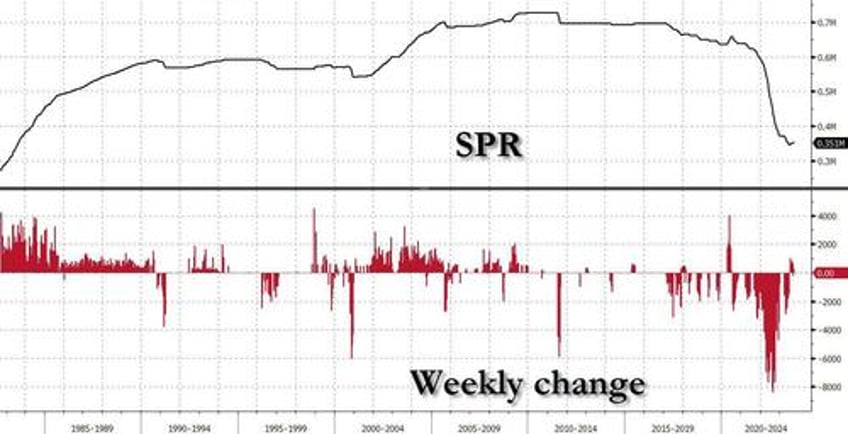

Suffering months of humiliating jeers about the dre state of the US SPR, which has been half-drained at a time when geopolitical risk is the highest it has been in years, the US Department of Energy announced that it wants to buy 6 million barrels of crude oil for the strategic petroleum reserve as part of efforts to refill it after a massive release last year of close to 200 million barrels.

The release was the result of a political attempt by the White House to bring retail fuel prices down ahead of the 2022 Midterm elections following Russia’s invasion of Ukraine, which at the time some warned would empty the strategic petroleum reserve at a time when it was better full. The outcome was partially successful as Democrats retained the Senate, the problem is that the SPR remains the emptiest it has been in 40 years.

This year, the Department of Energy has repeatedly said it wanted to start refilling the SPR but the price never seemed right, after the department set itself a range of between $68 and $72 per barrel for the refill push.

Then, idiotically, when oil prices did decline to the low $70s earlier this year (amid expectations that Biden will finally tip the US into a recession) the cartoonish amateurs at the Department of Energy headed by the incompetently cackling Jennifer Granholm...

Reporter: “What is the Granholm plan to increase oil production in America?”

— Washington Free Beacon (@FreeBeacon) November 5, 2021

Energy Secretary Jennifer Granholm, laughing: “Oh my God… that’s hilarious!” pic.twitter.com/OlBZ2th9KA

... bought only a few million barrels for the SPR, which remains at a 40-year low. The total amount bought so far is 4.8 million barrels, which cost the DoE an average of below $73 per barrel, according to Reuters.

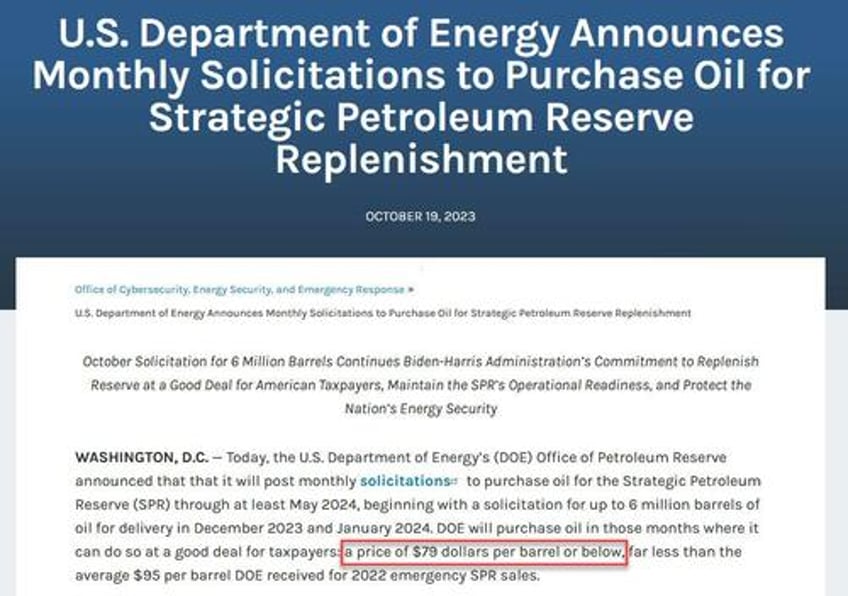

And now, the DoE is saying that it was ready to buy oil for the reserve at a price of $79 per barrel or less. The timeframe for the potential purchases is December and January. Which of course means there will be zero refilling since oil will not drop that low and instead the DOE will be forced to keep chasing higher, pushing the price of oil in the process.

West Texas Intermediate is currently trading at $90 per barrel. Whether it could decline to $79 over the next two months is anyone’s guess but given that OPEC, and more specifically Saudi Arabia, remains determined to keep a lid on production, chances for that are slim, even with higher Venezuelan oil production now that Washington lifted the oil sanctions for six months.

News of the plan to refill the SPR has helped to push oil prices higher, which now have a new price floor one which eliminates the chance of WTI falling anywhere close to $79 anytime soon, absent a massive economic recession of course, yet since a recession will spark immediate QE and even more fiscal stimulus, any oil price drop will be temporary at best.

Meanwhile, instead of encouraging US oil output to refill the SPR faster and at a much lower cost to the US, the idiots who control Biden's teleprompter would rather cut deals with dictators such as Maduro instead of empowering and funding US shale/E&Ps to produce much more at a time when the world is the closest it has been to WW3 since the Cuban Missile Crisis.