- APAC stocks began the week mostly positive but with the gains capped ahead of this week's major risk events including the US Presidential Election.

- PredictIt odds shifted over the weekend in favour of a Harris election victory; NYT/Siena final polls showed the race was deadlocked in 6/7 battleground states.

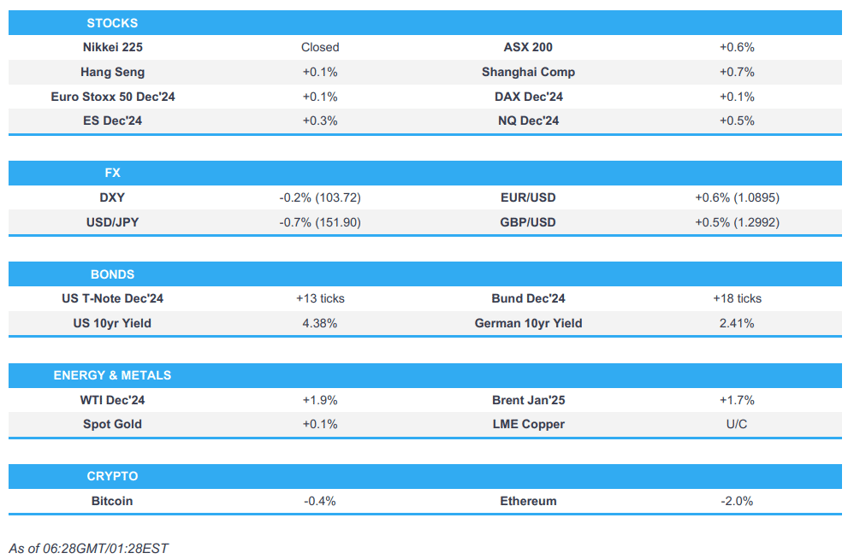

- European equity futures are indicative of a steady cash open with the Euro Stoxx 50 future +0.1% after the cash market closed higher by 1.0% on Friday.

- DXY is softer vs. peers in a scaling back of the USD supportive "Trump trade"; JPY and antipodeans have been the main beneficiaries.

- OPEC+ agreed to delay the December oil output increase by one month, according to a Reuters source.

- Looking ahead, highlights include EZ Sentix Index, Manufacturing PMIs, US Employment Trends, US Durable Goods, Australian PMIs (Final), Comments from ECB’s Elderson, Supply from EU & US.

- Earnings from Volvo Car AB, Ryanair, Kingspan, Fidelity National Information Services, NXP Semiconductors, Vertex Pharmaceuticals, Diamondback Energy, Palantir Technologies, Marriott International & Fox.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks closed in the green on Friday with the major indices boosted by the soft US payrolls report in which the headline printed just 12k (exp. 113k, prev. 223k), but was likely weighed on by the hurricanes and strike activity, while the unemployment rate was unchanged and average earnings printed inline with estimates. Furthermore, participants also reflected on recent earnings including the impressive results from Amazon (AMZN) although Apple (AAPL) was pressured.

- SPX +0.41% at 5,729, NDX +0.72% at 20,003, DJIA +0.69% at 42,052, RUT +0.61% at 2,210.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US VP Harris leads former US President Trump in Iowa at 47% vs 44% in a new Des Moines Register/Mediacom Iowa Poll as she picked up support from women in the ruby-red state which Trump had won in 2016 and 2020. Furthermore, PredictIt odds shifted over the weekend in favour of a Harris election victory.

- NYT/Siena final polls showed the race was deadlocked in six out of the seven battleground states and that all seven of them were within the margin of error with Harris leading Trump in Nevada at 49% vs 46%, North Carolina at 48% vs 46%, Wisconsin at 49% vs 47% and Georgia at 48% vs 47%, while Trump leads in Arizona at 49% vs 45% and the candidates were tied in Pennsylvania at 48% vs 48% and in Michigan at 47% vs 47%.

- Political Polls noted via social media platform X that the updated Nate Silver model on the electoral college shows Harris taking the lead with 270 vs Trump at 267.

APAC TRADE

EQUITIES

- APAC stocks began the week mostly positive but with the gains capped amid the holiday closure in Japan and as global markets braced for this week's major risk events including the US Presidential Election.

- ASX 200 was led by strength in tech, telecoms and utilities, while financials also benefitted after Westpac's earnings.

- Hang Seng and Shanghai Comp were mixed as the former traded indecisively with strength in automakers offsetting the losses in the property sector, while the mainland was underpinned amid tailwinds from an unwinding of the Trump trade and with the NPC Standing Committee convening this week with participants eyeing the approval of over CNY 10tln of additional debt issuance for the next few years.

- US equity futures (ES +0.3%, NQ +0.4%) were mildly pressured at the reopen but then rebounded albeit with price action rangebound amid the uncertainty heading into Tuesday's Presidential Election as polls continued to point to a coinflip although Harris was seen gaining further momentum and was even predicted by pollster Ann Selzer for a shock win in the red state of Iowa.

- European equity futures are indicative of a steady cash open with the Euro Stoxx 50 future +0.1% after the cash market closed higher by 1.0% on Friday.

FX

- DXY was pressured after the Trump trade unwound owing to recent polls which showed Harris gaining momentum and was in the lead in most of the battleground states although all remained within the margin of error, while PredictIt odds shifted in favour of a Harris victory and the updated Nate Silver electoral college model also showed Harris taking the lead with 270 electoral votes.

- EUR/USD benefitted from the dollar weakness and briefly returned to the 1.0900 level amid light EU-specific newsflow.

- GBP/USD approached just shy of the 1.3000 handle with the dollar pressure the main driver across the FX space.

- USD/JPY trickled lower to beneath the 152.00 territory with price action not helped by the lack of Japanese participants.

- Antipodeans were among the outperformers amid the mostly positive risk tone and stronger yuan, while the RBA also began its 2-day policy meeting with the central bank expected to maintain rates and its hawkish tone.

- PBoC set USD/CNY mid-point at 7.1203 vs exp. 7.1208 (prev. 7.1135).

FIXED INCOME

- 10yr UST futures gapped higher on an unwinding of the Trump trade after polls from over the weekend were in favour of the Harris campaign including a shock poll that showed her ahead in the ruby-red state of Iowa which Trump won twice previously, although further upside was capped as overnight cash trade remained shut owing to the holiday closure in Japan.

- Bund futures were mildly positive but remained beneath the 132.00 level with little fresh catalysts from Europe.

COMMODITIES

- Crude futures climbed at the open after reports OPEC+ agreed to delay the December oil output increase by a month, while geopolitical concerns remained heightened with Iran planning a strong and complex response to Israel.

- OPEC+ agreed to delay the December oil output increase by one month, according to a Reuters source, while OPEC confirmed that Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria and Oman extended the 2.2mln bpd voluntary adjustments for one month until the end of December.

- Libya’s NOC said production rates of Waha Oil Company reached above 335k bpd.

- Canada is to unveil details of a proposed emissions cap on the oil and gas sector on Monday.

- Spot gold traded rangebound following last week's pullback from record levels but with prices kept afloat by a softer dollar.

- Copper futures were underpinned alongside the mostly constructive mood in Asia but with further gains capped with markets bracing for this week's major risk events.

CRYPTO

- Bitcoin ultimately shrugged off the Trump trade unwind and reversed an initial dip to climb above the USD 69,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Commerce Minister met with Australia's Trade Minister on Sunday and said China hopes Australia will continue to improve its business environment and treat Chinese companies fairly and equitably. China's Commerce Minister also met with French Foreign Trade Ministerial Delegate Sophie Primas and stated the EU's countervailing investigation on China's electric vehicles has 'seriously hindered' China-EU auto industry cooperation.

- RBNZ said geopolitical tensions were highlighted as a risk to stability, while it noted that concern about geopolitical tensions has been increasing recently and potential impacts from geopolitical risks cannot be underestimated.

- Indonesia extended its tax holiday policy with an adjustment amid global minimum tax implementation, while it is considering extending tax incentives to property and electric vehicles sectors in 2025 and is considering making it longer for exporters to retain earnings in the domestic market beyond three months.

GEOPOLITICS

MIDDLE EAST

- Iran’s Supreme Leader Khamenei said the US and Israel should know they will undoubtedly receive a crushing response for what they do against Iran and the resistance front, according to state media. It was also reported that Iran’s Islamic Revolutionary Guard Corps said the country will “certainly” launch a new attack against Israel, according to ISNA.

- Iran is planning a strong and complex response to Israel involving even more powerful warheads and other weapons, according to WSJ citing Iranian and Arab officials briefed on the plans.

- US warned Iran that it won’t be able to restrain Israel if Iran attacks, according to Axios. It was separately reported that US B-52 bombers arrived in the Middle East after Washington announced their deployment as a warning to Iran, while the Pentagon said the move aims to protect US personnel and interests in the region, according to AFP and France 24.

- Israeli PM Netanyahu said pushing Hezbollah back beyond the Litani River is key to returning residents to homes in northern Israel. It was separately reported that Netanyahu cancelled his visit to Metula after a Hezbollah drone explosion occurred just 20 minutes prior to his arrival, according to Israeli media reports.

- Israeli troops detained a Syrian citizen in recent months who they said was an Iranian operative in Syria who had gathered intelligence on Israeli troops in the border area. It was separately reported that Israeli commandos launched a seaborne raid into northern Lebanon on Saturday and seized a senior Hezbollah operative, while Israel said that it killed Hezbollah’s rocket unit commander in southern Lebanon, according to Reuters and FT.

- Israel officially notified the UN it is cancelling the agreement that regulates UNRWA operations in Israel, the West Bank and Gaza, according to Axios's Ravid.

- Israel's Channel 12 quoting a senior official noted expectations of reaching an agreement to end the war in Lebanon within two weeks at most, according to Sky News Arabia.

- Hamas senior official Hamdan said dialogue among Palestinian factions in Cairo is positive but added that he didn’t want to jump to any conclusions and noted that Hamas has not received any written proposals regarding a possible ceasefire in Gaza, according to Reuters citing Al Aqsa TV.

- Hamas insists on unified negotiations to prevent Israel from resuming fire after a prisoner release and Egypt continues mediation efforts with Palestinian and Israeli parties to reach a Gaza ceasefire and increase humanitarian aid access, according to a senior security source cited by Egypt’s Al Qahera News.

- Political adviser to Iraqi Prime Minister Fadi al-Shammari told Sky News Arabia that an Israeli strike on Iraq cannot be ruled out but added that they do not want to give justifications for Israel to do so.

- Yemen’s Houthis said it will continue the maritime blockade against Israeli vessels amid intelligence reports of asset transfers and said it will not recognise changes in ownership of Israeli shipping companies, as well as warned against collaboration.

OTHER

- Russia’s Deputy Chairman of the Security Council Medvedev said the US is mistaken if it thinks that Russia will not use nuclear weapons in case of a threat to its existence, according to TASS.

- Russian forces took over Vyshneve village in Ukraine’s Donetsk region, as well as captured Pershotravneve and Kurakhivka in eastern Ukraine, according to the Russian Defence Ministry.

- North Korea and Russia reaffirmed a commitment to implement the strategic partnership reached in June and their foreign ministers agreed to hold more dialogues going forward, according to KCNA.

- India’s Foreign Ministry spokesperson said India and China have commenced verification patrolling on mutually agreed positions in both Demchok and Depsang.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves said she was wrong to tell British voters before the election that Labour wouldn’t announce new tax increases and she didn’t appreciate the size of the fiscal deficit but noted that Labour won’t need a similar budget during Parliament, according to Bloomberg.

- Former UK Secretary of State for Business and Trade Kemi Badenoch won the race to be the next leader of the Conservative Party after beating Robert Jenrick in the months-long contest, according to Sky News.