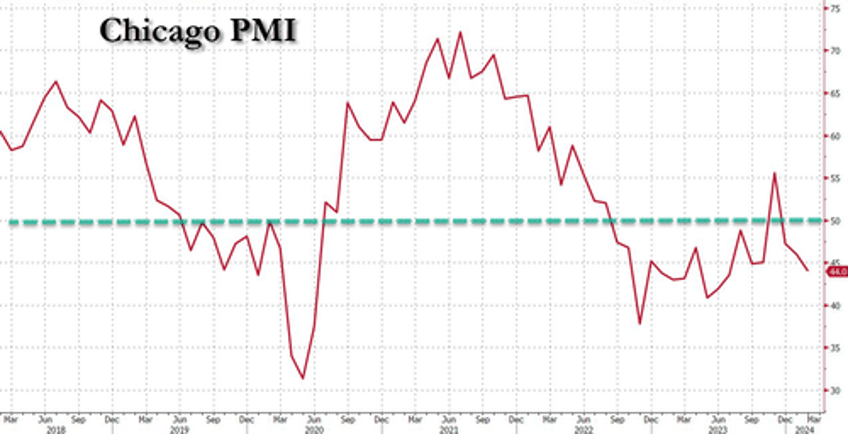

The trend for 'soft' survey data is very much not the friend of the 'soft-landing' or 'goldilocks' narrative peddlers as it slumps from extreme optimism to disappointed pessimism (even as hard data has improved)...

Source: Bloomberg

And today saw more of the same as the Chicago MNI tumbled further off the 'weird' spike in November, deeper into contraction at 44 (from 46 and well below the expected bounce to 48)...

Source: Bloomberg

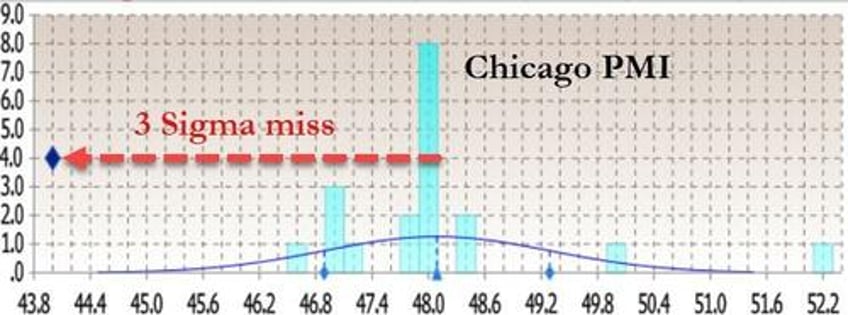

That was below all analysts' estimates and 3 standard deviations less than expected...

Source: Bloomberg

Under the hood was even more problematic:

New orders fell at a slower pace; signaling contraction

Employment fell at a faster pace; signaling contraction

Inventories fell at a slower pace; signaling contraction

Supplier deliveries fell and the direction reversed; signaling contraction

Production fell at a faster pace; signaling contraction

Order backlogs fell at a slower pace; signaling contraction

Worse still, Prices paid rose at a faster pace...

So, in summary: slower growth, declining production, shrinking orders, falling employment... and accelerating inflation - is it any wonder that 'soft survey' data is disappointing - not exactly election-winning headlines.