Tyson Foods Inc., the world's largest processor of chicken, beef, and pork, tumbled Monday morning in New York after it reported adjusted earnings per share for the third quarter that missed the average analyst estimate.

Third Quarter Results:

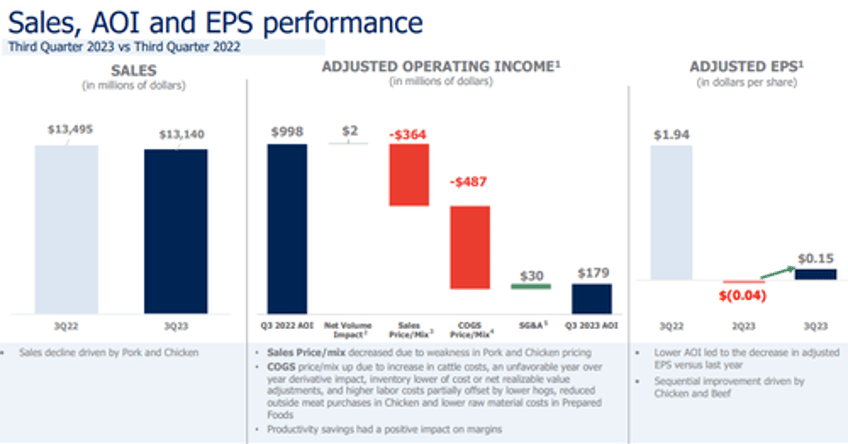

Adjusted EPS 15c vs. $1.94 y/y, estimate 26c (Bloomberg Consensus)

Loss per share $1.18 vs. EPS $2.07 y/y

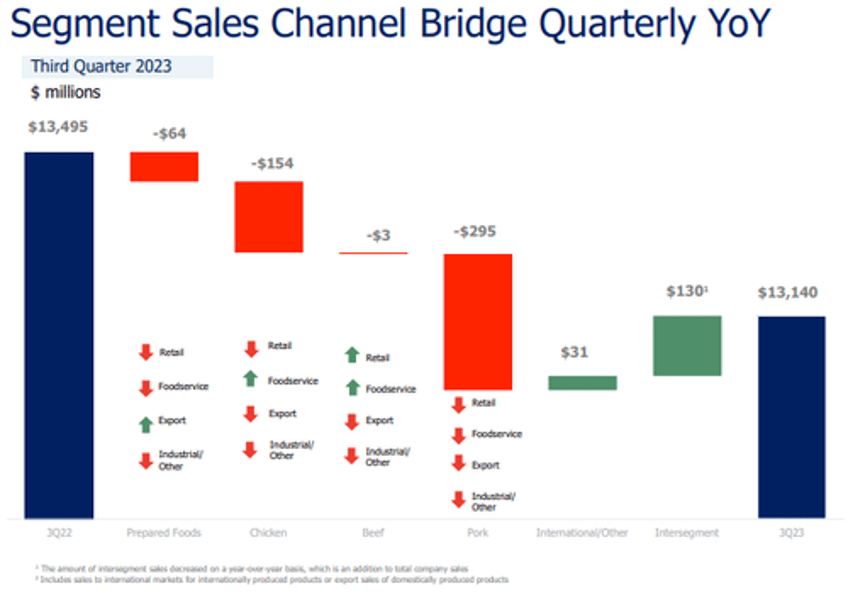

Sales $13.14 billion, -2.6% y/y, estimate $13.59 billion

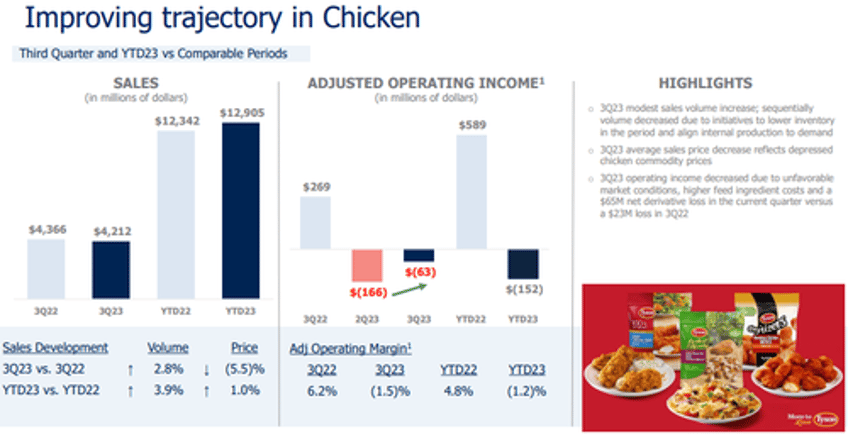

Third quarter sales declined due to weakening demand compared to the same quarter last year.

Third-quarter sales volumes reveal consumers ditched beef and pork for less expensive chicken.

The real great rotation: from beef and pork to chicken. Tyson foods Q3:

— zerohedge (@zerohedge) August 7, 2023

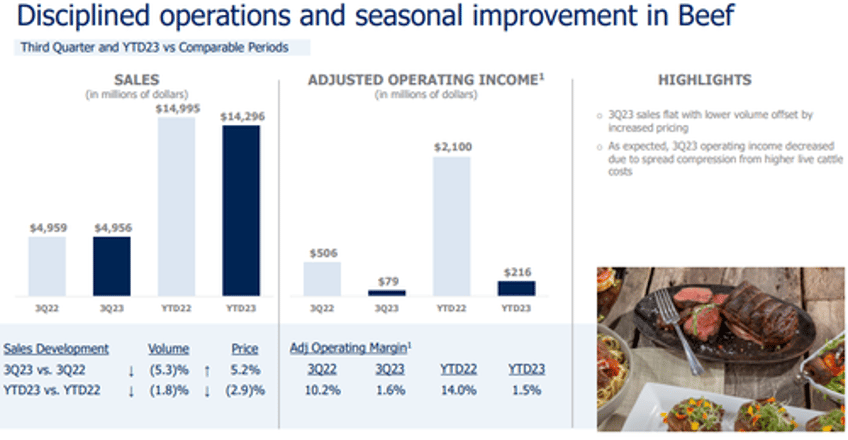

Beef Sales Volume -5.3% vs, est -2%

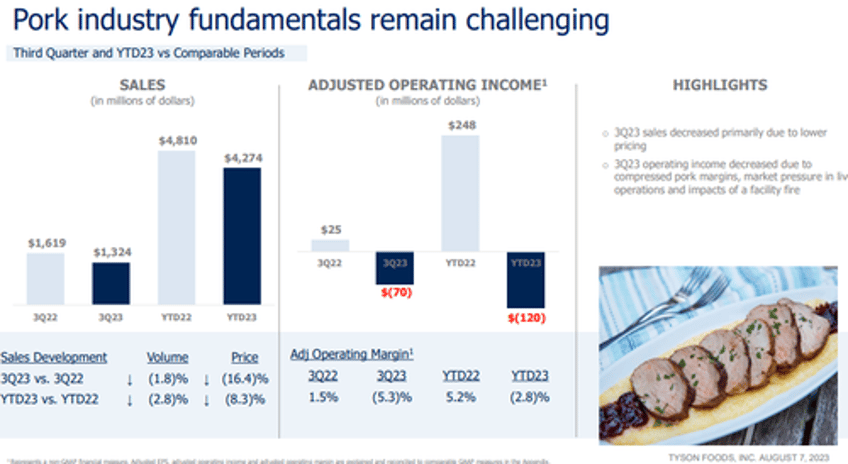

Pork Sales Volume -1.8% vs, est +1.5%

Chicken Sales Volume +2.8% vs. -2.1% y/y

Insects undisclosed yet

There also appears to be a reduction in prepared food sales, such as items found in the frozen food section at supermarkets.

Third Quarter Sales:

Sales volume +0.3%

Beef Sales Volume -5.3% vs. +1.3% y/y, estimate -2%

Pork Sales Volume -1.8% vs. -1.7% y/y, estimate +1.5%

Chicken Sales Volume +2.8% vs. -2.1% y/y

Prepared Foods Sales Volume -0.7% vs. -8.5% y/y, estimate +4% (2 estimates)

International/Other Sales Volume +0.5% vs. +21.9% y/y

Update on the beef segment:

Update on the pork segment:

Update on the chicken segment:

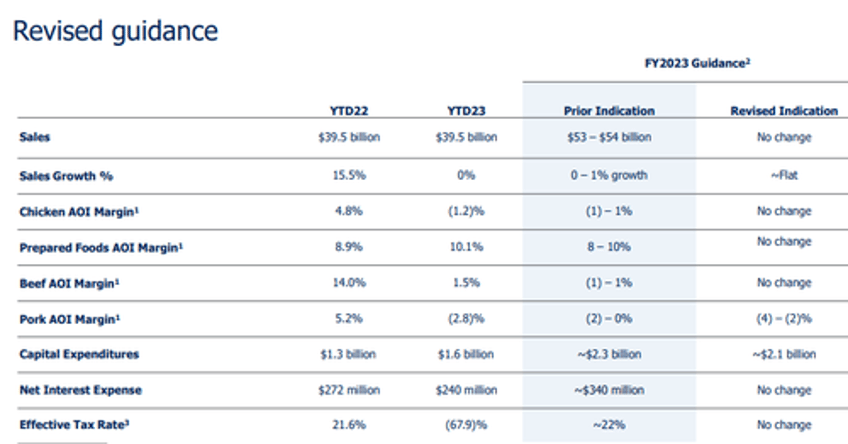

Tyson listed nine-month highlights that showed sales are flat:

Sales of $39,533 million, flat from prior year

GAAP operating income of $68 million, down 98% from prior year

Adjusted operating income of $697 million, down 81% from prior year

GAAP EPS of $(0.56), down 108% from prior year

Adjusted EPS of $0.97, down 86% from prior year

Total Company GAAP operating margin of 0.2%

Total Company Adjusted operating margin (non-GAAP) of 1.8%

Repurchased 5.4 million shares for $343 million

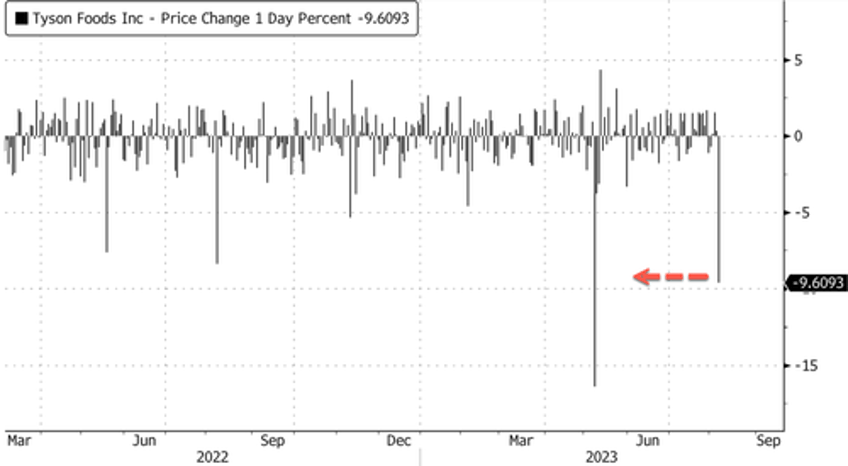

Tyson shares plunged 11% at the opening of the cash session.

Largest plunge since execs slashed the outlook for the year in May, calling the protein market "challenging."

Here's an update on guidance:

Donnie King, President and CEO of Tyson Foods, wrote in a statement, "The current market dynamics remain challenging."

King announced the closure of four chicken facilities in North Little Rock, Arkansas; Corydon, Indiana; Dexter, Missouri and Noel, Missouri.

The biggest takeaway is that American consumers are becoming more cautious and pulling back on meat purchases amid two years of negative real wage growth.