We asked in May Did Europe's Luxury Bubble Just Burst?

By June, we pointed out Luxury Recession: Diamond Prices Crash, Rolex Downturn Persists.

On Tuesday, we said First Rolexes, Then Diamonds, Now Consumers Revolt Against Mercedes S-Class As Luxury Bust Worsens.

Reconfirming our thoughts about the deflating luxury bubble is news that luxury conglomerate LVMH reported slowing sales growth, sending shares down 6% and tumbling into a bear market.

The French group, controlled by billionaire Bernard Arnault, has faced sliding demand for high-quality products, such as leather goods, perfumes, watches, and wine, in China, Europe, and the US amid a soaring interest rate environment.

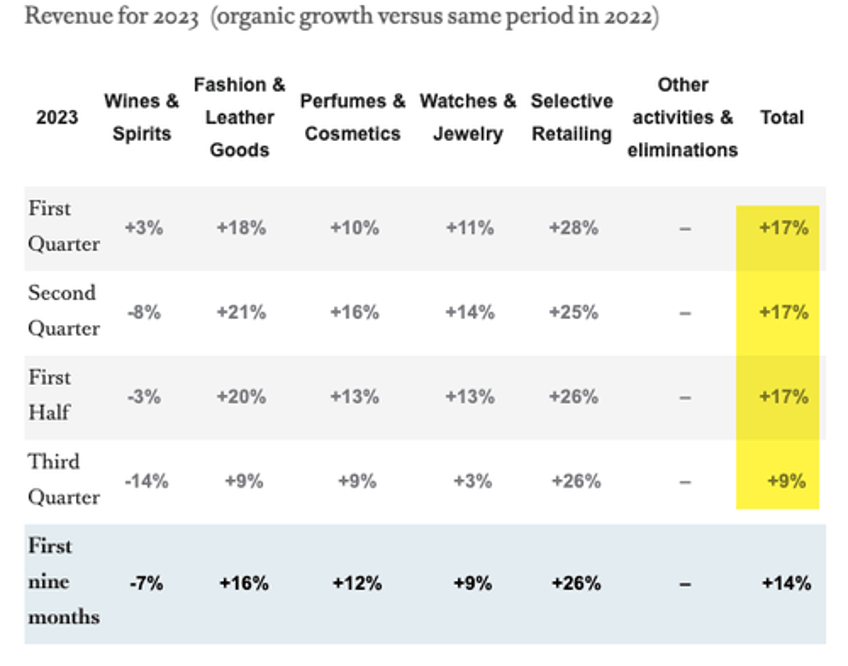

LVMH, whose brands include Louis Vuitton, Tiffany & Co., Christian Dior, Fendi, and others, reported sales in the third quarter grew 9% to €19.9 billion, down from +17% in the second quarter, reflecting softer luxury sales worldwide. Sales at the wines and spirits unit plunged 14%, much worse than estimates. The watches and jewelry unit was also under pressure, as well as the fashion and leather goods unit and perfumes and cosmetics. Selective retailing remained robust in the quarter.

"After three roaring years and outstanding years, growth is converging toward numbers that are more in line with the historical average," LVMH CFO Jean-Jacques Guiony told investors during a quarterly presentation.

LVMH shares in Paris stumbled more than 6% on the news.

"In an uncertain economic and geopolitical environment, the group is confident in its continued growth . . . LVMH is counting on the dynamism of its brands and the talent of its teams to further strengthen its lead in the global luxury market in 2023," LVMH said.

Citigroup analysts said LVMH's "limited outlook comment" would be "unhelpful for a sector remaining out of favor and having underperformed in the last six months."

Here's what investors are saying (list courtesy of Bloomberg):

Swiss Life Gestion Privee

- "All eyes are now on Hermes which is likely to see some consensus downgrades as it will most likely be affected by a similar foreign exchange impact than the one suffered by LVMH", said Head of Equities Eric Bleines

- Hermes reports 3Q sales on Oct. 24

- For companies that are exposed to wine and spirits, this confirms that destocking is taking place and one should be careful since it could take a bit longer than expected

- "The luxury sector is resilient but perhaps this has been overestimated: there remains a cyclical component to it which can't be ignored"

- "This is a miss sure but this is not such a big deal; one has to look at the bigger picture, these are not bad figures"

Meeschaert Asset Management

- One big takeaway is the miss of the wine and spirits division

- "This does not bode well for companies such as Remy Cointreau or Pernod Ricard," said Harry Wolhandler, head of equities management

- Profit warnings are to be expected in the alcoholic beverage sector

- One positive development is the good sales dynamic in China, the stabilization in the US but there is also some deceleration in Europe

- Against this backdrop it is better to favor best-in-class stocks with pricing power and profit growth visibility and stay away from restructuring equity stories such as Kering, Wolhandler argued

Banque Eric Sturdza

- "It's not that bad really, but in terms or perception, this is their first miss in three years," said portfolio manager Ludovic Labal

- The slowdown of European consumers is the main concerning development in the trading update

- Overall, it confirms that the luxury sector is slowing down but the impact will be less severe for top stocks like LVMH or Hermes than for laggards and stocks perceived as being in the "value" segment of the sector

Palatine Asset Management

- "I used to say that I liked LVMH because they typically do better than expected but it's the first time in a while that they disappoint," said senior portfolio manager Bruno Vacossin

- The big miss of the trading update is on wine and spirits

- One has to put today's share price fall in perspective with the 3% gain made

And comments from big banks:

RBC (outperform)

- The 2024 outlook remains uncertain and negative earnings revisions are likely not over, analysts led by Piral Dadhania wrote

- Revenue miss is likely to add further pressure to the broader luxury sector in the near term

- Key Fashion & Leather division missed expectations for the first time in a number of years

- Trends are moderating across the board, LVMH management told analysts

- Price target lowered to €800 from €810

Barclays (equal-weight)

- Lower consumption from the European local consumer was the main changing factor

- CFO didn't comment on the earnings outlook but said FX would be a headwind for margins

- Analysts led by Carole Madjo see "risk of earnings pressure in the short term and weaker top-line growth in 2024"

- Equal-weight rating confirmed

Barclays (equal-weight)

- Lower consumption from the European local consumer was the main changing factor * CFO didn't comment on the earnings outlook but said FX would be a headwind for margins * Analysts led by Carole Madjo see "risk of earnings pressure in the short term and weaker top-line growth in 2024"

- Equal-weight rating confirmed

Morgan Stanley (overweight)

- "Overall, while today's miss is not extremely material in magnitude, and market expectations had been lowered in recent weeks, today's release will nevertheless be taken negatively for LVMH and the broader luxury good sector," analysts led by Edouard Aubin wrote

- Four divisions out of five came below expectations with the largest miss coming from Wines & Spirits

- All regions decelerated but this was more pronounced in Europe

AlphaValue (add)

- Softer pace was mainly due to moderated growth in Asia, especially in China and the normalization of both local and tourist demand in Europe

- "The uncertain macro environment in the Western world and the challenging consumer environment in China have weighed on the demand for luxury goods," analyst Jie Zhang wrote

LVMH is a bellwether for luxury. And with JPM Markets Desk's latest warning, "Sentiment is quickly turning very negative across US consumer," and another from several other banks that show credit card spending unexpectedly cratered in September - this doesn't bode well for the strong consumer narrative into a US presidential election cycle in 2024.