By now it has become abundantly clear (and if it isn't, the openly biased media has certainly made it its purpose to highlight over and over) what the downside is to the US from Trump's ongoing trade war against the world, but especially China: sliding markets, rising rates, dumping dollar. The economy has so far proven resilient, with hard data surprising to the upside for the past 2 months (perhaps as a result of pre-buying ahead of tariffs), even as sentiment (among Democrats) has crashed and inflation expectations (also among Democrats) have exploded (yet oddly those same Democrats aren't rushing to spend all their hard-earned savings today instead of waiting a year from now when they are certain their purchasing power to be 6-10% lower). However, as Michael Every writes today, if what is now effectively a US-China trade embargo remains in place, the US economy "could see shortages on shelves within weeks and/or of price rises" and then, even if there is a tariff U-turn logistics would then be overwhelmed.

In short, we know what the pressure points for the US are. But what about China, and why has the media kept such a tight lid on reporting across the Pacific (besides the obvious, namely that in a Trump world, China, Democrats and the media are all aligned in seeking to tear down the US).

To answer this all important question - because stated simply, the first country that hits a max pain point will also be the one that loses the trade war - we were one of the (very) few to take a closer look at how the sudden freeze in China's exports to the US and their various supply chains is translating into a domestic economic impact, and found that several sectors of China's economy are already in deep pain (see "Chinese Plastics Factories Face Mass Closure As US Ethane Supply Evaporates").

Today, the FT picks up where we left off, and finds that factories across all of China have begun shutting down and furloughing workers "as the trade war unleashed by US President Donald Trump dries up orders for products ranging from jeans to home appliances."

As we first explained earlier this week, with most Chinese goods now facing US duties of at least 145%, or simply lacking the raw materials needed to process goods and sent them onward to the US, Chinese factory owners told the FT that American customers have cancelled or suspended orders, forcing them to cut production.

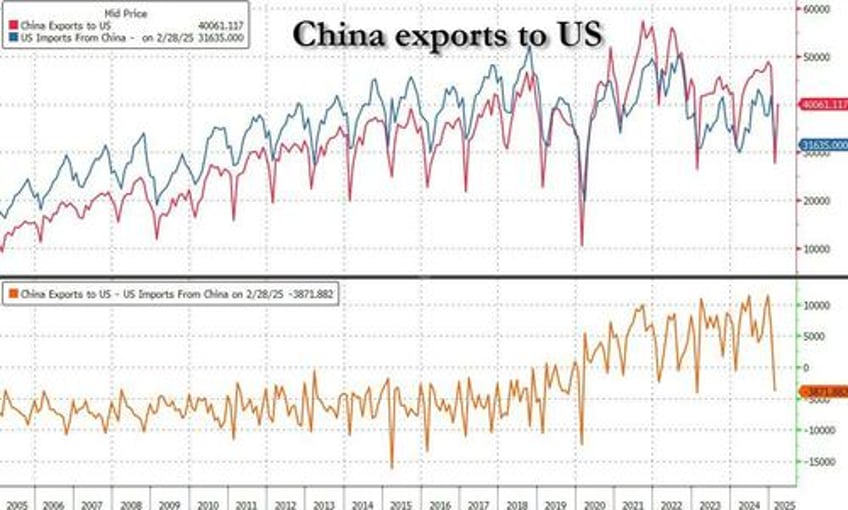

With about 15% of all Chinese exports last year going to the US...

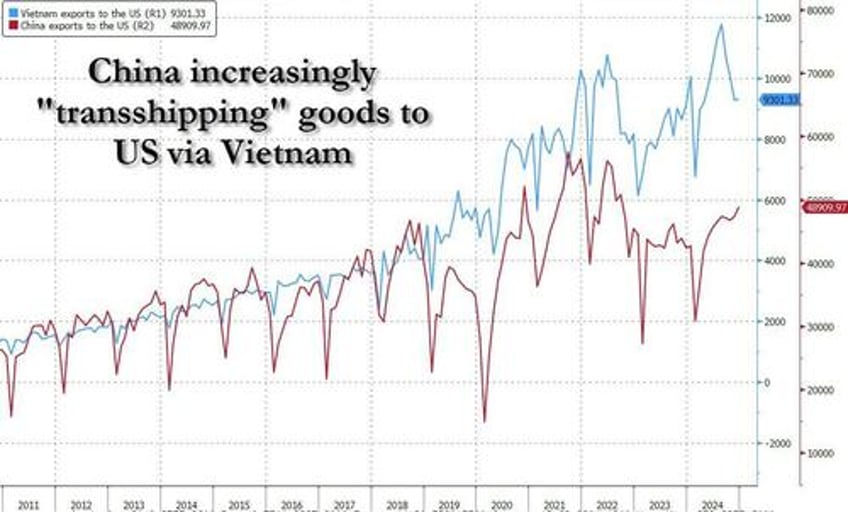

... and with China increasingly transshipping billions of goods to the US using such (formerly) untariffed venues such as Vietnam...

.... it is not all surprising that as China's largest trading partner halts most imports, pain would be pervasive. And it is: in interviews with the Financial Times and via dozens of social media posts, workers shared pictures of quiet production lines or factory suspension notices, highlighting how the tariffs are starting to bite.

According to workers who opened up to the FT, trade war had prompted the suspension of production for a week or more at plants making products ranging from shoe soles to jeans, electrical outlets and portable stoves.

Some factory owners said they were cutting overtime or weekend work.

Wang Xin, head of the Shenzhen Cross-Border E-Commerce Association, an industry group representing more than 2,000 Chinese merchants, said many of them were “extremely anxious” and had told factories and suppliers to halt or delay deliveries. This had prompted some factories to suspend production for one to two weeks, she said.

Three factory recruiters in Guangdong who work with manufacturers said more factories were cutting overtime and weekend work with only the most heavily dependent on American orders putting the whole factory on leave.

“Our export orders disappeared so we’ve temporarily stopped,” said a 28-year-old plastics factory worker in Fujian province, adding that production had been halted for a week so far.

Others are bracing for a much longer shutdown: executives at DeHong Electrical Products in Dongguan, Guangdong province, gave workers one month leave on minimum wage and said the factory was under “significant near-term pressure” after clients suspended orders.

“Management is working hard to find solutions, including expanding into new markets and optimising cost structures, so we can resume normal operations as soon as possible,” DeHong said in a notice seen by the Financial Times. As Treasury Secretary Scott Bessent said yesterday, "good luck" finding a replacement market that will absorb all your US-based production.

The problem for China is that unlike the US, it has no centralized social safety net, so the longer the trade war continues and the more workers are furloughed - then fired - the progressively faster the situation will get.

Hangzhou Stellarmed, a company in Zhejiang province that makes endoscopy kits primarily for the US market, told full-time workers they could use the rest of April to find new jobs and provided them with access to a headhunting agency. Once again, good luck finding new jobs when on the margin, millions of export workers are about to be laid off everywhere.

“We don’t know how long this will last,” said Shi, the factory owner, who did not want to be identified by her full name. “We can only wait and see, there is nothing we can do.”

Similar anecdotes are prevalent across the country: plastic mould maker Dongguan Yuanguan Technology blamed the tariffs for forcing it to cancel all weekend overtime at its factory, according to a company notice and a worker.

A 26-year-old man in Zhejiang said the toy factory he worked at sold mostly to the US, forcing management to give workers about two weeks off. “It’s not easy at the moment,” he said, asking not to be named.

Needless to say, it is unclear how widespread the factory suspensions are, said Han Dongfang, founder of China Labour Bulletin, which closely tracks Chinese manufacturing and labour. “The rearrangement of China’s manufacturing sector will be a long-term process and workers will be sacrificed,” he said. Furthermore, the fact that any marginal pain will be amplified as trade war weakness will mean that Beijing will do everything in its power to prevent the full extent of the shutdowns from being revealed.

Meanwhile, China’s electronics supply chain - which employs tens of thousands of people - got a reprieve last week when Washington exempted smartphones along with some other electronics from the steepest tariffs. But domestic eletronics producers are bracing for the worst, expecting to be swept in the trade war along with the rest of their peers, and big tech companies and cities with large concentrations of exporters, such as Shenzhen and Dongguan, are rolling out support programs intended to “stabilize foreign trade”. Shenzhen last week unveiled subsidies for companies to participate in foreign trade shows and said it would expand export insurance to help cover cancelled US orders, among other policies. Yet again, good luck.

A manager at Ningbo Taiyun Electric said they had suspended production on April 12, but had since restarted reduced output of electric hair straighteners and curling irons. “We still have some orders from Europe, we’re trying to get more,” said the manager, who asked not to be named. “Hopefully the US will change its policies.” Because if it doesn't, millions will end up unemployed; and with no short-term welfare state benefits to hold them over until the economy recovers, it could get very ugly... just as Trump expects it will.

Elsewhere, UBS' Chief China Economist, Tao Wang thinks China still has a big output gap as its growth recovery has been weak, something which the nevertrump media also refuses to highlight. That’s why the Central Economic Work Conference last year said China has three priorities: 1) boost consumption, 2) support technology innovation and 3) defend the world trade order.

Regarding the trade war, it is a big demand shock to China happening now, but according to UBS China policy response will only happen later, if only so Xi does not telegraph weakness before Trump. This will drag China growth this year to only 3.4% y/y.

Tao thinks China will respond mainly with bazooka fiscal stimulus, and monetary easing will be in the secondary role, just as we predicted.

China, which reported a record trade surplus of nearly $1tn last year, has responded to Washington’s tariffs by imposing an extra 125 per cent levy on imports from the US. While Trump has repeatedly said he wants to speak with Chinese President Xi Jinping to resolve trade issues, Beijing appears in no hurry to request a call between the two leaders... But when a procession of angry unemployed factory workers heads for Beijing, Xi will be running to dial the White House.