PCE inflation data, just released and in line with expectations, could already be used by the Federal Reserve to justify rate cut in March.

But it would be a policy mistake, as inflation leading data is turning higher.

The over five-and-a-half cuts expected by the market this year are unlikely to be realized.

Driving using the rear-view mirror is rarely a good idea, but that is exactly what happens with most inflation analysis.

Inflation itself very lagging - it takes time for price changes to feed through, and it is backwards looking, i.e. it only tells us how prices have changed over the last month or year, not how they will change.

Even worse, core inflation lags headline, as it takes time for changes in the price of commodities to feed through to other goods and services.

And to cap it all off, it is common to take what inflation has done over the last few months or so and project this forward – and therefore make no accommodation for unexpected price shocks.

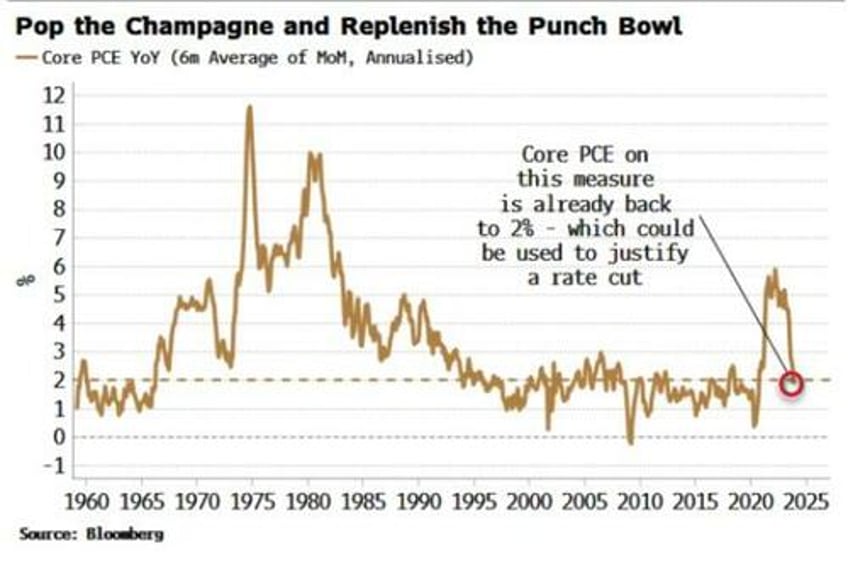

The latter method could be used by the Fed to justify a cut in March (currently priced with ~50% odds).

Taking the average of the last six months of core PCE month-on-month changes and annualizing it gets the measure to 1.9%, under the Fed’s 2% target.

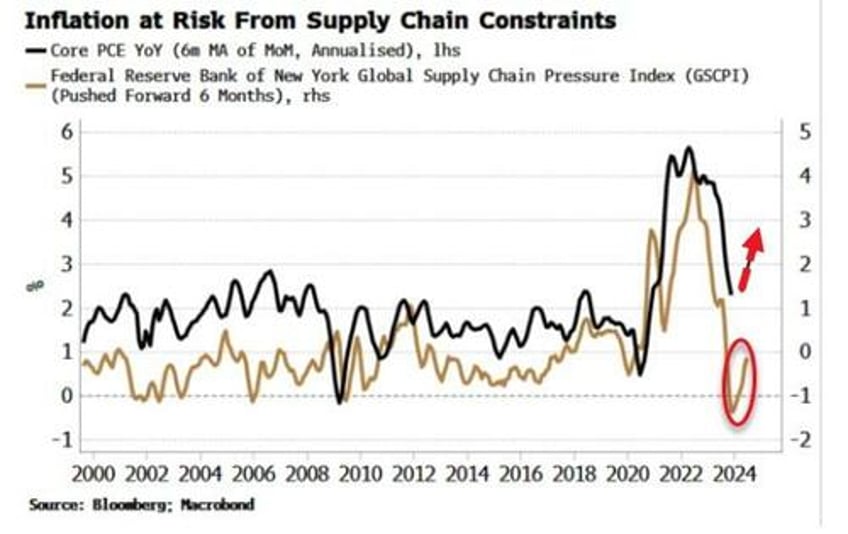

But there are multiple signs that inflation will begin to pick back up again later this year.

Leading indicators for wages, profit margins, inflation in China are all pointing to a re-acceleration in price growth.

Supply-chain pressures are another one: the Fed’s index of them is rising, and leads the annualized core PCE measure by about six months.

A Fed cut in March (or probably at any point this year) is likely to prove to be a policy mistake. Why the Fed chose to pivot in December is still not clear. One hypothesis is liquidity conditions are set to deteriorate this year as the government’s interest bill rises sharply; the RRP gets closer to being fully depleted; and the Treasury, at its refunding announcement next week, may start issuing much more longer-term debt.

Despite the pretense that balance-sheet and rate policy are independent, in actuality a rate cut would help stabilize reserves by reducing the government’s interest costs.

Put it all together, and while the Fed will almost certainly cut this year, a resurgence in inflation means they are highly unlikely to meet the market’s expectations of ~135 bps of rate reductions in 2024.