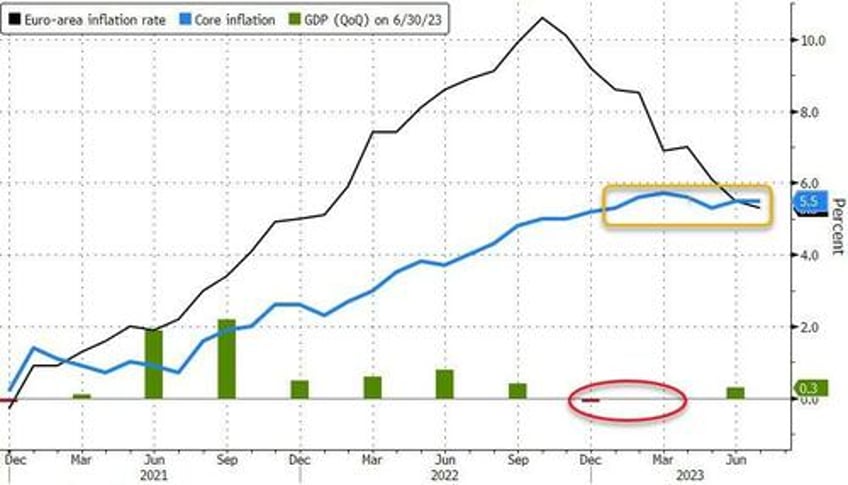

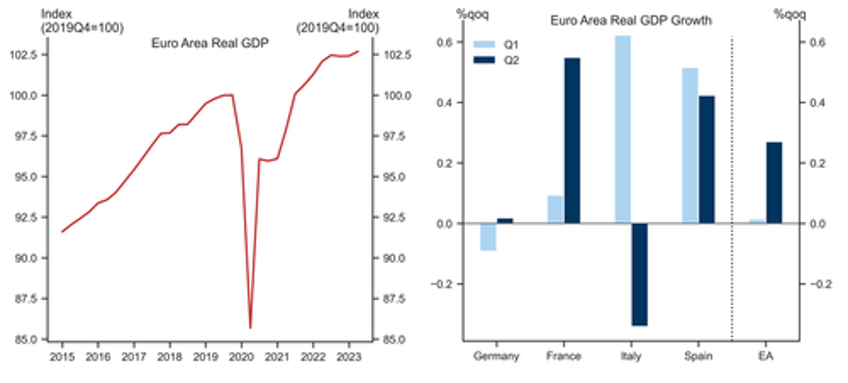

As expected, euro-zone economic growth returned to growth in Q2 with GDP rising 0.3% QoQ (better than the 0.2% rise expected) after shrinking and stagnating in the prior two periods.

While the euro zone's GDP number looks encouraging, it was buoyed by a bumper three months from Ireland, which expanded by 3.3%. Additionally, Q2 GDP growth was weaker than consensus expectations in Germany and Italy, in line with expectations in Spain and above expectations in France.

Although stronger than expected, Goldman notes that with today's print stronger than expected, the Euro area is on track to avoid a technical recession but the GDP prints in Austria, Germany and Italy point to extended weakness in the manufacturing sector.

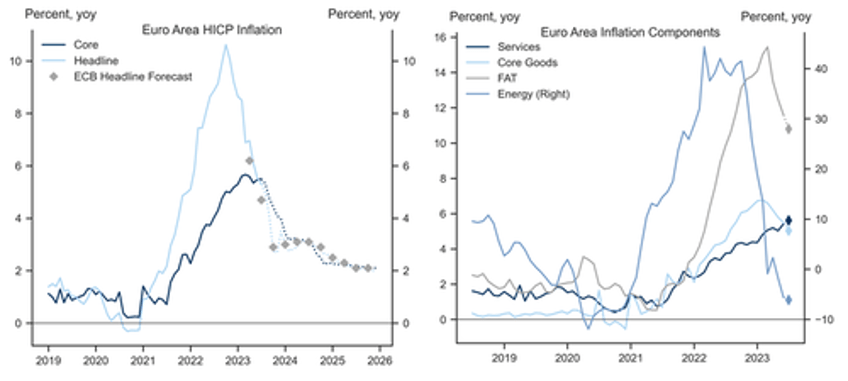

However, more problematically for The ECB, while headline consumer price inflation slowed to just 5.3% from a year ago in July, as expected; in a sign of lingering dangers, the closely watched Core CPI (that excludes volatile costs like food and energy) overshot estimates by a touch to stay at 5.5%, surpassing the headline gauge for the first time since 2021.

The breakdown by main expenditure categories showed services inflation rose 0.2pp to 5.6%yoy, and non-energy industrial goods inflation fell 0.5pp to 5.0%yoy.

Of the non-core components, energy inflation fell five-tenths of a percentage point to -6.1%yoy, while food, alcohol and tobacco inflation fell eight-tenths of a percentage point to 10.8%yoy.

Furthermore, Goldman raised its forecast for EU inflation, now expecting core and headline inflation to be 4.0%yoy (vs 3.8%yoy previously) and 3.5%yoy (vs 3.4%yoy previously) respectively in December 2023.

Looking ahead, the region’s outlook is far gloomier, the ECB warned last week after lifting rates for a ninth time since July 2022.

Confidence indicators are flashing red, with AXA’s Gilles Moec among analysts warning of a “hard-ish landing.”

President Christine Lagarde reiterated her message over the weekend that in the current uncertain environment another hike or “perhaps a pause” are the options for the next policy decision, in September.

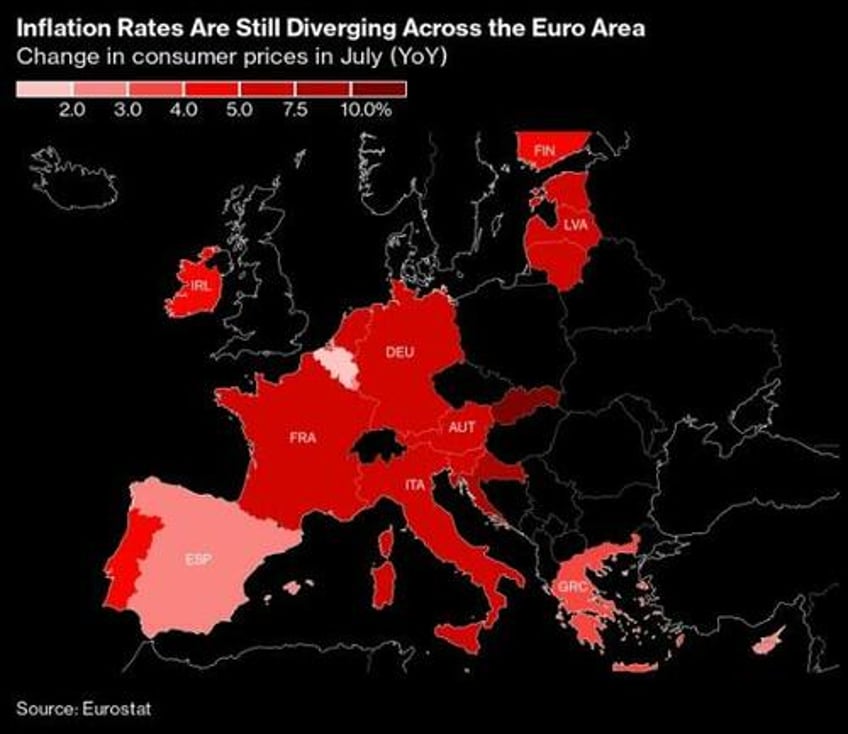

As Bloomberg concludes, the latest inflation and GDP figures for the euro zone leave both options on the table - the economy is not yet tanking, while core inflation remains sticky.