This was not the release tech bulls wanted ahead of the most anticipated report of earnings season.

Shares of cybersecurity company Palo Alto crashed as much as 20% after it slashed its revenue forecast for the year, sparking concerns that tech euphoria may be misguided and that customers are reining in tech spending.

Here's what the company just reported for the just concluded fiscal Q2 ended Jan 31:

- Sales rose 19% to $1.975 billion beating estimates of $1.97 billion, and in line with the company's Nov guidance of $1.955BN-$1.985BN.

- Product revenue grew more slowly than service and support sales, underscoring an ongoing shift at the company.

- Adjusted EPS rose to $1.46 a share, also beating estimates of $1.30, and above the company's November guidance of $1.29-$1.31

While the historicals were solid, it was the company's guidance that shocked investors:

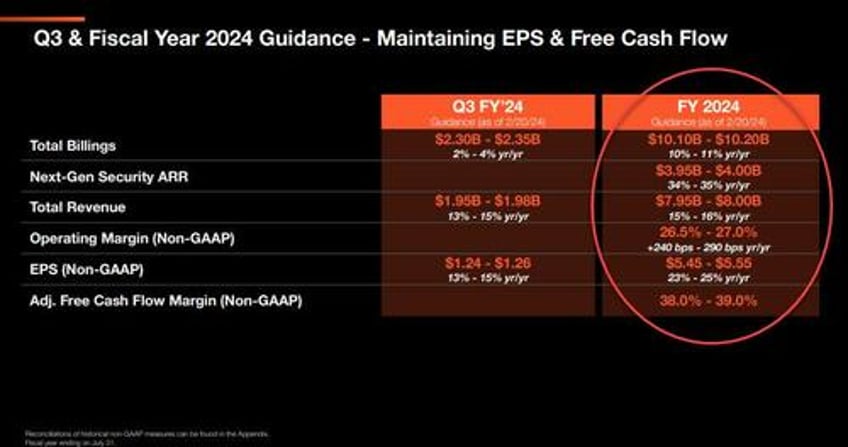

- PANW reported that sales in 2024 will be $7.95BN-$8BN this fiscal year, a decline from the previous projection of as much as $8.2 billion, and also a big miss to analyst estimates of $8.18 billion.

- The top end of Palo Alto Networks’ sales forecast represents an increase of 16%, well below its 25%-plus growth rate of recent years;

- according to Bloomberg, the outlook suggests that customers may are dialing back their spending ambitions, even as online attacks proliferate.

- Worse, Palo Alto said that its closely watched billings would come in the range of $10.1BN-$10.1BN this year, a huge drop from its previous range went as high as $10.8 billion.

The silver lining: the company did maintain its outlook for earnings and free cash flow for fiscal 2024, which Chief Financial Officer Dipak Golechha said reflected “disciplined execution on profitable growth”, although granted it didn't do much for the stock after hours.

CEO Nikesh Arora echoed those remarks on a conference call, telling analysts that the company has been successfully executing its profitable growth strategy. But he also said customers were facing “spending fatigue” in cybersecurity.

“This is new,” he said. Customers are finding that adding incremental products “is not necessarily driving a better security outcome for them.” Just wait until customers discover the very same thing about chatbots which aren't driving a better revenue outcome either.

Palo Alto shares fell as much as 19% in extended trading following the earnings report. Palo Alto Networks, alongside other cybersecurity companies like Crowdstrike Holdings, had outperformed most of its tech peers in 2024. Shares had climbed 24% this year on the hope that cyber investments would continue to surge. Now it's time to pull the hype punchbowl away with the stock giving away almost all YTD gains in seconds.