By Sagarika Jaisinghani and Farah Elbahrawy, Bloomberg Markets Live reporters and analysts

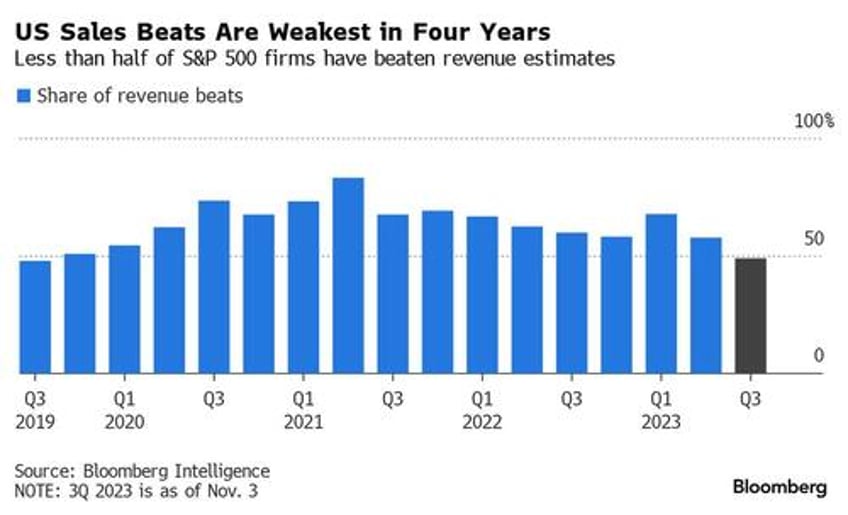

Corporate America is delivering the bleakest sales reports in four years this earnings season, a sign that weakening consumer demand is limiting companies’ ability to raise prices further.

With more than 80% of S&P 500 firms having reported, less than half have beaten revenue estimates for the third quarter — the lowest share since the same period in 2019, according to data compiled by Bloomberg Intelligence. The pace of sales growth globally has also moderated to “the lower end of their pre-pandemic ranges,” Deutsche Bank Group AG strategists said.

That’s overshadowed a surprise increase in quarterly earnings so far, with investors instead focusing on a long list of revenue warnings from the likes of Apple Inc. and Estée Lauder Cos. In Europe, too, the season has been characterized by high-profile cuts including from Remy Cointreau SA.

“We heard a lot of caution in managements’ guidance during the season and that’s exactly what we are watching for — weaker sales and margins compression as pricing power wanes,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “For now, consumer and corporates still have access to credit, but it’s getting harder and more expensive. Once that dries out, we would see more pain.”

Apple warned last week that revenue in the holiday quarter will be about the same as last year, disappointing investors banking on a rebound in growth. Estée Lauder shares tumbled after the owner of the MAC and Tom Ford brands flagged declining sales. Remy Cointreau fell to a three-year low after the French distiller cut its annual sales guidance.

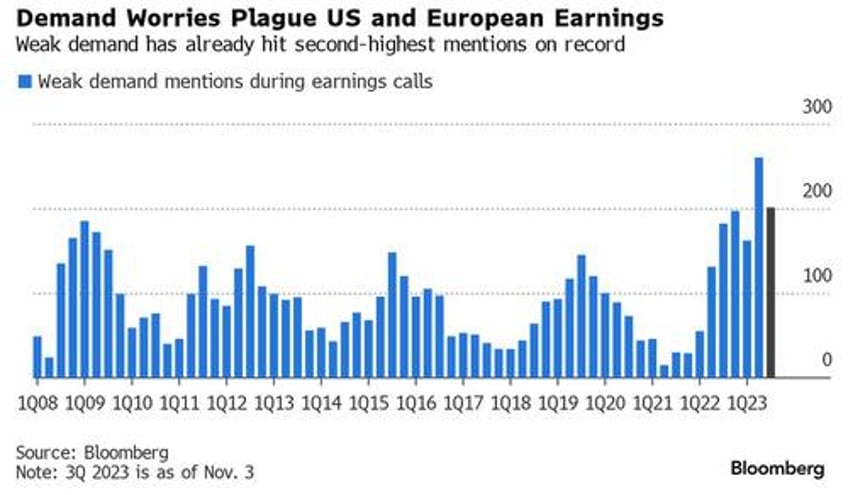

A Bloomberg analysis of earnings call transcripts shows “weak demand” is among the top trending phrases in both the US and Europe. With 20% of companies still to report, these mentions are already the second-highest on record, according to data going back to 2000.

Figures from Barclays Plc also show that management teams are sounding far more negative about the outlook for revenue than they are about profits as margins appear to hold be holding up for now. As a result, analysts are revising sales estimates down faster than those for earnings-per-share, strategist Emmanuel Cau said.

For Morgan Stanley’s Michael Wilson, the trend particularly signals eroding pricing power for goods over services. The strategist — among the top equity bears on Wall Street — retained his pessimistic view on the S&P 500 for the remainder of 2023, citing a gloomy earnings outlook, weaker macro data and deteriorating analyst views.