Restrictive monetary conditions, from higher yields and tighter lending conditions, are the Fed’s “Waterloo.”

If you don’t remember, the “Battle of Waterloo” was fought on June 18th, 1815. The battle was a catastrophic defeat for the Napoleonic forces and marked the end of the Napoleonic Wars. Before that defeat, Napolean had a successful campaign of waging war in Europe.

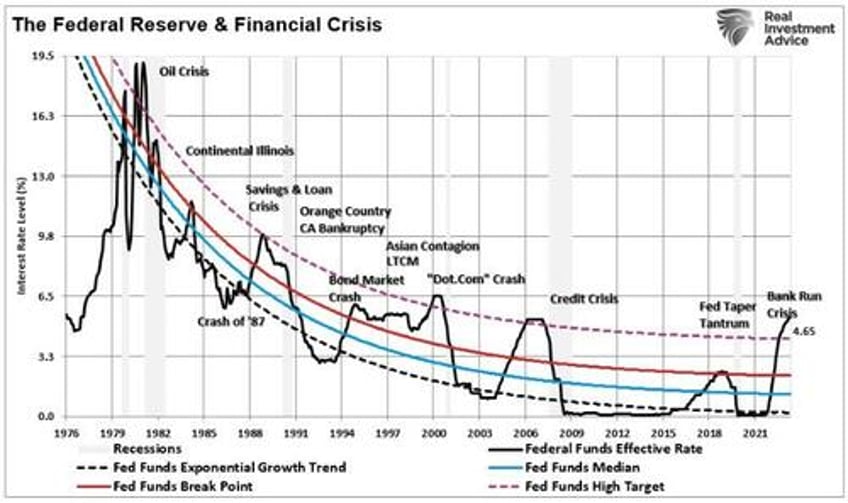

Today, the Federal Reserve has successfully waged a war against inflation. Of course, as is always the case throughout history, the Fed campaign has consistently met its eventual “Waterloo.” Rather, the point where rate hikes and tighter monetary policy eventually cause a problem somewhere in the financial system. Such is particularly the case when the Fed funds rate exceeds levels associated with previous crisis events.

Much like Napoleon, who was confident entering the battle of Waterloo and the eventual victory, the Fed remains convinced of its eventual success. Following the most recent FOMC meeting, the Federal Reserve reiterated its “higher for longer” mantra and upgraded its economic forecast to include a “no recession” scenario.

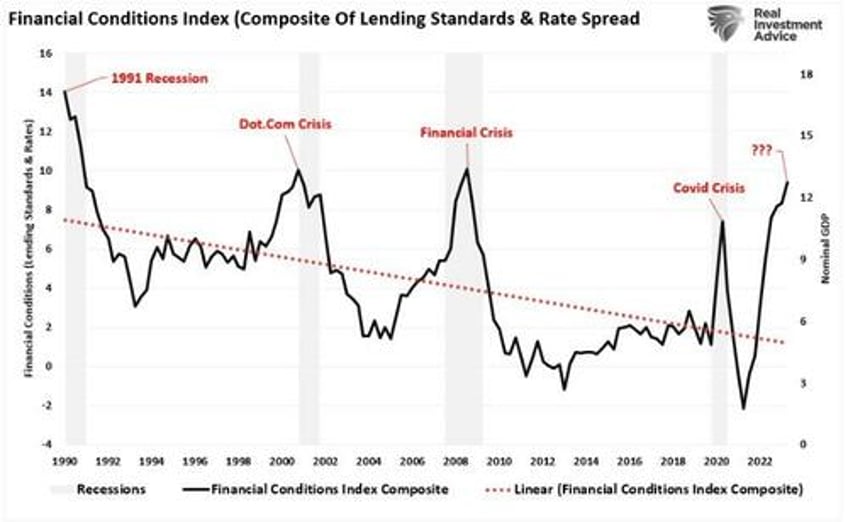

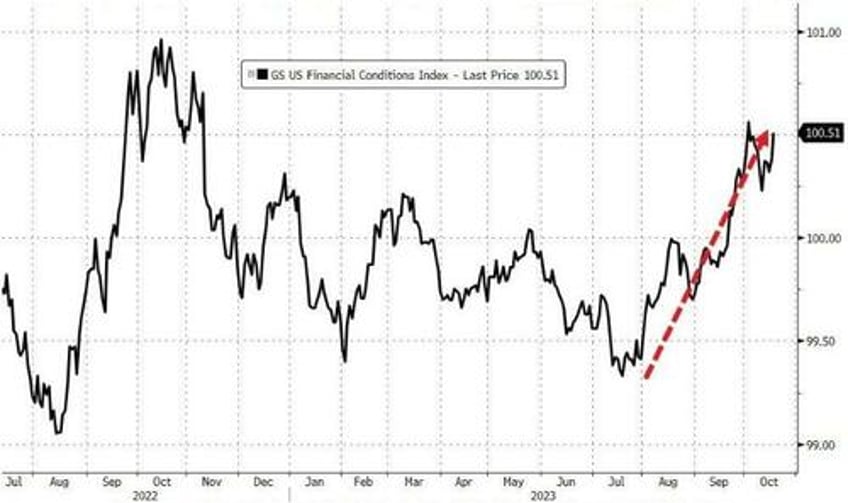

However, while Jerome Powell has one hand tucked into his lapel with a smirk, the recent surge in yields may be his eventual undoing. As shown, financial conditions have become increasingly restrictive. The chart combines bank lending standards with interest rates and the spread to the neutral rate. Due to increasing debt levels in the economy, the level at which financial conditions are too restrictive has trended lower.

Given the sharp rise in yields over the last couple of months, it is unsurprising that recent comments from Federal Reverse members suggest that bond yields have become restrictive, suggesting an end to further rate hikes.

How To Say “No More” Without Saying It?

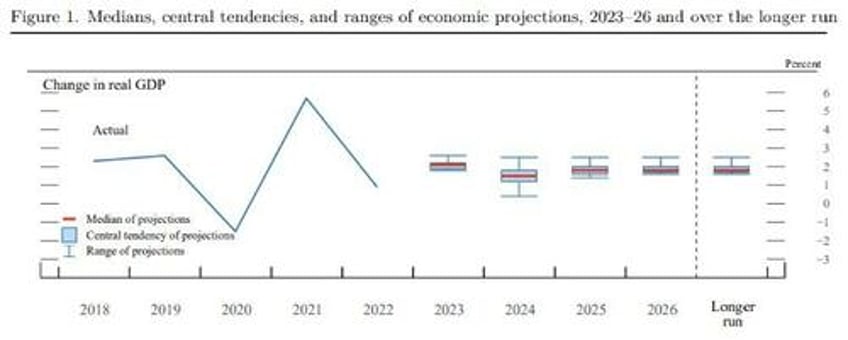

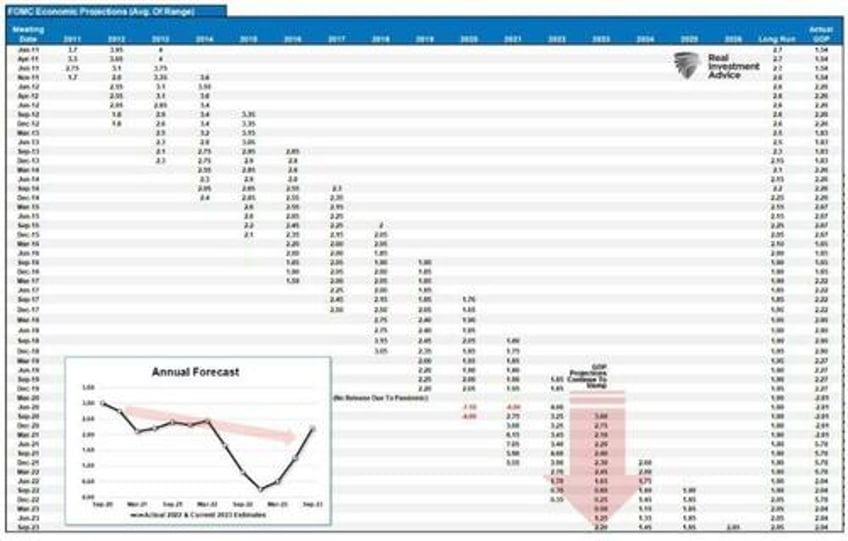

The Fed’s “soft landing” hopes are likely overly optimistic. The context of the recent #BullBearReport discussed the long record of the Fed’s economic growth projections. To wit:

“However, there is a problem with the Fed projections. They are historically the worst economic forecasters ever. We have tracked the median point of the Fed projections since 2011, and they have yet to be accurate. The table and chart show that Fed projections are always inherently overly optimistic.

As shown, in 2022, the Fed thought 2022 growth would be near 3%. That has been revised down to just 2.2% currently and will likely be lower by year-end.”

As noted, the Fed’s outlook for more robust growth and no recession has allowed it to keep “one more rate hike” on the table. The prospect of further rate hikes spooked the stock and bond markets immediately. However, following the announcement, we explained why the Fed needed such a statement to keep markets in line.

“The Fed projecting one last rate increase is also a way of preventing investors from immediately turning to the next question: When will the Fed cut? The risk is that as soon as investors start doing that, rate expectations will come down sharply, and with them, long-term interest rates, providing the economy with a boost the Fed doesn’t want it to receive just yet.

That is right. Since October last year, the market has been hoping for rate cuts and increasing asset prices in advance. Of course, higher asset prices boost consumer confidence, potentially keeping inflationary pressures elevated. Keeping a rate hike on the table keeps the options for the Federal Reserve open.“

Such was what Powell did in his speech yesterday by stating:

“Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

However, the recent surge in long-term U.S. Treasury yields, and tighter financial conditions more generally, means less need for the Federal Reserve to raise interest rates further, as Jerome Powell noted yesterday.

“Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.”

While the markets misread much of Powell’s commentary, concerned about “higher rates,” Powell reiterated that weaker economic growth and lower inflation remained its primary goal.

“In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal”

Unless interest rates collapse substantially, which will only happen with the onset of a recession, the message from the Fed is becoming clear: The rate hiking regime is over.

Rate Cuts Are Coming

While the Fed is hopeful they can navigate a soft landing in the economy, such has historically never been the case. Higher interest rates, restrictive lending standards, and slower economic growth will result in a recession. The cracks in the economy are already becoming more abundant.

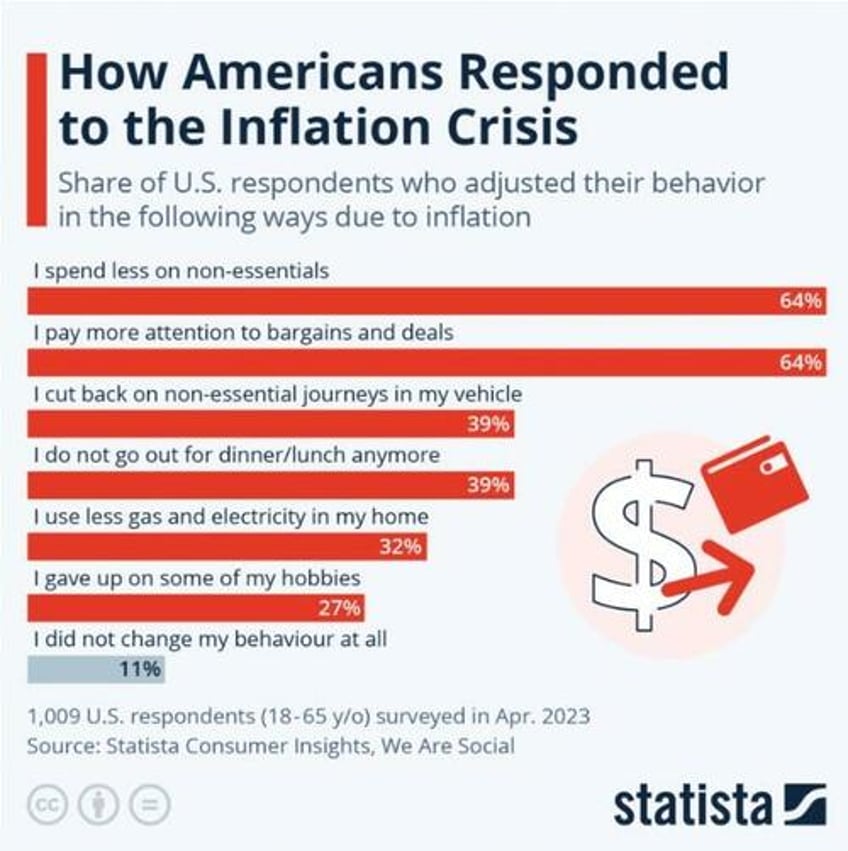

Statista’s Felix Richter noted, via Zerohedge, that inflation has neutralized pay increases and that many Americans were left with less than before. Such is because wage growth failed to keep up with surging prices for essential goods and services, including food, gas, and rent.

Furthermore, in a joint effort that underscores the impact of monetary policy on one of the most rate-sensitive sectors of the economy, the National Association of Home Builders, the Mortgage Bankers Association, and the National Association of Realtors wrote a letter to Jerome Powell. In that open letter was their key concern:

“To convey profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path contributes to recent interest rate hikes and volatility.” – CNBC

To address these pressing concerns, the MBA, NAR, and NAHB urge the Fed to make two clear statements to the market:

“The Fed does not contemplate further rate hikes;

“The Fed will not sell off any of its MBS holdings until and unless the housing finance market has stabilized and mortgage-to-Treasury spreads have normalized.”

Why would the three major housing market players make these requests?

“We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid.”

Given that housing activity accounts for nearly 16% of GDP, you can understand the request. Critically, such a letter would not have been written unless significant cracks in the foundation had already formed.

If history is any guide, the Fed’s next policy change will be to cut rates amid concerns about a recessionary outcome.

In other words, Jerome Powell may have engaged in his last battle of this campaign.