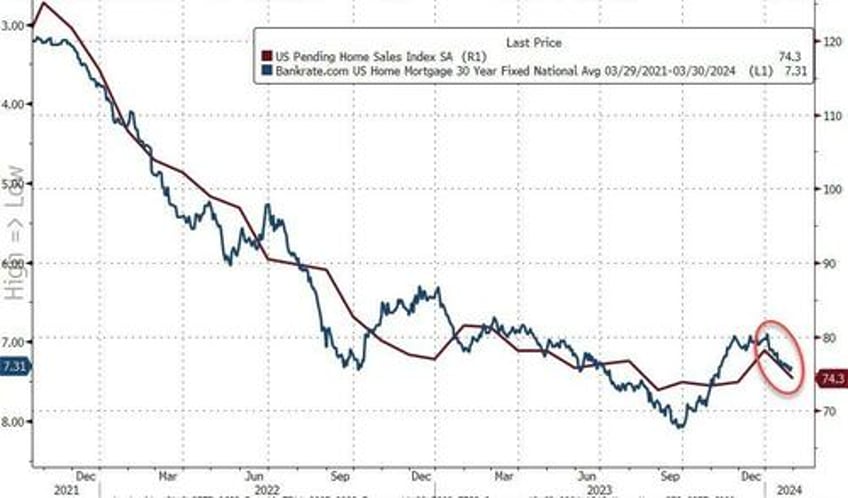

Pending home sales puked in January, tumbling 4.9% MoM (vs +1.5% MoM exp). This was made worse by a large downward revision for December (from +8.3% MoM to +5.7% MoM)...

Source: Bloomberg

That was the biggest MoM decline since August and dragged the YoY sales decline to -6.82%, tumbling back near record lows...

Source: Bloomberg

Realtors gonna realtor...

“This combination of economic conditions is favorable for home buying,” Lawrence Yun, NAR’s chief economist, said in a statement.

“However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.”

WTF are you talking about Larry?

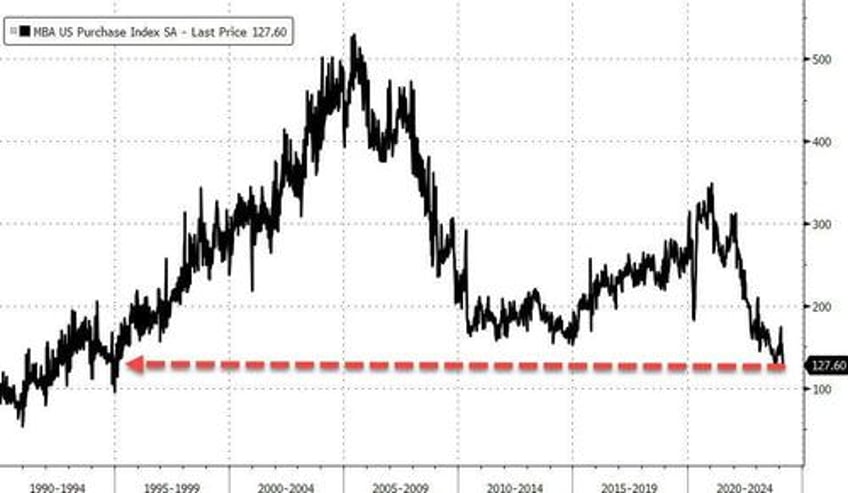

Earlier this week, a gauge of US mortgage applications for home purchases fell for a fifth week, nearing its lowest level since 1995.

Who could have seen that coming? As rates surged once again...

Source: Bloomberg

The pending-home sales report is a leading indicator of existing-home sales given houses typically go under contract a month or two before they’re sold.

The index of contract signings decreased 7.3% in the South, the nation’s biggest housing market.

Pending sales also fell 7.6% in the Midwest, but climbed 0.8% in the Northeast and 0.5% in the West.

“Southern states and those in the Rocky Mountain time zone experienced faster job growth compared to the rest of the country,” Yun said.

“As a result, long-term housing demand is increasing more significantly in these regions. However, the timing and number of purchases will largely depend on the prevailing mortgage rates and inventory availability.”

Overall sales are expected to increase 13% this year, according to NAR’s economic outlook, but as the chart above shows, unless rates start tumbling soon, that ain't gonna happen.