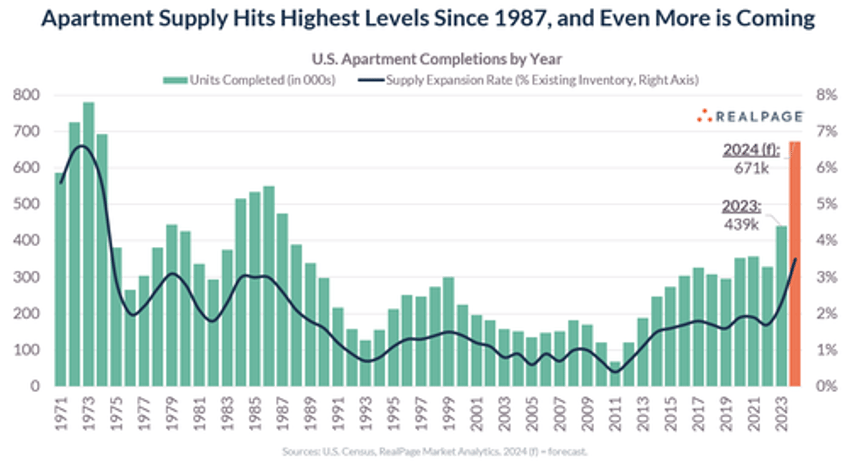

There is some encouraging news for the millions of Americans forced onto the sidelines by the worst housing affordability crisis in a generation and stuck in expensive apartments: The supply of apartments in the US has reached its highest levels in nearly forty years and is anticipated to expand even more this year. This increase may provide renters with greater bargaining power when renegotiating their leases.

"US apartment supply in 2023 surged to the highest levels since 1987, with more than 439,000 units completing. Even more will complete in 2024," Jay Parsons, chief economist at RealPage, wrote in a post on social media platform X. He continued:

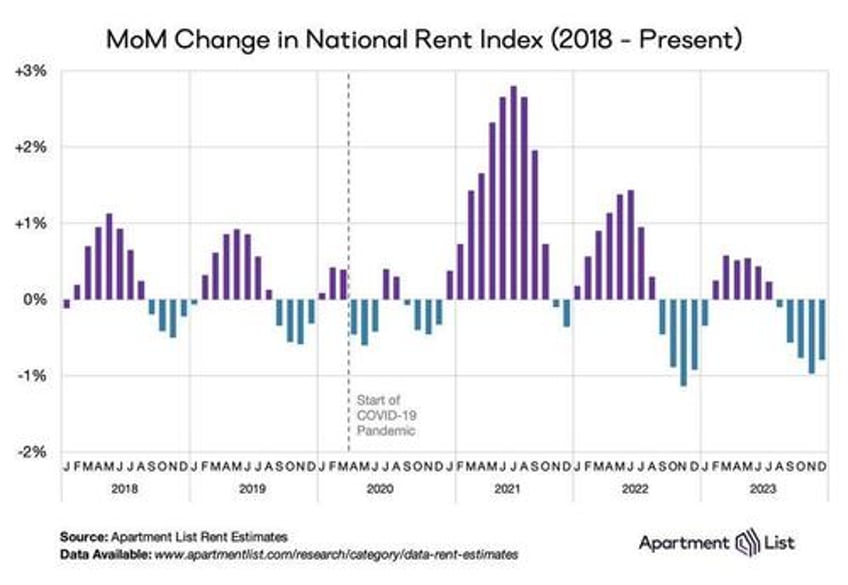

That means renters suddenly have a lot more options, and in turn, rent growth has evaporated.

The upside is that apartment demand rebounded strongly in 2023 following a sluggish 2022, but not enough to keep pace with the 36-year high in supply.

Not ironically, this wave of supply is resulting from construction starts that began back when rent growth and occupancy rates were at/near record highs. Those projects are delivering into a very different environment in 2023-24, and consequently, starts have plunged. Supply will drop way off in 2025-26.

The good news:

Remember: It's all about supply. Rents fell in 2023 across 40% of US metro areas – and nearly all of them (primarily in the Sun Belt, Mountains or West Coast) saw significant new supply entering the market. By comparison, nearly one-third of US metro areas (almost all in the Midwest or Northeast) produced rent growth of 3% or more in 2023, and nearly all of them had little supply to work through.

And more supply is coming:

In all likelihood, 2024 will bring another year of more supply than demand – adding another challenge for apartment investors also confronting higher expenses and elevated debt costs. The outlook should substantially improve in 2025-26, barring a collapse in the economy, given the certainty of far less supply.

The good news is more supply will lead to further rent declines.

The bad news is that lower rents will pressure multi-family owners amid a commercial real estate downturn already hammering offices.