By Peter Tchir of Academy Securities

It Was the Best of Times, It Was the Worst of Times

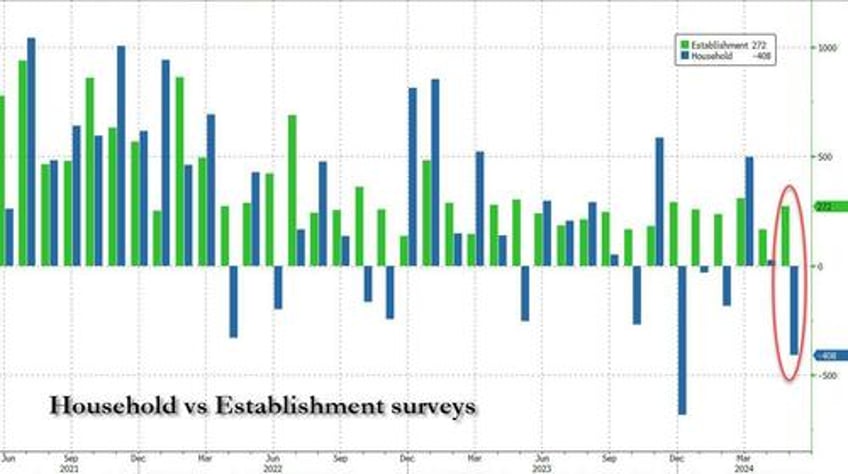

Why do we both having both an establishment survey and household survey if we cherry pick the data to look at?

The headline number was simply awesome. 272k jobs, 229k in the private sector, both beating expectations (and an even lower “whisper” number). “Only 15k of downward revisions to the prior month. Unequivocally strong headline jobs.

Monthly and annual earnings ticked higher and were above expectations, and last month’s annual level was also bumped up. Signals potential inflationary pressures remain and may even be rebounding.

Then things get “weird”. The unemployment rate ticked up to 4%. That occurred as the participation rate slipped back to 62.5% (tied for the lowest level since February of last year). That is because the household survey showed a job loss of 408k. A difference of almost 700k between the two versions of this report. I still struggle to understand why we use the household for the unemployment rate, and treat that as valid, while ignoring the actual number of jobs created or lost in this report.

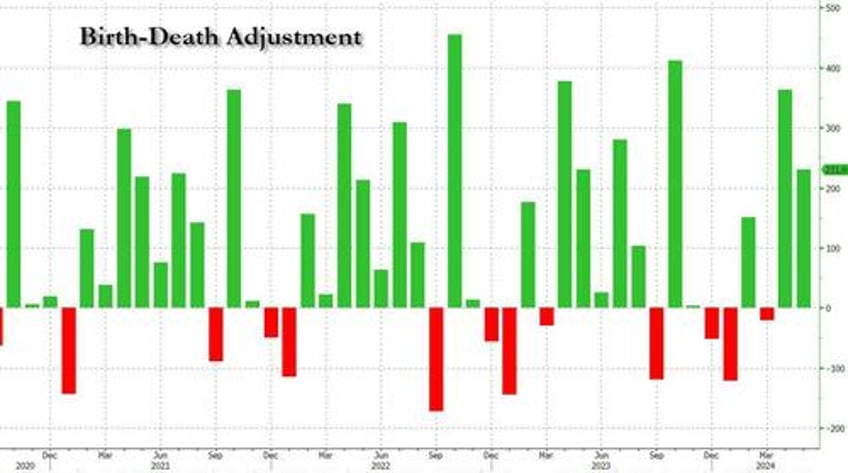

While not quite as extreme as last month, the birth/death model added 231k, Basically all of the private payroll jobs were created by the birth/death model which has been an increasingly large part of the report – we touched on this last month in Jobs “Exceptionalism”.

The other part of the household survey showed 625k full time jobs lost, while 286k part time jobs were added. Another issue we’ve been struggling with (and mentioned in that earlier “exceptionalism” report) has been that so many of the jobs, according to the household report, have been part-time, and that trend continued.

The establishment survey makes it look like an incredibly strong and healthy labor market.

The household survey makes it look like a very weak labor market.

If we pick and choose the data to look at, it is the best of times (which seems in line with the stock market). If we look at other data, it is the worst of times (which seems to line up with sentiment surveys).

The establishment data was so strong, and the wages were so hot, that July is off the table. I still think September is too treacherous for the Fed to cut (with the election looming). I think the path to higher yields has now been paved and we will follow it to higher yields, especially at the longer end. See Updated Rates Outlook, from earlier this week.

I hope you live in the “establishment” world, because that “household” world seems pretty darn bleak!