Authored by Simon White, Bloomberg macro strategist,

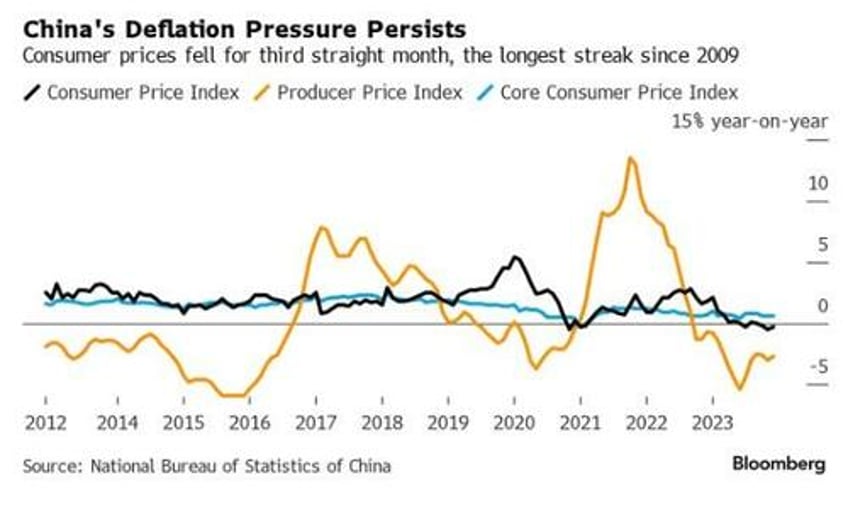

Money and inflation data released overnight in China continues to show scant signs of an upturn that would justify a risk-on mood. Sentiment in stocks is weak, but we are not yet at extremes that indicate an imminent bounce in prices.

It’s becoming a bit “waiting for Godot” in looking for an upturn in China. Inflation data earlier today improved only slightly (but was slightly weaker than expectations), even though both PPI and CPI remain in deflationary territory.

One of the most reliable signs, however, of a durable recovery in China will be when money growth, especially M1, inflects higher. But there was no sign of that in today’s data.

M2 growth came in at 9.7% for December versus 10% for the prior month, while M1 held steady at an anemic 1.3%. Aggregate financing continued to weaken on a trend basis.

Stimulus has yet to gain traction in China, and arouse animal spirits. Nonetheless, in a sign the market is becoming inured to bad news, stock futures and the yuan are little changed after the money data was released.

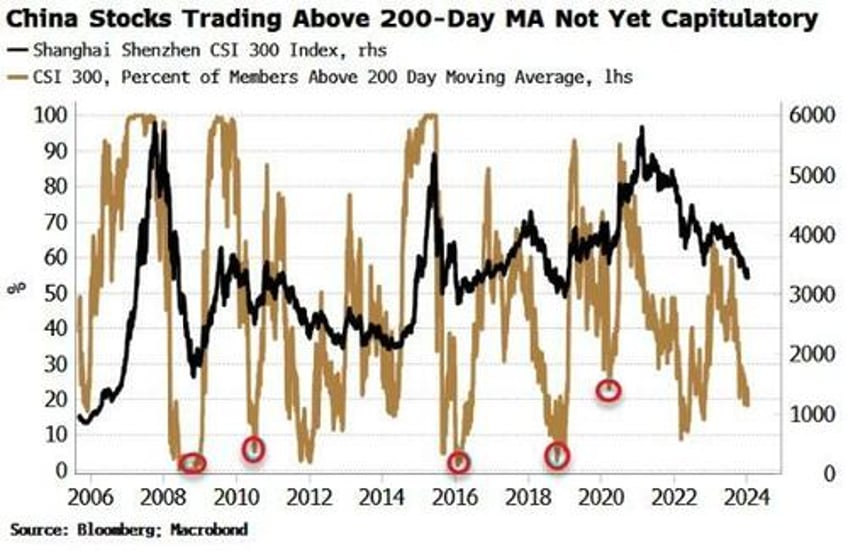

For an upturn in equities, it’s worth keeping an eye on breadth.

It’s on the soft side at the moment, but when it hits extreme lows, it’s typically a sign a bounce in prices is close.

The chart below shows the percentage of stocks in the CSI 300 trading above their 200-day moving average.

It’s low, but we likely need to see a bit more negativity before any tradeable reversal is in.

[ZH: However, amid all this, it appears someone knows something...]

two days ago it was FXI. Today it's FXI and KWEB https://t.co/Psijg12PbX pic.twitter.com/cbUzhr9eWx

— zerohedge (@zerohedge) January 12, 2024