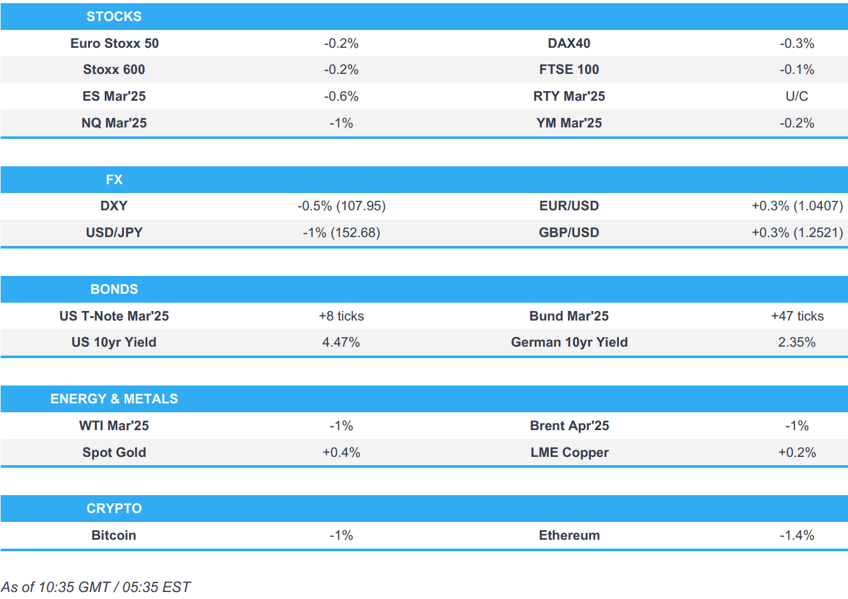

- European bourses mostly lower; NQ underperforms with GOOGL -7% & AMD -8% post-earnings, AAPL -2.5% as China mulls a probe on its App Store.

- EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

- Dollar dragged lower again, JPY is boosted by wage data, EUR/USD above 1.04.

- Bonds bid as AAPL reports hit sentiment and into Bessent's first Quarterly Refunding.

- Gold continues to print record highs on lingering uncertainty; crude on the backfoot despite the firmer Dollar.

- Looking ahead, US ADP National Employment, ISM Services, International Trade, ECB Wage Tracker, NBP Policy Announcement, Speakers including ECB's Lane, Fed’s Barkin, Goolsbee, Jefferson & Bowman, US Treasury Quarterly Refunding Announcement.

- Earnings from Uber, Disney, Ford, Arm & Qualcomm.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS

- US Customs and Border Protection notice stated US tariffs of 10% will apply to Hong Kong as well as mainland China.

- US Postal Service temporarily suspended inbound parcels from China and Hong Kong, according to Bloomberg.

- EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 -0.2%) began the session with a clear downward bias, and has traded sideways at subdued levels throughout the morning. Little price action was seen following the release of today's EZ Final PMIs/ECB Wage Tracker.

- European sectors began the session with a negative bias, and sentiment continues to remain downbeat. Healthcare tops the pile, lifted by post-earning strength in Novo Nordisk (+3.6%) and GSK (+5.2%). Autos and Parts has parked itself right at the bottom of the pile, with losses driven by downside in Renault after it was reported overnight that the Nissan/Honda merger could collapse; recent sources suggest the deal has been scrapped. The French automaker holds a 17% stake in Nissan.

- US equity futures are mixed, with clear underperformance in the tech-heavy NQ (-1% vs RTY U/C) after Alphabet's (-7.3%) Q4 results; the Co. missed on Revenue expectations, as cloud growth slowed. Further for the index, AMD (-8.5%) tumbles; the Co. topped analyst expectations and highlighted strong AI-driven growth, but data centres sales missed.

- Furthermore, equity sentiment was hit by reports that China is weighing a probe into Apple's (AAPL) App store fees/practices, via Bloomberg citing sources; AAPL -2.5% in pre-market trade.

- Nissan (7201 JT) board decides to scrap merger talks with Honda (7267 JT), according to Reuters sources.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS SUMMARY

- Advanced Micro Devices (AMD) -8.5% pre-market: Beat on Q4, strong AI-driven growth. Missed data centre sales forecasts.

- Alphabet (GOOGL) -7.3% pre-market: Q4 missed, Cloud growth slowed, foresees 2025 capex above-exp. Making the Gemini 2.0 flash AI model available from Wednesday. Continues its strong relationship with NVIDIA (NVDA).

- Amgen (AMGN) -1.4% pre-market: Q4 beats, Phase 3 trials for obesity drug MariTide will start before mid-year.

- Snap (SNAP) +3.7% pre-market: Strong Q4 numbers, execs. hint at price hikes ahead.

- Credit Agricole (ACA FP) +1.1%: Q4 beat. Loan loss provisions above exp.

- Equinor (EQNR NO) -2.4%: Q4 miss. USD 5bln buyback. 2025 Oil & Production to grow +4% Y/Y.

- GSK (GSK LN) +5.2%: Q4 mixed, FY beat. Announced buyback.

- Novo Nordisk (NOVOB DC) +3.5%: Q4 beat, slight Wegovy miss. Diabetes value market share U/C, diabetes care sales +20%.

- Pandora (PNDRA DC) -1.3%: Q4 mixed/in-line, new buyback, China performance remained challenging at end-Q4.

- TotalEnergies (TTE FP) +1.4%: Q4 beat, raises dividend.

FX

- DXY is lower for a third consecutive session as markets continue to price in a more constructive trade environment after Trump's concessions to Mexico and Canada earlier in the week. From a US macro perspective, today sees the release of ADP in the run-up to Friday NFP print, whilst ISM services data is also due; a slew of Fed speakers are also on the agenda. DXY has crossed below its 50DMA at 107.77 with the next downside target coming via the 30th Jan low at 107.50.

- EUR/USD has gained a footing above the 1.04 mark, which is in stark contrast to the 1.0209 trough seen at the start of the week. This has mainly been as a result of the easing trade tensions between the US and Mexico/Canada. Final EZ PMI and the ECB's latest wage tracker data had little sway on EUR. ECB Chief Economist Lane is due to speak.

- GBP is once again on the front foot vs. the USD, whilst steady vs. the EUR. UK-specific drivers are on the light side in the run up to Thursday's BoE rate decision which is widely expected to see a 25bps rate cut via an 8-1 vote split. UK services PMI was revised lower but GBP was unfazed. Cable is up for a third session in a row with Monday's 1.2248 trough very much in the rear-view mirror, with the pair currently at 1.2520.

- Antipodeans are both near the top of the G10 leaderboard as optimism around trade continues to percolate following the easing of tensions between the US, Mexico and Canada earlier in the week. It remains to be seen whether this optimism is unfounded for the antipodes given that China’s retaliatory tariffs on the US come into effect on February 10th.

- PBoC set USD/CNY mid-point at 7.1693 vs exp. 7.2661 (prev. 7.1698).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A morning of gains for USTs, upside was initially modest in nature and tempered by hawkish developments out of Japan via the largest wage data and remarks from former official Hayakawa around potentially hiking twice more in 2025. Further upside in the complex continued in the European session, with some impetus potentially stemming from reports that China could investigate Apple. Specifically, USTs lifted to a 109-15 session high over the course of 20-minutes. Ahead, US ADP National Employment, ISM Services, Quarterly Refunding Announcement and a slew of Fed speakers.

- Bunds are firmer. For the bloc specifically, the region’s final PMIs have been subject to slightly more revision than is usually the case with French figures revised down amid political uncertainty; the EZ print saw Composite unrevised while Services saw a mild downward revision. The first formal release of the ECB’s wage data saw a very slight revision higher in the 2025 estimate to 3.256% from the initial 3.2% estimate; a slight pull back was seen in Bunds, but the upside has since continued alongside peers. Bunds at a current 133.64 peak.

- Gilts are following peers throughout the morning and hit a 93.47 peak just after the release of the UK’s own Final PMIs. Figures which were subject to modest negative revisions while the internal commentary points to an increasingly stagflationary environment.

- Click for a detailed summary

COMMODITIES

- Another soft morning for the crude complex despite the weak Dollar but after the US and Chinese presidents failed to conduct a call yesterday to discuss tariffs. On that front, US President Trump said he would speak to Chinese President Xi at the appropriate time and is in no rush, while he responded 'that's fine' when asked about China’s retaliatory tariffs. On the flip side, US President Trump signed a memorandum regarding maximum pressure on Iran. WTI Mar resides in a USD 72.17-72.97/bbl range and Brent Apr within 75.60-76.34/bbl confines.

- Firm trade seen in precious metals, partly amid the momentum gold has upheld as it prints fresh record highs. Spot gold has reached levels as high as USD 2,870/oz to the upside (vs USD 2,839.74/oz low) with clean air seen until prices reach round and half-round levels.

- Mixed trade in base metals with copper futures rangebound despite the return to the market of its largest buyer as participants also digested disappointing Caixin Services PMI data. 3M LME copper resides in a USD 9,151.00-9,209.00/t range.

- Iranian Oil Minister says unilateral sanctions on major oil producers will place pressure on OPEC, as US President Trump orders "maximum pressure" on Tehran. Adds, unilateral sanctions will destabilise the market.

- Private Inventory Data (bbls): Crude +5.0mln (exp. +2.0mln), Distillate -7.0mln (exp. -1.5mln), Gasoline +5.4mln (exp. +0.5mln), Cushing +0.1mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- ECB Wage Tracker: 2025 Estimate 3.256% (prev. estimate 3.2%)

- EU HCOB Composite Final PMI (Jan) 50.2 vs. Exp. 50.2 (Prev. 50.2); HCOB Services Final PMI (Jan) 51.3 vs. Exp. 51.4 (Prev. 51.4)

- German HCOB Services PMI (Jan) 52.5 vs. Exp. 52.5 (Prev. 52.5); HCOB Composite Final PMI (Jan) 50.5 vs. Exp. 50.1 (Prev. 50.1)

- French HCOB Services PMI (Jan) 48.2 vs. Exp. 48.9 (Prev. 48.9); HCOB Composite PMI (Jan) 47.6 vs. Exp. 48.3 (Prev. 48.3)

- Italian HCOB Composite PMI (Jan) 49.7 (Prev. 49.7); HCOB Services PMI (Jan) 50.4 vs. Exp. 50.5 (Prev. 50.7)

- Spanish Services PMI (Jan) 54.9 vs. Exp. 56.7 (Prev. 57.3)

- UK S&P Global PMI Composite - Output (Jan) 50.6 vs. Exp. 50.9 (Prev. 50.9); S&P Global Service PMI (Jan) 50.8 vs. Exp. 51.2 (Prev. 51.2)

- Italian Retail Sales NSA YY (Dec) 0.6% (Prev. 1.1%); Retail Sales SA MM (Dec) 0.6% (Prev. -0.4%)

NOTABLE EUROPEAN HEADLINES

- The Times' Shadow BoE MPC voted 5-4 in favour of lowering the base rate by 25bps to 4.50% this week; the dissenters cited stubborn wage growth as justification for holding rates.

- ECB's de Guindos says he is not sure where ECB interest rates will end up; see inflation approaching the ECB target.

NOTABLE US HEADLINES

- Morgan Stanley expects the Fed to deliver only one 25bps cut this year, in June (prior forecast was for two 25bps cuts)

- Fed's Jefferson (voter) said there is no need to hurry further rate cuts and a strong economy makes caution appropriate, while he added that interest rates are likely to fall over the medium term and disinflation is expected to continue, though progress may be slow. Furthermore, he said the Fed faces uncertainty around government policy and that growth and labour market conditions are expected to remain solid.

- US President Trump mulls revoking loans from the USD 400bln clean energy office, according to Bloomberg.

- US government officials have privately warned that Elon Musk’s blitz appears illegal, according to The Washington Post. It was separately reported that the US Treasury gave Elon Musk's DOGE 'read-only' access to the payment system.

- US Senate confirmed US President Trump's nominee Pam Bondi as Attorney General.

GEOPOLITICS

MIDDLE EAST

- US President Trump said he had fantastic talks with Israeli PM Netanyahu and many countries will soon be joining the Abraham Accords, while they discussed how to ensure Hamas is eliminated and Trump stated that Gaza should not go through the process of rebuilding and occupation by the same people, and instead, various domains should be built for Gazans to live in. Trump added the US will take over the Gaza Strip and own it with the site will be levelled and economic development to be created. Furthermore, Trump said they are working hard to get all hostages and more hostages will be released, if not, it will make 'us' somewhat more violent.

- Israeli PM Netanyahu said US President Trump is the greatest friend Israel has ever had in the White House and they must eliminate Hamas, recover hostages and ensure that Gaza does not pose a threat to Israel. Netanyahu also stated that Trump sees a different future for Gaza and it is a different idea worth paying attention to and could change history.

- Hamas official Sami Abu Zuhri said President Trump's remarks about the desire to control Gaza are ridiculous and absurd, while he added that any ideas of this kind are capable of igniting the region.

- Saudi Arabia stressed its rejection of attempts to displace Palestinians from their land and said it will not establish relations with Israel without the establishment of a Palestinian state.

- US Middle East envoy Witkoff said President Trump is telling the Middle East that Gaza will probably be uninhabitable for 10-15 years.

RUSSIA-UKRAINE

- Ukrainian drone attack sparked a fire at an oil depot in Russia's Krasnodar region.

CRYPTO

- Bitcoin is a little lower and trading around USD 97.5k.

APAC TRADE

- APAC stocks traded mixed with the region only partially sustaining the positive momentum from the US, as Chinese markets reopened from the Spring Festival and participants digested disappointing China Caixin Services PMI data.

- ASX 200 edged higher with the gains led by outperformance in the resources, tech and mining sectors, while Australian Services and Composite PMI figures were revised higher from the preliminary release.

- Nikkei 225 swung between gains and losses with the index pressured intraday as the Japanese currency strengthened after data showed the fastest pace of wage growth in Japan since 1997.

- Hang Seng and Shanghai Comp declined on the mainland's return from the Spring Festival holiday as participants digested the recent US-China tit-for-tat tariffs, while disappointing Chinese Caixin Services PMI data added to the downbeat mood.

NOTABLE ASIA-PAC HEADLINES

- Temu and Shien targeted in new EU measures against "dangerous and cheap" e-commerce imports into Europe.

- China's Foreign Ministry, on US President Trump saying he is in no hurry to speak with Xi, says what is needed it dialogue and consultation not unilateral action.

- US President Trump's administration weighs adding Shein and Temu to its forced labour list, according to Semafor.

- BoJ director general of monetary affairs Masaki said the BoJ sees underlying inflation gradually heading toward 2% and price rises post-pandemic have been driven mostly by cost-push factors, such as rising import costs from a weak yen. Masaki stated the BoJ will keep raising interest rates if underlying inflation accelerates towards the 2% target as projected but added the BoJ must support economic activity with accommodative monetary conditions.

DATA RECAP

- Chinese Caixin Services PMI (Jan) 51.0 vs. Exp. 52.3 (Prev. 52.2); Composite PMI (Jan) 51.1 (Prev. 51.4)

- Japanese Overall Labour Cash Earnings (Dec) 4.80% vs. Exp. 3.60% (Prev. 3.00%, Rev. 3.90%)