Porsche AG is out with the latest warning that the interest rate shock increasingly pressures consumers and will spark demand issues next year.

Bloomberg quoted Porsche's CFO Lutz Meschke as saying high interest rates are sidelining consumers. He added Porsche's largest market, China, has also seen demand issues due to a lackluster recovery in the economy that will remain under pressure next year.

"In 2024, we expect a challenging year due to the geopolitical situation and the economy in China," Meschke told investors on a call Wednesday morning while discussing the company's nine-month results.

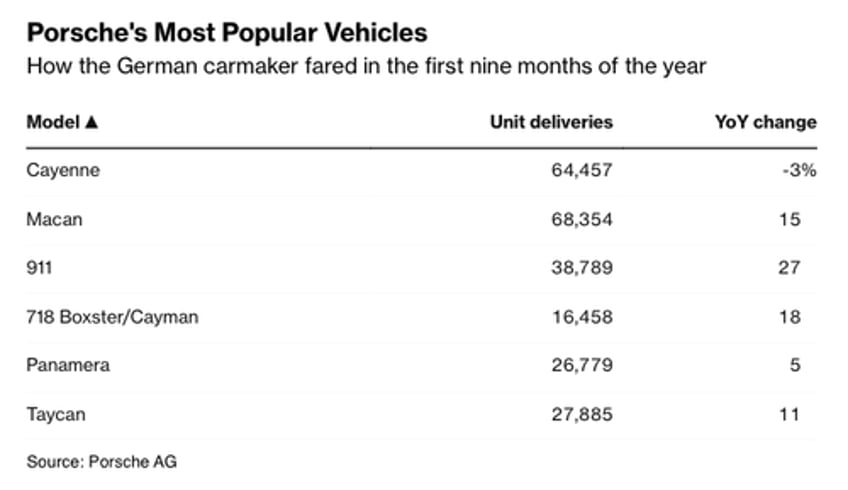

For the first nine months of the year, demand for the German automaker's most popular vehicles remained strong. There was a weakness for the Cayenne, while the sales of high-margin 911 helped offset the issues in China.

Meanwhile, sales of Mercedes-Benz Group AG's luxury vehicles, such as the S-Class, have already seen a slide in the third quarter as ongoing threats of a global trade slowdown increase into 2024.

A luxury downturn has been underway this year. We asked in May: Did Europe's Luxury Bubble Just Burst?

By June, we pointed out Luxury Recession: Diamond Prices Crash, Rolex Downturn Persists.

In early October, we noted, First Rolexes, Then Diamonds, Now Consumers Revolt Against Mercedes S-Class As Luxury Bust Worsens.

Then, we showed demand woes were materializing in high-end clothing companies: 'It Ain't Gucci': LVMH Shares Tumble As Luxury Bubble Unravels.

As a reminder, a recent market survey of Deutsche Bank clients found an increasing number were "nervous about yield-led global accidents."

The slowdown in luxury may be an ominous sign of mounting recession risks for 2024.