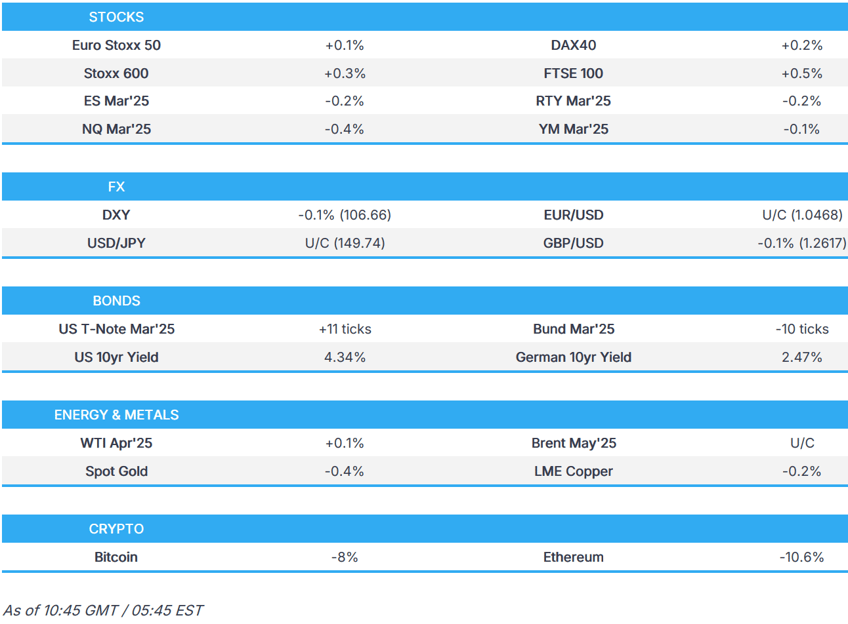

- European bourses are mostly firmer after opening entirely in the red following a negative APAC handover; though US futures remain in the red.

- DXY is a touch lower, EUR/USD stuck on a 1.04 handle, Antipodeans lag.

- Diverging performance with USTs higher whilst Bunds are lower awaiting coalition and/or spending updates.

- Choppy trade in crude with metals subdued despite the softer Dollar.

- Looking ahead, US Consumer Confidence, Richmond Fed Index, NBH Policy Announcement, Fed Discount Rate Minutes Speakers including RBA's Jones, Fed's Barr, Barkin, ECB’s Schnabel & BoE’s Pill, Supply from the US, Earnings from Home Depot, Dr Pepper, AMC, Lucid.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump's team is seeking to tighten chip controls on China with the US said to be pressing Japan and Netherlands to align on China restrictions, while it is weighing tighter controls on Nvidia (NVDA) chip exports to China, as well as considering more restrictions on SMIC (981 HK) and CXMT. Furthermore, US officials reportedly met with Japanese and Dutch counterparts to restrict Tokyo Electron (8035 JT) and ASML (ASML NA) engineers from maintaining semiconductor equipment in China, according to Bloomberg.

- Mexico studies tariffs on China in a bid to strike a deal with US President Trump, while Mexican President Sheinbaum said she sees agreements with the US by Friday and that Mexican officials are in Washington studying possible China levies, according to Bloomberg.

- WTO panel is to examine measures adopted by Turkey targeting Chinese EV imports.

- French President Macron said he hoped he convinced Trump on trade and noted that they do not tariff the US, while he added that they don't need a trade war and the urgency is to increase security expenditure.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.2%) are mostly modestly firmer vs. an entirely negative open; sentiment gradually improved as the morning progressed, paring some of the early-morning losses following a negative APAC handover.

- European sectors are mixed vs opening mostly lower. Healthcare tops the pile, with Novo Nordisk (+4%) shares on the front foot. Tech is the clear underperformer today, after Bloomberg reported that US President Trump's team is seeking to tighten chip controls on China; it was also said that US officials reportedly met with Japanese and Dutch counterparts to restrict Tokyo Electron and ASML engineers from maintaining semiconductor equipment in China.

- US equity futures are mixed, with the RTY holding afloat whilst peers are in the red and as the NQ underperforms a touch, amid the broader Tech declines. Reminder, Nvidia numbers due after hours on Wednesday.

- EU court backs Italian antitrust ruling against Google (GOOG) curbs on Android auto access.

- Alibaba (BABA) to open-source video GenAI model Wan 2.1, via a post on X.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- After a pick-up late in the US session yesterday, DXY is a touch lower in early European trade. Trump was able to provide the dollar with some support yesterday after stating that he will be proceeding with tariffs on Mexico and Canada. Today's data slate sees the release of US Conference Board consumer confidence which is expected to slip to 102.5 from 104.1. Today's speaker slate includes Fed's Barr and Barkin. DXY is currently within a 106.56-79 range and above yesterday's YTD low at 106.12.

- EUR is trivially firmer/flat vs. the USD with focus in Europe primarily on the political landscape in the wake of the fallout of the German Federal Election and the subsequent coalition-building process. From a monetary policy perspective, the latest ECB Euro Area Indicator of Negotiated Wage Rates showed Q4 wage growth slow to 4.12% from 5.43% but had little sway on EUR. Note ECB’s Schnabel is due to speak at 13:00GMT. EUR/USD is currently tucked within Monday's 1.0453-0528 range.

- USD/JPY initially edged higher overnight and briefly reclaimed the 150.00 status but then faded the gains amid the broad downbeat risk tone across the APAC region and Japanese Services PPI data which slightly accelerated as expected. USD/JPY has delved as low as 149.20 with the next downside target coming via Monday's YTD low at 148.84.

- GBP is flat vs. the USD and EUR with macro newsflow light for the UK. We heard yesterday from BoE's Dhingra who remarked that if rates are lowered by 25bps at a quarterly pace, you will still be in restrictive territory all of this year. That being said, she is very much viewed as s dovish outlier on the MPC. Of greater interest today is comments from BoE Chief Economist Pill. Currently trading within a 1.2607-38 range.

- Antipodeans are both a touch softer vs. the USD. AUD/USD is down for a third consecutive session after printing a YTD peak at 0.6408 last Friday. Fresh macro drivers are lacking for Australia with attention instead turning to January inflation data due overnight with consensus looking for weighted CPI Y/Y to hold steady at 2.5%.

- PBoC set USD/CNY mid-point at 7.1726 vs exp. 7.2530 (prev. 7.1717).

- RBI is seen as likely to be selling USD's to stop the INR's downside, via Reuters citing traders.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer, picked up a touch on Monday’s strong 2yr outing before grinding marginally higher overnight and then lifting back above the 110-00 mark to a 110-09 peak in the European morning, a high the benchmark has remained in proximity to since. Ahead, the speakers continue with Barr & Barkin due before POTUS signs his latest executive order. Amidst that, the US will sell 70bln of 5yr notes; follows a 2yr which saw a slightly softer b/c than the prior but still a strong level of demand, particularly for the indirect figure.

- Bunds towards the top-end of a 131.87-132.45 band with the benchmark essentially flat as participants continue to digest the German election and await clues on coalition talks; the high printed just before the EZ wage tracker as the general risk tone took another modest leg lower. On the latter, the figure moderated from the prior in-fitting with proxies while an extensive text release from ECB’s Nagel largely focussed on the Bundesbank's accounts while monetary comments were in-fitting with his hawkish bias. No reaction to either event. A well received German Green Bund outing also had little impact.

- Gilts are firmer, somewhere between USTs and Bunds in terms of magnitude as the benchmark acknowledges both the tepid risk tone and reports suggesting the UK could get involved in European-wide defence spending; a source cited by the FT said the UK Treasury “is interested in” the idea of a rearmament bank for such funding. Given that structuring spending in this way would limit the impact on Reeves’ fiscal position. Gilts find themselves in the green and holding towards the top-end of a slim 92.67-91 band.

- UK sells GBP 1.6bln 1.125% 2035 I/L Gilt: b/c 3.52x (prev. 3.12x) and real yield 1.115% (prev. 1.128%).

- Germany sells EUR 1.495bln vs exp EUR 1.5bln 1.80% 2053 Green Bund: b/c 2.4x (prev. 2.6x), average yield 2.73% (prev. 2.84%) & retention 0.33% (prev. 24.60%)

- Italy sells EUR 2.75bln vs exp. EUR 2.5-2.75bln 2.55% 2027 & EUR 1.5bln vs exp. EUR 1.25-1.5bln 1.80% 2036 BTP€i

- German 10-year spread to swaps hit the most negative on record, according to Bloomberg.

- Saudi Arabia offers Middle East's first sovereign Euro Green Bond, via Bloomberg; 7-year Green Bond IPT mid swaps +155bps, 12-year Conventional Bond IPT mid swaps +175bps, according to IFR.

- Click for a detailed summary

COMMODITIES

- Crude is a little firmer in what has been a lacklustre and choppy session for the complex thus far. Initially oil prices were subdued alongside the risk-off sentiment seen in early-European trade, but did improve a touch thereafter. More recently, prices have been choppy with Brent May currently trading in a USD 74.17-76/bbl parameter.

- Subdued trade across precious metals despite the softer Dollar but with price action contained to tight ranges amid a lack of driver this morning. Spot gold remains at the record highs printed yesterday (USD 2,956.31/oz) with today's range currently between USD 2,929.64-2,953.42/oz.

- Lacklustre trade across base metals despite the weaker Dollar but with the broader sentiment on the back foot and newsflow on the quieter side. 3M LME copper currently resides in a USD 9,424.95-9,500.05/t range after finding resistance at the half-round figure.

- US President Trump commented on Truth that they want the Keystone XL Pipeline built and suggested easy approvals.

- India could reportedly extend import curbs on low ash metallurgical coal used in steelmaking, according to Reuters sources.

- IEA Director says Europe has been importing a lot of Russian LNG to help economies; might be a high time to replace it with LNG from Qatar beginning 2027.

- Click for a detailed summary

NOTABLE DATA RECAP

- German GDP Detailed QQ SA (Q4) -0.2% vs. Exp. -0.2% (Prev. -0.2%); YY NSA (Q4) -0.4% vs. Exp. -0.4% (Prev. -0.4%)

- ECB Euro Area Indicator of Negotiated Wage Rates (Q4) 4.12% (prev. 5.43%)

NOTABLE EUROPEAN HEADLINES

- ECB's Nagel says inflation outlook is fairly encouraging; persistent core and services inflation warrants caution, via Bloomberg; German economy in "stubborn" stagnation; ECB should take one step at a time and not rush more cuts. Hopes for swift formation of the new German economy.

- ECB's Kazaks says "I think we have to continue cutting rates", via Bloomberg; will take rate cuts "step by step", rate path to hinge on Trump policies. Must be cautious as we near the end of the terminal rate. Joint borrowing instrument needed for big investments. Europe at a critical point, need to invest in defence.

- Reuters poll: 66/66 expect the BoE to hold rates at 4.5% in March with a median view of a cut in Q2 to 4.25%.

NOTABLE US HEADLINES

- Fed's Goolsbee (2025 voter) said if the administration enacts policies that drive up prices, the Fed has to take them into account by law, while he added that auto parts suppliers have expressed concerns about tariffs and before the Fed can go back to cutting rates, it needs more clarity. Furthermore, Goolsbee said the full details of the administration’s policy package are still to be determined and they have to take a wait-and-see posture.

- Fed's Logan (2026 Voter) does not comment on monetary policy in prepared remarks; says once quantitative tightening ends, it would make sense to overweight purchases of shorter dated securities; floats idea of discount window loan facility.

- Elon Musk said subject to the discretion of the President, employees will be given another chance and a failure to respond a second time will result in termination.

- BofA Global Markets President DeMare says clients are doing less today than Q4 and the beginning of the year; still a good quarter even with client uncertainty, via Bloomberg TV. Says if they do not see productivity from AI, then investments will be scaled back.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin says President Putin is "okay" with European peacekeepers in Ukraine, refers to earlier statement that such a move would be unacceptable. When asked about a possible US-Russia rare earths deal, says the US needs rare earth minerals, and "Russia has a lot". Many steps need to be taken to restore trust between the US and Russia. When asked about the UN vote on Ukraine on Monday, says it sees the US taking a much more balanced stance. Says European stance on Ukraine may become more balanced as a result of contacts with the US.

- US President Trump said he emphasised the importance of the critical minerals and rare earth deal with Ukraine in meeting with French President Macron, while Trump added that he is in serious discussions with Russian President Putin about ending the war and talks are proceeding very well. Trump also said he was talking with French President Macron about trade deals at the White House and will meet with Ukrainian President Zelensky either this week or next to sign a minerals deal. Trump later said he had great conversations including with Russia on ending the Ukraine war and the meeting with French President Macron is another step forward towards ending the war.

- French President Macron said they need something substantial for Ukraine and Europe, while he stated his message to US President Trump was to be careful and that they have to go fast but first need a truce in Ukraine. Macron also stated that he thinks he had a strong convergence with Trump on Ukraine and a truce could be reached in the coming weeks, as well as noted that it is feasible to establish a truce at least and start negotiating for peace. Furthermore, Macron said he is working with the UK on a UK-France proposal for presence to maintain peace with US backup and backstop, while he spoke with European leaders and that many are ready to be part of security guarantees.

- UN General Assembly adopted the amended US-drafted Ukraine resolution that backs Ukraine's sovereignty and territorial integrity, while it approved all proposed European amendments to the US-drafted resolution on Ukraine and rejected the proposed Russian amendment to the US-drafted resolution on the Ukraine war anniversary. It was later reported that Russia failed at the UN Security Council to amend the US-drafted resolution on Ukraine and vetoed a European attempt to amend the US-drafted resolution on Ukraine, while the UN Security Council adopted the US-drafted resolution on Ukraine.

- Poland scrambled aircraft to ensure airspace security after Russia launched strikes on Ukraine, while all of Ukraine was reportedly under air raid alerts as the air force warned of Russian missile attacks.

- Russia Foreign Minister Lavrov to visit Iran on Tuesday, according to RIA.

CRYPTO

- Bitcoin is considerably lower and has slipped below USD 88k; Ethereum sees deeper losses and reaches levels not seen since October 2024 (USD 2.33k).

APAC TRADE

- APAC stocks traded lower following the weak handover from the US where the tech sector led the declines and risk appetite was sapped amid ongoing uncertainty surrounding tariffs and geopolitics.

- ASX 200 retreated with underperformance seen in the tech, consumer discretionary and financial sectors, while defensives showed resilience and energy was also lifted following a jump in Woodside Energy's profit.

- Nikkei 225 slumped at the open on return from the long weekend but was off worse levels as shares of Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo rallied following reports late last week that Berkshire Hathaway plans to gradually raise its investments in Japanese trading houses.

- Hang Seng and Shanghai Comp conformed to the negative mood amid headwinds from trade frictions with the US seeking to tighten chip controls on China and after the PBoC's MLF operation resulted in a net drain of CNY 200bln. Nonetheless, Chinese markets were well off today's worst levels as the heavy slump at the open spurred some dip buying.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 300bln 1-year MLF operation with the rate kept at 2.00% for a net drain of CNY 200bln.

- Huawei improved production of AI chips and achieved a yield close to 40% which marks a breakthrough for China's tech goals, according to the FT.

- Bank of Korea cut its base rate by 25 basis points to 2.75%, as expected, with the rate decision unanimous and interest rates for the special loan programme were also lowered. BoK said US tariff policies, Fed policies, and stimulus measures by the Korean government are some of the uncertainties for the economy, while it noted it is necessary to remain cautious about high FX volatility. BoK Governor Rhee stated that four board members said current policy rates could be maintained for the next three months and two board members said further rate cuts are possible for the next three months, while Rhee added that the market consensus expecting two more rate cuts this year aligns closely with the central bank's views.

- PBoC Advisor says Chinese CPI will decline moderately in February; changes in external environment will increase pressure on expanding domestic demand this year.

- Opposition Japan innovation party (ISHIN) agrees on details of LDP, Komeito Coalition's revised state budget, according to a party official; revised state budget would pave way for passage of JPY 115tln FY2025-26 budget.

- China's MOFCOM urges the EU to stop listing Chinese enterprises and to cease spreading false accusations against China; China will take necessary measures to firmly protect the legitimate rights and interests of Chinese enterprises.

DATA RECAP

- Japanese Services PPI (Jan) 3.10% vs Exp. 3.10% (Prev. 2.90%, Rev. 3.00%)