will serve as the basis for a "large market of trusted information", as Goldman puts it "like Amazon is for consumer goods today" (Pro subscribers can find the full Goldman report can be found in the usual place).

But it's not just Goldman: none other than the most important man in the world of finance (sorry Jamie Dimon), the head of Blackrock - which buys and sells ETFs, bonds, and any other asset class at the Fed's bidding - Larry Fink, said he is backing an ether ETF just after the SEC gave approval to Bitcoin. Specifically, the king of Wall Street, said "I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we're going to be going." And whatever Larry sees, and wants, Larry gets.

Part 2: ETH ETF pic.twitter.com/qnmB7azyQN

— Cryptik1.eth |🛸 (@Cryptik1E) January 12, 2024

That said, with just 2 months left until the SEC is expected to greenlight Ethereum ETFs, some are skeptical that the regulator will be as "forthcoming" this time as back in January with bitcoin, most notably Bloomberg's ETF guru Eric Balchunas who gives just 35% odds of an Ethereum ETF being approved in May, as "we’re 73 days from the final deadline, and there’s been no contact or comments from the SEC to the issuers. That’s not a good sign... The SEC has to give comments and the issuers have to work on correcting them. They may have to refile and they might even want to have a couple of meetings — it’s kind of a long process."

Needless to say, Standard Chartered's analyst Geoffrey Kendrick does not agree, and just as he sees much more upside to bitcoin, he sees even more potential gains for ether, which last week quietly and successfully implemented its long-awaited Dencun upgrade, thanks to which ETH is now as competitive as Solana in terms of transaction costs, via layer 2s.

But that is hardly a value proposition (just don't tell it to all those who are currently blowing Solana NFT memecoin bubbles which will burst spectacularly in a few days, assuming the centralized database that is Solana doesn't collapse - as it tends to do every other month - first). What is of potential value, is that ether ETF approval is coming one way or another, and according to Kendrick, the SEC will do so on May 23, the final deadline for the first batch under consideration, and consistent with the timeline for the SEC’s January 2024 approval of Bitcoin ETFs: "Albeit I note this is now a non-consensus view. I think the process should be the same as it was for the BTC ETFs and I don’t see why the SEC would not approve" especially since in the UK, the LSE announced on 11 March that it would accept applications for ETH and BTC ETFs, which Kendrick's think increases the chances of US approval.

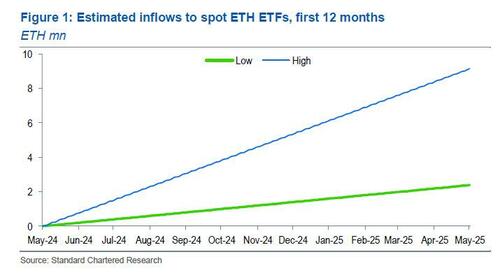

What happens then? Well, if the ETH ETFs are approved, Doug estimates $15-45BN - or 2.39-9.15 million ETH - in the first 12 months after approval, using the same logic as he applied to the BTC ETF inflows; importantly, he now sees more price upside than he previously did, and believes that ETH would keep pace with BTC, with the current 5.4% price ratio holding for the rest of 2024: "Given that we now see BTC reaching the USD 150,000 level by end-2024, this would imply a level of USD 8,000 for ETH" or just more than double from here.

But the real value of ETH will shine in 2025 when Kendrick expects the ETH-BTC cross to track higher, back to 7%, as real world use cases on ETH - the same ones laid out by Goldman - start to take shape. This, he believes, "will see ETH to USD14k by year-end 2025." There could be more gains: the report goes on to note borrow heavily from the Goldman ETH initiation report above, and states that...

"If real-world use cases start to take practical shape before the end of 2025 (we see gaming as the most likely), then we think markets will start to see ETH as the digital assets version of a big tech stock. Indeed, we see several crossovers between tech and ETH, but because tech (most recently via AI) is already visible to end-users, it has taken most of the limelight so far. We expect that to change over time in favour of ETH, which is effectively a behind-the-scenes technology solution. This is because ETH’s smart contract platform enables future applications in much the same that Apple’s iOS system enables the building of apps.

In that scenario, we see the ETH-BTC price ratio rising back to the 7% level that was in place for 18 months from mid-2021 to end-2022. This would present further upside to our estimated USD 14,000 price level by end-2025."

Impossible, you say, no way ETH rises 4x from its current price of $3,500. Perhaps, but consider the potential rise in use cases in the aftermath of the Dencun upgrade which has sent the cost of layer 2 transactions as cheap as Solanas. As a result, Kendrick believes that ETH’s use cases will "evolve towards gaming and tokenization, adding significant demand via the existing NFT and DeFi channels, respectively. Importantly, this should provide ‘proof of concept’ examples in which real-world industries come on-chain to exploit the benefits of Ethereum over their existing setups. We expect significant developments on these fronts by 2025-26."

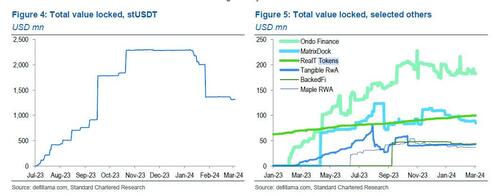

Tokenization of real-world assets has begun, but it is small so far. The largest is stUSDT (staked USDT, Figure 4) on the Tron network. Returns for stUSDT are driven by US Treasury yields. The others, which are primarily built on Ethereum, are shown in Figure 5. These offer investors a mix of exposure ranging from front-end Treasuries (Ondo) to real estate (RealT);

Note, the Standard Chartered analyst is not the first to say the true value of ETH is in tokenization: initially it was Goldman, and most recently it was the king of Wall Street, Blackrock's Larry Fink, who as we noted above, said "I see value in having an Ethereum ETF. These are just stepping stones towards tokenization and I really do believe this is where we're going to be going."

But while Goldman and Blackrock betting on ETH would be effectively a home run, what would guarantee a trifecta would be the last major holdout joining the bandwagon, and that's precisely what happened last week when the bank - whose boss has been the most vocally skeptical of bitcoin in recent years - put its chips on ETH.

In a March 14 note on Coinbase (which hiked the price target from $95 to $150; full note available to pro subs in the usual place) from JPM's Ken Worthington, the crypto analyst echoed Goldman, Standard Chartered and Blackrock, and said that while "the focus of the cryptocurrency marketplace has been the net new money going into U.S. spot Bitcoin ETFs and the positive impact on Bitcoin token prices" it is "ethereum and its native token Ether as a substantial contributor to the cryptocurrency ecosystem, and developer of blockchain technology."

Specifically, JPM writes that "it sees see the progression along the Ethereum roadmap, including the Dancun upgrade, which occurred this week on March 13, as driving crypto development, which is a longer-term positive and discuss this further in this research."

Compare and contrast that with, well, anything that Jamie Dimon has said about Bitcoin.

There is much more in the full report, including a full fawning section on ETH (that appears to have been taken almost verbatim from the Goldman initiating coverage report)...

... but the bottom line is that while Bitcoin was the pioneer in Wall Street's institutionalization race, having seen the startling success of bitcoin ETF adoption, the financial titans including Goldman, Blackrock - and now - JPM, have set their sights on what comes next, which is something near and dear to the people who manage trillions: the fastest, cheapest and most effective way to tokenize everything, from information, to data, to money itself. And they have picked the token to do it with.

So keep a close eye on what happens on May 23 when the SEC is reportedly pushing hard against ETF approval for the second biggest digital asset: with all three of the largest US financial institutions pushing hard, any resistance will die a quick and painless death.

More in the full notes from JPM, Std Chartered and Goldman