Is Bill Gross about to face another big loser? On Nov 2nd, the former 'bond king' wrote on X that "regional bank falling knife has hit bottom" adding that he was buying shares of Truist Financial, Citizens Financial Group, KeyCorp, and First Horizon.

The Regional Bank Index soared for two days after that, but the last two days have seen the index give some of those gains back...

And today, we get headlines that - on their face - would seem like very bad news for smaller banks as regulators push to close the cookie jar of cheap rescue cash that access to Federal Home Loan Banks has provided.

After a review of the system that lasted more than a year, the Federal Housing Finance Agency will move FHLBs away from serving as lenders of last resort for financial firms in turmoil, and back to their roots in housing finance. Specifically, the plans ratchet up federal oversight and seek to push banks toward the Fed’s discount window in times of extreme stress, according to a report to be published Tuesday.

As Bloomberg reports, banks borrow hundreds of billions of dollars from the government-chartered FHLBs each year to fulfill short-term funding needs.

The practice came under scrutiny after the FHLBs, which have implied backing from the government, lent heavily to Silicon Valley Bank, Signature Bank and First Republic Bank as they careened toward failure.

The report specifically notes that "concerns with FHLBank lending to significantly deteriorating financial institutions must be addressed."

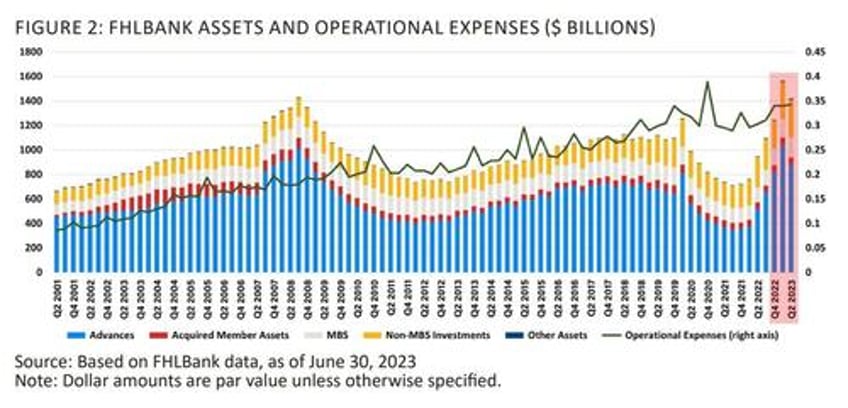

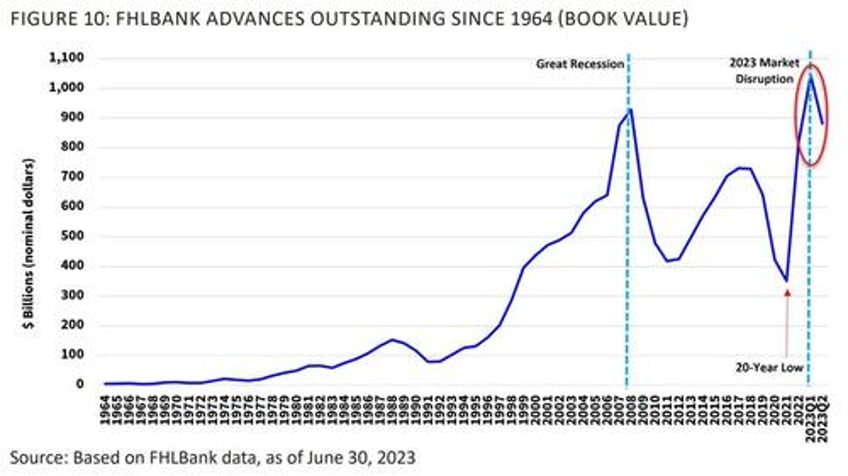

...advance volumes fell to 20-year lows in late 2021, coinciding with rising volumes of deposits that provided a liquidity cushion for commercial banks during the pandemic.

However, during the week beginning March 13, 2023, the FHLBanks funded $675.6 billion in advances, the largest one-week advance volume in FHLBank System history.

While the FHLBank advances helped many members withstand market stress, Silvergate Bank (an active borrower) voluntarily dissolved in the prior week.

Shortly thereafter, Silicon Valley Bank and Signature Bank failed after actively borrowing from their respective FHLBanks.

First Republic Bank, another member, failed approximately seven weeks later.

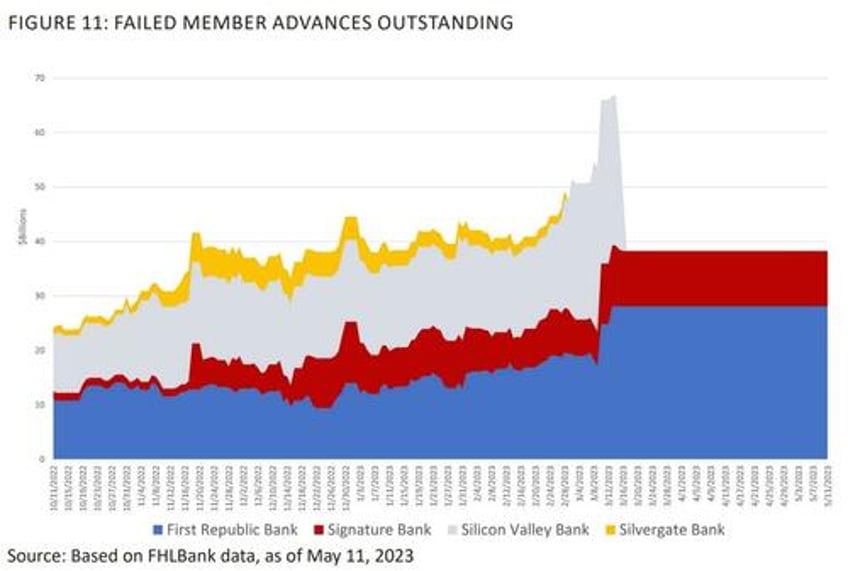

As shown in Figure 11, these four entities increased their borrowings from their FHLBanks starting in late 2022.

This resembled a pattern observed in the lead-up to the 2008 crisis, during which the System saw increased borrowing by members in distress just before failure.

The FHLBank System did not incur losses on its advances to these failed members.

The broader financial system, however, incurred losses because of these failures, highlighting the need for greater focus by the FHLBanks on evaluating member creditworthiness and better coordination with their members’ primary regulators when a member’s financial condition is deteriorating.

Even more problematically, the report notes that during the March 2023 bank failures, the FHLBanks also discovered that some large, troubled members had not established the ability to borrow from the Federal Reserve discount window and therefore were overly reliant on the FHLBanks.

While the FHLBanks continue to serve as a source for reliable liquidity - which allows members, particularly smaller members, to continue to serve their communities - the Federal Reserve has long been considered the U.S. banking system’s lender of last resort.

...Nevertheless, during the March 2023 bank failures, the FHLBank System’s role of providing low-cost liquidity came under stress, due to sizable advance demand from large members, some of which were significantly bigger than the FHLBanks themselves.

The reliance of some large, troubled members on the FHLBanks, rather than the Federal Reserve, for liquidity during periods of significant financial stress may be inconsistent with the relative responsibilities of the FHLBanks and the Federal Reserve.

Among the major changes, the Federal Housing Finance Agency, which oversees FHLBs, will propose a rule to force many banks to hold 10% of their assets in mortgage loans to maintain access to the FHLBs.

The regulator is also exploring new guardrails for lending money to troubled institutions and tougher stress tests.

Bloomberg's Alex Harris highlights some of the possible issues:

Smaller fed funds market: FHLBs are the largest lender of cash in the market for federal funds. If banks borrow less, FHLBs may have less excess cash to lend

Jumpier monetary policy rate: Less volume in the fed funds market could make the fed funds rate -- the US monetary authority’s target benchmark -- more prone to movements within the range, prompting officials to tweak tools to maintain control

Less issuance: The FHLB Office of Finance issues agency discount notes to fund system-wide demand for short-term loans, or advances. Fewer advances means less market supply, which may push T-bill yields lower and motivate buyers of FHLB paper, such as money-market funds, to continue parking cash at the Fed’s reverse repo facility

Higher costs: If banks have to turn elsewhere for funding, such as to the commercial paper market, that may drive borrowing rates higher for institutions

More reserves: Losing a portion of low-cost funding could drive bank liquidity coverage ratios lower, at which point institutions could hold more reserves to fill the funding gap. That means the banking system’s lowest comfortable level of reserves could actually be much higher

Simply put, this regulatory overhaul will ripple through dollar funding markets - and potentially Fed policy - as smaller US banks are forced to pay up for their emergency cash at The Fed's discount window or the BTFP (which will offer the market much more transparency into just how bad the situation is).

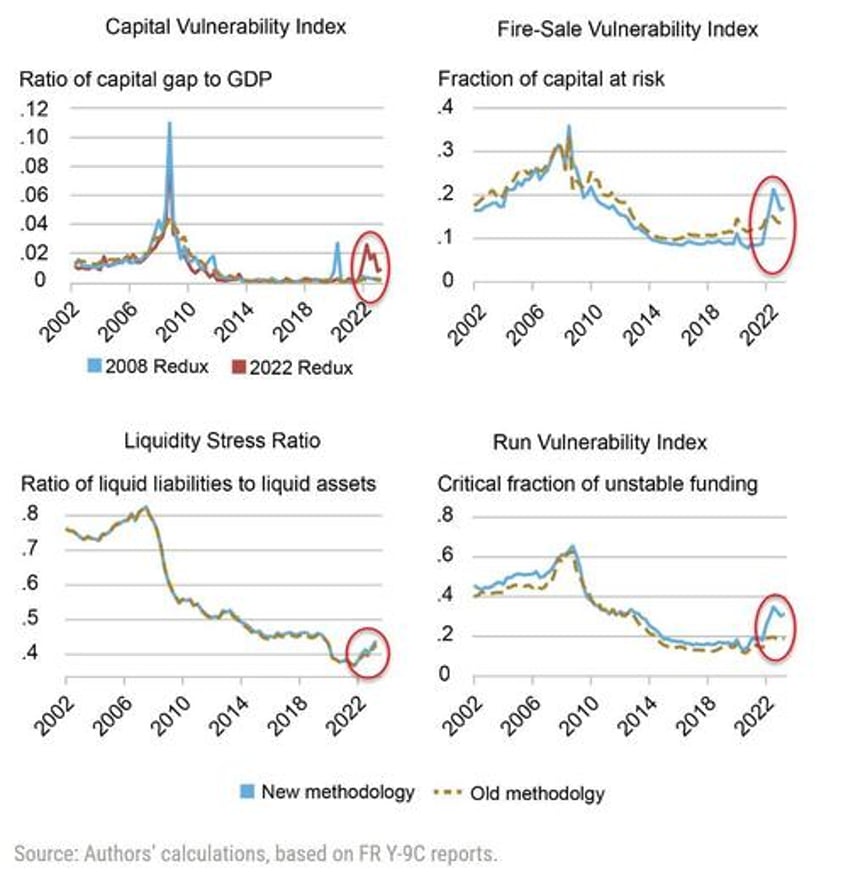

And in case you really believed Bill Gross, just a day ago, the NYFed blog reported new models of banking system vulnerability.

The most important change in methodology is that the measures now incorporate unrealized losses (or gains) on all securities. The goal of this change is to reflect more closely the economic value of bank assets in a stress scenario.

Their new measures, adapted to this recent shock, suggest a moderate increase in systemic vulnerability compared to the low levels of the previous ten years.