- APAC stocks traded mixed following the somewhat choppy performance stateside.

- President Trump stated he will impose 25% tariffs on autos, pharmaceuticals and chips.

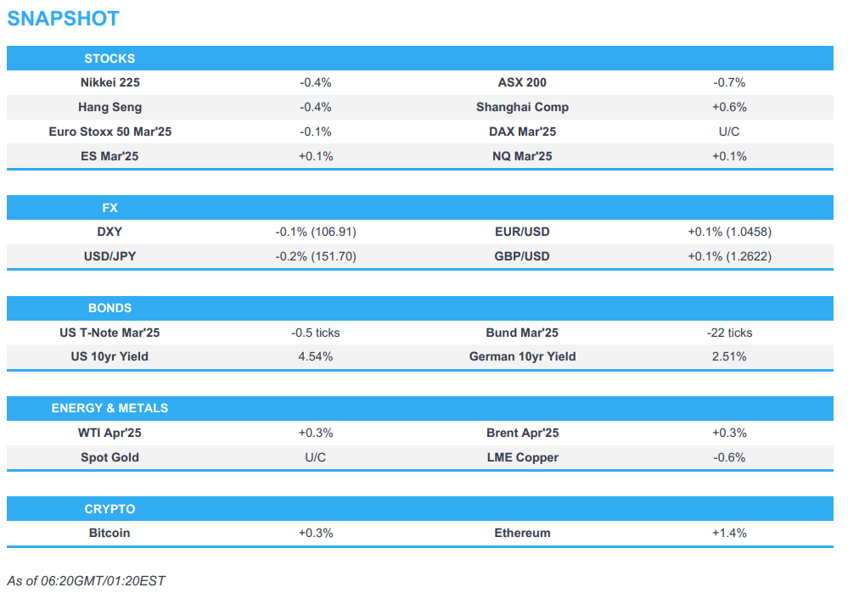

- European equity futures indicate a slightly lower open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 0.3% on Tuesday.

- The RBNZ delivered a third consecutive 50bps rate cut and signalled further cuts ahead; likely to step down to 25bps increments.

- DXY a touch softer, NZD leads, most other majors are broadly contained.

- Looking ahead, highlights include UK CPI, FOMC Minutes (Jan), Fed's Jefferson, Supply from UK, Germany & US.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed with marginal gains after a slight bid was seen heading into the settlement but were relatively rangebound in a day which was dominated by US and Russia high-level delegates holding a meeting in Riyadh regarding Ukraine. Following the gathering, the Russian side gave positive remarks with Russian Foreign Minister Lavrov noting that talks were “not unsuccessful”, while Ukrainian President Zelensky postponed his visit to Saudi Arabia until March 10th with sources stating that it was in order to not give legitimacy to US-Russia meeting.

- SPX +0.24% at 6,129, NDX +0.23% at 22,164, DJI +0.02% at 44,556, RUT +0.50% at 2,291.

- Click here for a detailed summary.

TARIFFS

- US President Trump said he will be announcing large companies that are coming back to the US related to chips and cars, while he added car plants are going to be built in the US and the auto tariff rate will be around 25%. Trump said pharmaceutical tariffs will probably be 25% or higher and will see announcements over the next couple of weeks. Trump also stated he was contacted by companies because of tariffs and that the EU has been very unfair to the US.

- China’s ambassador to WTO said US tariffs create tariff shocks that heighten economic uncertainty, disrupt global trade and risk global recession, while the ambassador added that US unilateralism threatens to upend the rules-based trading system and the WTO must have its voice.

NOTABLE HEADLINES

- Fed's Barr (voter) said AI presents some risks and AI's speed risks generating issues on a wider scale, while he also noted that they have made a lot of progress on inflation.

- US President Trump said the media seeks to sow division between them when asked about the media description of Elon Musk as an 'unelected president', while Trump said having someone as smart as Elon Musk to work with him in running the country's affairs is very important. Furthermore, he thinks Musk's team will discover a trillion dollars in wasted money.

- US President Trump posted on Truth that the Department of Justice has been politicised like never before over the past four years and he therefore instructed the termination of all the remaining “Biden Era” US attorneys.

- US President Trump’s administration is planning to lay off 40% of the workers at the federal housing administration, while the Pentagon was reported to create a staff termination list as DOGE targets the military, according to Bloomberg.

- Pharma leaders are to meet with US President Trump in a push to tweak drug policies, according to Bloomberg.

- US Senate confirmed Howard Lutnick as US Commerce Secretary.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the somewhat choppy performance stateside as attention centred on US-Russia talks on Ukraine, while US President Trump reiterated threats of tariffs on autos, chips and pharmaceuticals.

- ASX 200 was dragged lower by underperformance in energy and the top-weighted financial sector after a double-digit percentage drop in Santos's underlying profit and Big 4 bank NAB also reported a decline in earnings.

- Nikkei 225 briefly tested the 39,000 level to the downside following disappointing machinery orders and export data.

- Hang Seng and Shanghai Comp were mixed with sentiment in Hong Kong subdued and the mainland kept afloat in a reversal of recent fortunes, while the US tariff threat lingered and Chinese House Prices continued to contract Y/Y albeit at a less severe pace.

- US equity futures (ES +0.1%, NQ +0.2%) eked mild gains after the late bid on Wall St which helped the S&P 500 notch a record close.

- European equity futures indicate a slightly lower open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 0.3% on Tuesday.

FX

- DXY traded rangebound at the 107.00 level after strengthening yesterday as US participants returned from the long weekend amid a higher yield environment and with headline newsflow dominated by US and Russia talks in Riyadh regarding Ukraine. Elsewhere, President Trump threatened 25% tariffs on autos from April 2nd, as well as warned of tariffs on chips and pharmaceuticals, while the attention stateside now turns to the incoming FOMC Minutes.

- EUR/USD lacked demand after it recently gave up ground to a firmer dollar but retained a comfortable grip on the 1.0400 handle with the attention in Europe on discussions between European leaders over the Russia-Ukraine conflict.

- GBP/USD struggled for direction following the prior day's choppy performance and with participants awaiting UK CPI data.

- USD/JPY traded on both sides of the 152.00 level after disappointing Japanese Machinery Orders and Exports, as well as mixed comments from BoJ's Takata who stated the BoJ must gradually shift policy even after January's rate hike to avoid upside price risks from materialising but added that they need to take a cautious approach in shifting policy due to uncertainty.

- Antipodeans were firmer on the session but with two-way price action seen in which NZD was initially pressured after the RBNZ delivered a third consecutive 50bps rate cut and signalled further cuts ahead, although the currency later rebounded off lows after the dust settled and RBNZ Orr suggested at the press conference for a shift to 25bps cuts in April and May.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2807 (prev. 7.1697).

FIXED INCOME

- 10yr UST futures languished near the prior day's lows after suffering from a higher yield environment and corporate supply, while participants also awaited a looming 20yr auction and FOMC Minutes.

- Bund futures were subdued beneath the 132.00 level with demand contained ahead of a EUR 4.5bln Bund issuance.

- 10yr JGB futures traded indecisively as participants digested disappointing data and mixed BoJ rhetoric.

COMMODITIES

- Crude futures were kept afloat in rangebound trade after the recent US-Russia talks on Ukraine which Russian Foreign Minister Lavrov said were "not unsuccessful", while US President Trump criticised Ukraine in a press briefing and hinted that an election may be needed in Ukraine, as well as falsely claimed Ukraine started the war.

- US President Trump said he is looking at Venezuela very seriously and may not let Venezuela export oil via Chevron.

- North Dakota Pipeline Authority said the state's oil production is estimated to be down 120k-150k BPD due to recent extreme cold and related ops, while associated wellhead natural gas production is estimated to be down 0.34-0.42 BCFD.

- Russia's oil exports and transit from the Black Sea Port of Novorossiisk was suspended on February 18th due to bad weather but CPC Blend oil loadings are unaffected, according to Reuters citing sources.

- Spot gold held on to most of the prior day's firm gains and sat in close proximity to retest its record highs.

- Copper futures remained lacklustre amid the mixed risk sentiment in Asia-Pac markets.

CRYPTO

- Bitcoin was choppy and swung between gains and losses above the USD 95,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBNZ cut the OCR by 50bps to 3.75%, as expected, while it said rates were reduced further as inflation abates and if economic conditions continue to evolve, there is scope to lower the OCR further in 2025. RBNZ said the committee has the confidence to continue lowering rates and economic activity remains subdued although the economy is expected to recover over 2025. RBNZ lowered its official cash rate forecast to 3.45% for June 2025 (previously 3.83%) and to 3.1% in March 2026 (previously 3.43%), while it sees the OCR at 3.1% in June 2026 (previously 3.32%) and at 3.1% in March 2028.

- RBNZ Governor Orr said the OCR path projects 50bps by mid-year at around July and suggested two 25bp cuts with April and May 'about right', while he added the economy has significant spare capacity and 3.75% is the high end of the range of neutral rates. Furthermore, he said it would be a beautiful world if they could get rates to neutral and keep them there and they are seeing a a turnaround in the economy.

- BoJ's Takata said it is necessary for the BoJ to shift gears as appropriate and BoJ's flexibility has increased, while he added Japan's real interest rates remain deeply negative, with no change to the accommodative monetary environment. Takata said they must adjust the degree of monetary support further if the economy moves in line with the BoJ's forecasts and must gradually shift policy, even after January's rate hike, to avoid upside price risks from materialising. However, he also stated the BoJ needs to take a cautious approach in shifting policy due to uncertainty over the US economic outlook and difficulty in gauging the neutral rate level.

DATA RECAP

- Chinese House Prices MM (Jan) 0.0% (Prev. 0.0%)

- Chinese House Prices YY (Jan) -5.0% (Prev. -5.3%)

- Japanese Trade Balance (JPY)(Jan) -2758.8B vs. Exp. -2100.5B (Prev. 130.9B, Rev. 132.5B)

- Japanese Exports YY (Jan) 7.2% vs. Exp. 7.9% (Prev. 2.8%)

- Japanese Imports YY (Jan) 16.7% vs. Exp. 9.7% (Prev. 1.8%, Rev. 1.7%)

- Japanese Machinery Orders MM * (Dec) -1.2% vs. Exp. 0.1% (Prev. 3.4%)

- Japanese Machinery Orders YY * (Dec) 4.3% vs. Exp. 6.9% (Prev. 10.3%)

- Australian Wage Price Index QQ (Q4) 0.7% vs. Exp. 0.8% (Prev. 0.8%)

- Australian Wage Price Index YY (Q4) 3.2% vs. Exp. 3.2% (Prev. 3.5%)

GEOPOLITICS

MIDDLE EAST

- Israel Minister of Strategi Affairs Dermer will work with US Special Envoy Witkoff on phase two talks which are focused on demands to end the war, while there will be working teams and professional ranks traveling to Qatar and Egypt, according to Jerusalem Post citing sources.

RUSSIA-UKRAINE

- US President Trump said talks with Russia were very good and he is more confident, while he added that he does not think they would have to remove all troops from Europe and it is fine if Europeans want peacekeeping troops in Ukraine. Trump criticised Ukraine who he said wants a seat at the table but noted that Ukraine has had a seat and this could have been settled easily, as well as falsely accused Ukraine of starting the war and suggested Ukraine should hold an election. Furthermore, Trump said it was the Ukrainian leadership that allowed the war to continue so far and he is disappointed after Ukraine denounced its exclusion from US-Russia talks, while he also stated that he will probably meet with Russian President Putin before the end of the month.

- Intelligence reportedly shows Russian President Putin is not interested 'in a real peace deal' and is going through the motions but still thinks he can eventually control all of Ukraine, according to the sources cited by NBC News.

- France convenes a second meeting to discuss Ukraine and European security on Wednesday which will include NATO allies not invited on Monday. Furthermore, it was reported that among the countries invited are Norway, Canada, Baltic States, Czech Republic, Greece, Finland, Romania, Sweden and Belgium.

- German Defence Minister said Russian threat will remain even with the possibility of peace in Ukraine and their experts estimate that in 4 to 7 years Putin will be able to launch an attack on NATO territory, according to Al Jazeera.

- EU is reportedly working on an initiative to provide Ukraine with additional military support as soon as possible, with an aim to deliver at least 1.5mln rounds of artillery ammunition, air defence systems, deep-precision strike missiles and drones, as well as support to train and equip brigades and bolster ties between the defence industries of the EU and Ukraine, according to Bloomberg citing a document.

OTHER

- China’s Foreign Minister Wang Yi met with Bolivia’s Foreign Minister at the UN and said China is willing to work with Bolivia to elevate their strategic partnership, while he added that Latin America belongs to its people and is not any country’s "backyard", as well as stated that China will always be a trustworthy friend and partner of Latin America.