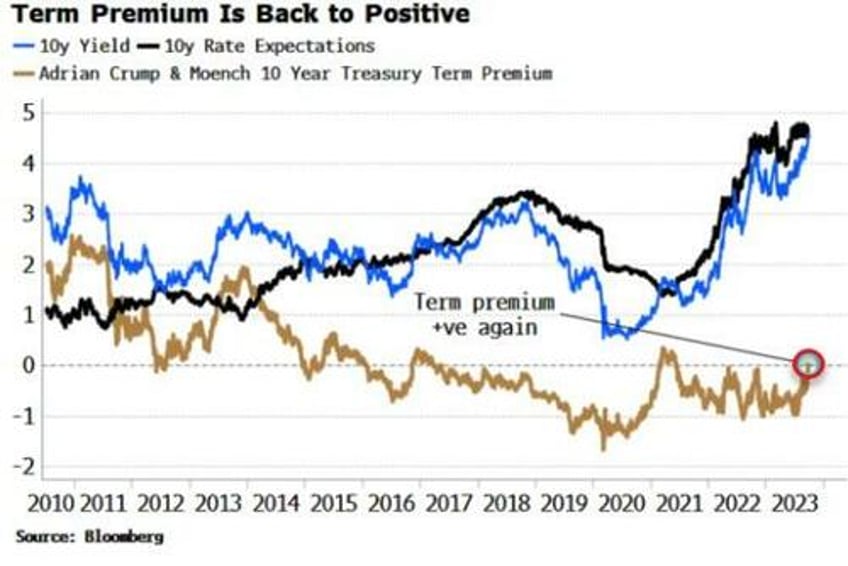

Rising term premia, which have recently turned positive again, has been driving the rise in yields and the bear steepening in the yield curve, with more likely to come.

After spending most the past six years negative, bond risk premia, aka term premia, are positive again on long-dated Treasuries (measures such as the ACM term premium is shown in the chart below; Kim and Wright term premium also recently turned positive).

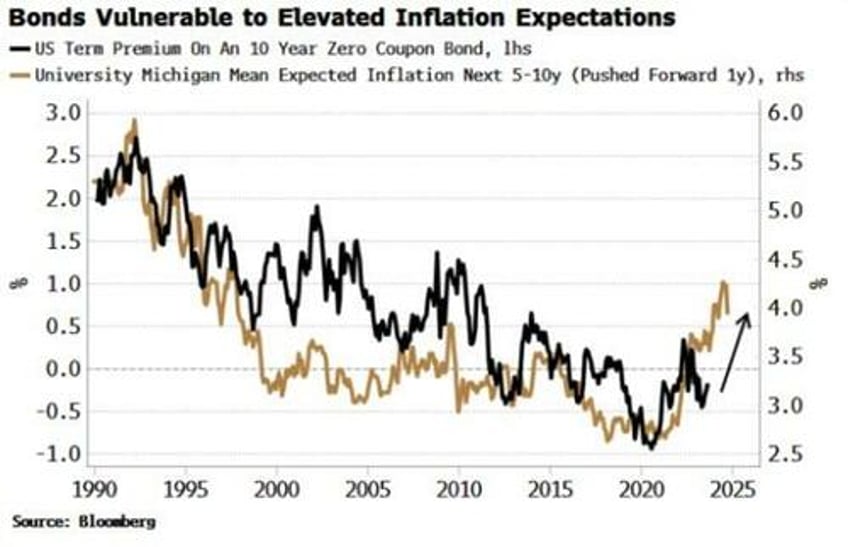

Term premia have fallen relentlessly since the GFC, driven by central-bank appetite for bonds through QE, and from the appeal of fixed-income as a portfolio hedge.

But with the stock-bond correlation positive again, driven by elevated inflation and inflation expectations, bonds are losing their efficacy in the traditional 60/40 approach to portfolio investing. Term premia are rising to reflect this.

As colleague Ed Harrison just noted, it’s not only the change in Fed expectations that’s driving the move in yields. When it comes to the yield curve, it is term premium’s rise that’s been behind the recent bear steepening. The yield curve and term premium have tracked each other very closely over the last 30-40 years.

There’s likely more to come. Inflation expectations remain historically elevated, and point to term premia’s rise continuing.