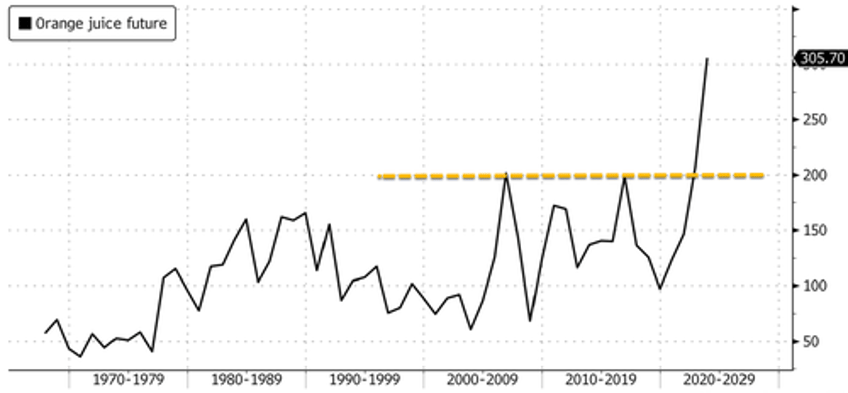

On Monday, orange juice futures rocketed to an all-time high due to global supply concerns among agricultural traders. The citrus greening disease continues to affect Florida and is spreading in Brazil -- both regions are top producers, and a potential production loss from these areas could significantly tighten global supplies.

A new report from Bloomberg shows Brazil's Citrosuco, one of the world's top orange juice producers, has considered declaring a force majeure on supplies to clients after the crop disease and extensive rainfall damaged citrus groves.

In a July 17 letter sent to clients and seen by Bloomberg, the company said it was being "severely affected" by greening disease and rain that flooded farms. It added it won't be able to ensure supplies at the volumes and prices previously agreed. Citrosuco confirmed the contents of the letter, which it said was sent as a warning to some clients who had contracts for delivery earlier this year. In a statement to Bloomberg on Monday, the company added the communication was part of specific commercial negotiations.

While the letter stated "supply performance is currently prevented by force majeure, until further notice," the company said it had not taken the actual legal step associated with invoking force majeure, a clause companies usually enforce when an unforeseen event, such as a fire or natural disaster, prevents them from complying with a contract. --Bloomberg

Citrosuco's warning was enough to send orange juice futures in New York above the $3 handle per pound, a new record high.

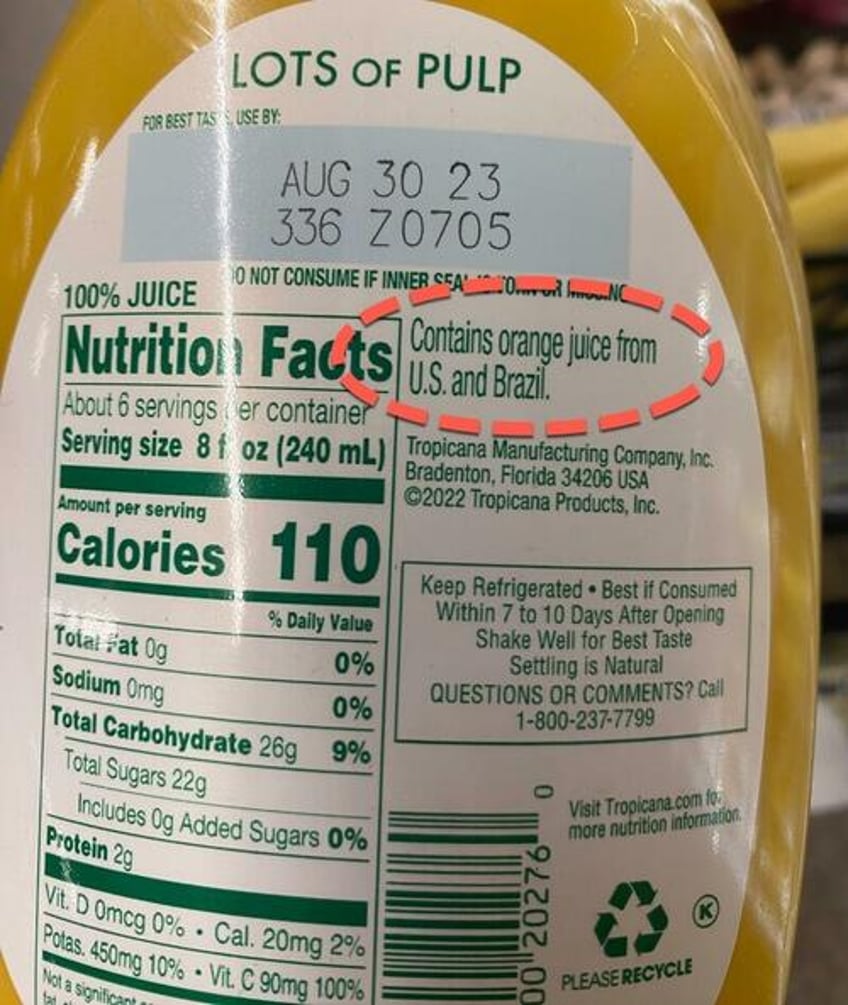

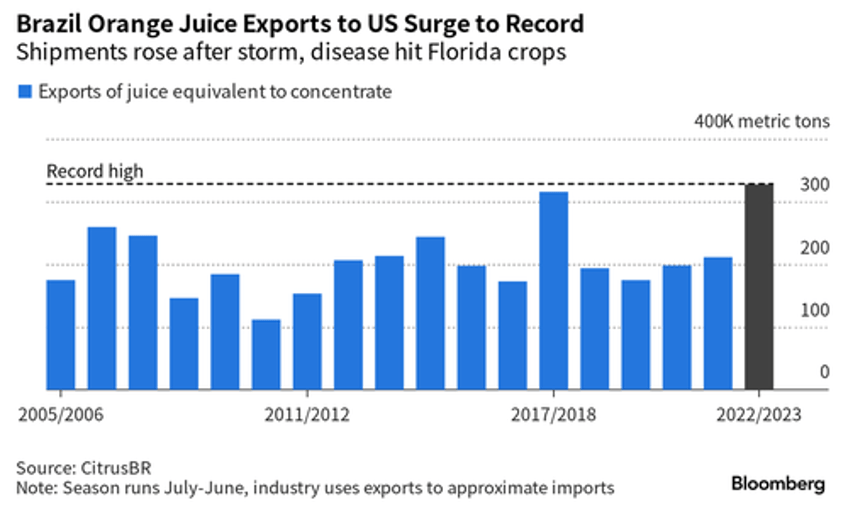

Data from the US Department of Agriculture and Citrosuco show Brazil exports 80% of its orange juice. Consumers who purchased OJ at US supermarkets have increasingly noticed labels on bottles that read: "Contains orange juice from US and Brazil."

This is because Florida supplies are low and exports from Brazil have soared to new highs.

"The proliferation of disease continues to be great in Florida and the chance of a large comeback in production for the new season is limited," Judy Ganes, president of J. Ganes Consulting, told Bloomberg.

Ganes said, "There are signs that disease is more prevalent in Brazil, too, which is also facing long-term problems with their crops."

Even though egg prices have crashed, breakfast inflation remains elevated for yet another reason.