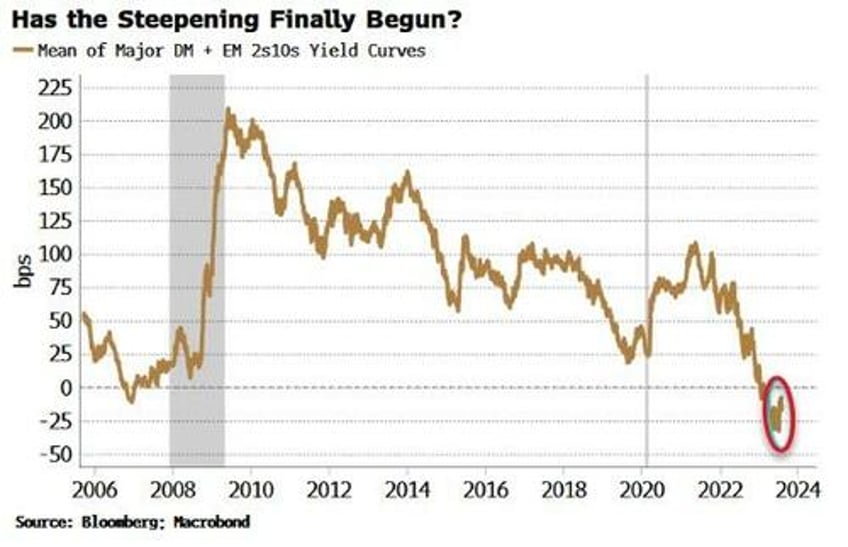

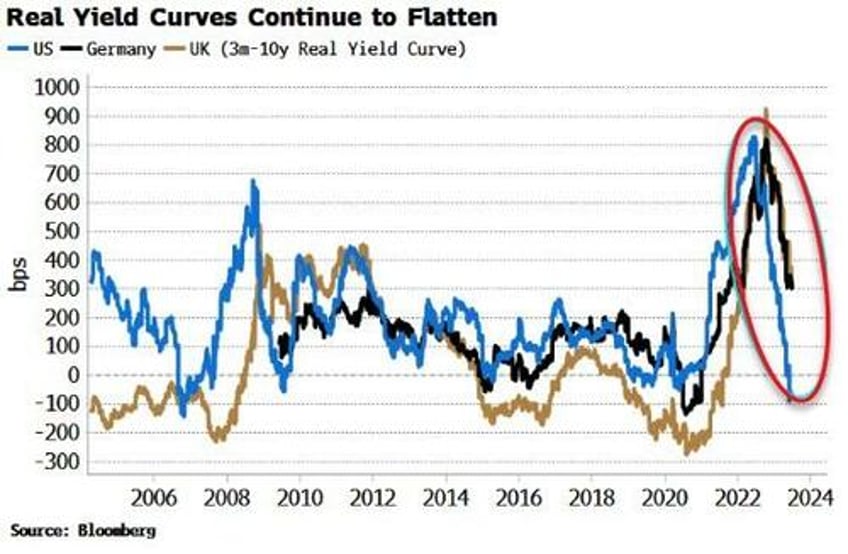

Yield curves around the world over the last month have shown early signs of steepening. But it’s a re-steepening in real yield-curves that investors should be alert for, as this would be a negative signal for liquidity and thus risk assets.

Never underestimate the BOJ’s propensity to surprise. After giving the impression policy would be unaltered, at its meeting last week the BOJ shifted their ceiling for 10y rates from 0.5% to 1%, and introduced greater flexibility in its yield-curve control policy. 10y yields broke through 50 bps, and currently trade at just over 60 bps (with the BOJ buying bonds this morning), while USDJPY whipsawed around and closed higher on the day by 1.2%.

The policy adjustment coincided with yield-curve steepenings in the US, UK and Europe. This would be consistent with Japanese investors’ unwind of some of their US and European sovereign debt, along with the funding legs, to take advantage of the extra yield offered on JGBs.

It’s not clear, though, whether the yield differentials will be enough – 10y UST and JGB yields have both risen by about the same amount over the last week – to sustain flows back to Japan from the US. And flows in the other direction will continue to be limited as USTs remain very unattractive to Japanese investors after hedging costs.

Regardless, even before the BOJ, global yield curves had already begun to show signs of a re-steepening trend over the last month.

But when it comes to gauging the likely outlook for risk assets, it’s real yield-curves that have more utility in an elevated-inflation environment. The real yield-curves of the major countries continue to flatten aggressively as inflation falls, driving short-term real yields higher.

For the US, the flattening real yield-curve should keep pressure on the dollar (with last week’s BOJ actions adding to USDJPY downside).

This will continue to support excess liquidity, as the dollar value of foreign currencies rises.

The single biggest endogenous risk facing risk assets is a re-acceleration in inflation. While that is expected at some point, for the time being real yield-curves should keep flattening, and risk assets should stay supported.