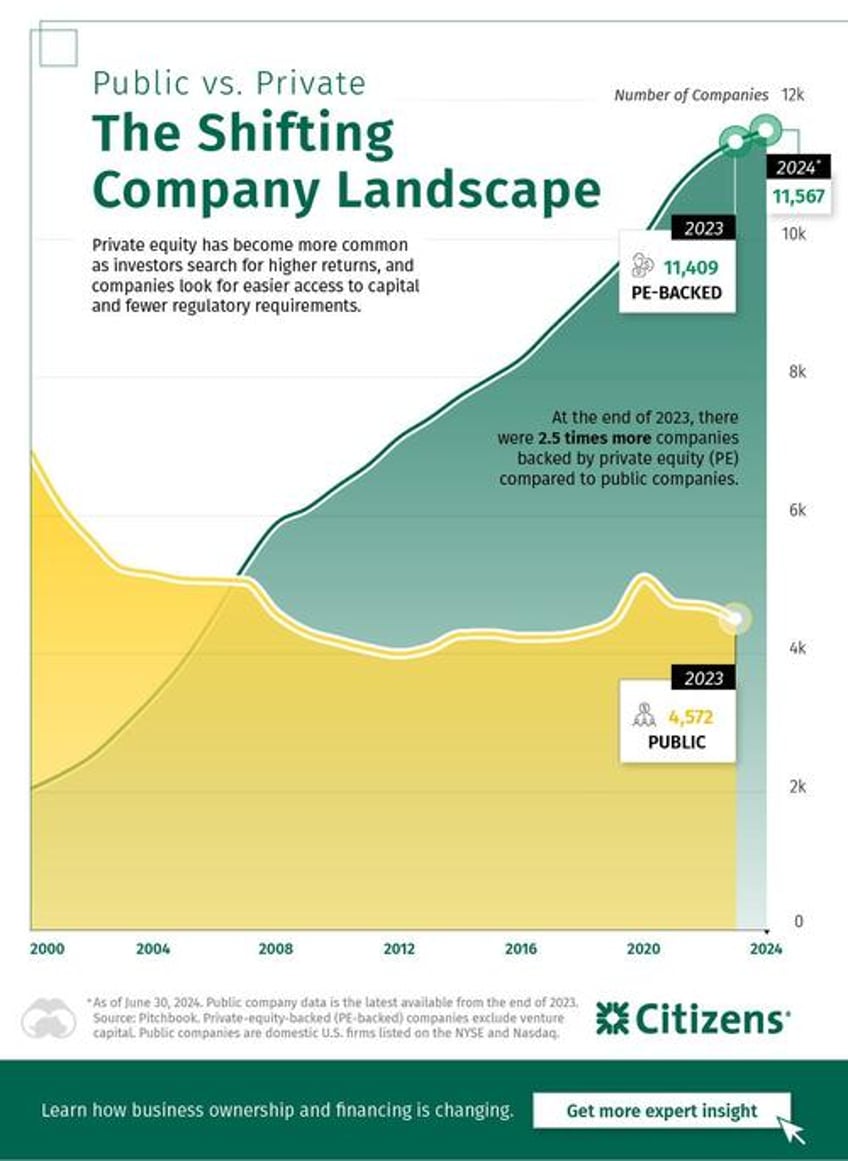

Over the last 25 years, the number of privately-held companies has grown and the number of public companies has dropped. What’s been driving this shift?

In this graphic from Citizens Bank, Visual Capitalist's Jenna Ross explores the rise of private equity (PE) and what this could mean for mid-sized companies.

The Rise of Privately-Held Companies

Back in 2000, public companies were much more common. However, by the end of 2023, the majority of companies were funded by private equity firms.

| Year | Public | PE-backed |

|---|---|---|

| 2000 | 6,917 | 2,042 |

| 2001 | 6,177 | 2,256 |

| 2002 | 5,685 | 2,524 |

| 2003 | 5,295 | 2,932 |

| 2004 | 5,226 | 3,385 |

| 2005 | 5,145 | 3,909 |

| 2006 | 5,133 | 4,573 |

| 2007 | 5,109 | 5,298 |

| 2008 | 4,666 | 5,880 |

| 2009 | 4,401 | 6,097 |

| 2010 | 4,279 | 6,421 |

| 2011 | 4,171 | 6,726 |

| 2012 | 4,102 | 7,121 |

| 2013 | 4,180 | 7,402 |

| 2014 | 4,369 | 7,721 |

| 2015 | 4,381 | 7,986 |

| 2016 | 4,331 | 8,268 |

| 2017 | 4,336 | 8,709 |

| 2018 | 4,397 | 9,135 |

| 2019 | 4,563 | 9,562 |

| 2020 | 5,153 | 10,049 |

| 2021 | 4,805 | 10,711 |

| 2022 | 4,763 | 11,143 |

| 2023 | 4,572 | 11,409 |

| 2024* | - | 11,567 |

* As of June 30, 2024. Source: Pitchbook. Private-equity-backed companies exclude venture capital. Public companies are domestic U.S. firms listed on the NYSE and Nasdaq.

The growth of privately-held companies funded by PE has been driven by a number of factors:

There are fewer regulatory requirements

Companies are able to keep their financials private

It is typically easier to access capital

Investors are looking for higher returns

At the same time, the number of public companies has been declining. However, it’s important to keep in mind that this trend is significantly influenced by mergers and acquisitions. Research from Dartmouth demonstrates that when accounting for these mergers, the decline in U.S. public companies is much less pronounced. This suggests that many public companies are growing through acquisitions, which can often lead to synergies.

On top of this, the market value of public companies still dwarves that of privately-held companies. At the end of 2023, the net asset value of private equity funds was just 4.6% of the total value of U.S. public companies. This is largely due to the differences in company size, with the biggest public companies worth trillions of dollars.

Takeaways for Mid-Sized Companies

The decline in public companies is not as dramatic as it may seem at first glance, and these companies still dominate in terms of market value.

However, PE has grown as an attractive option for mid-sized companies that may be looking for easier access to capital or that want to avoid the requirements of being publicly listed. With another option available to them, companies can choose the ownership structure that best suits their needs.