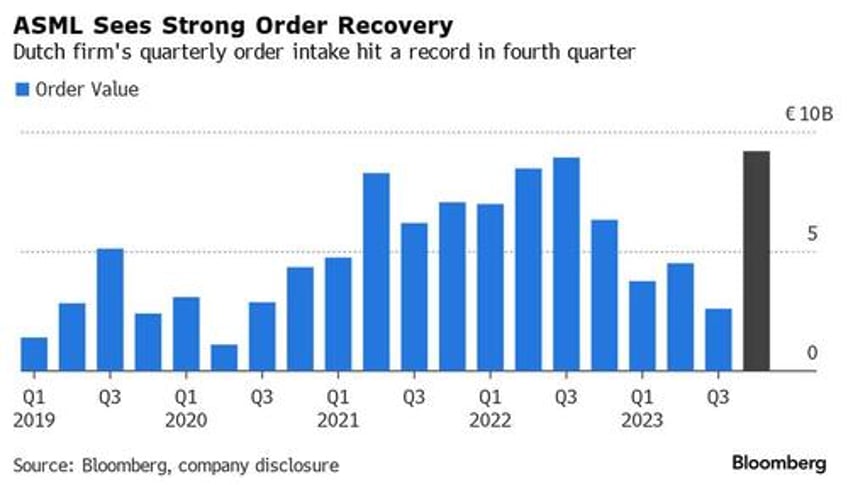

Exactly three months ago, AI stocks were soaring, semiconductor names were flying and the tech sector was euphoric after Dutch chip giant ASML - the world’s sole producer of equipment needed to make the most advanced chips and Europe’s most valuable technology company - reported a record surge in its orderbook (just days after its Asian peer Taiwan Semi did the same)...

... and which the market immediately concluded, in its infinite stupidity, that this was the definitive confirmation of a flood of demand for AI chips and infrastructure with Bloomberg pouring oil on the fire, saying that the ASML results were "a sign that the semiconductor industry may be recovering" adding that "chipmakers are increasingly optimistic the sector’s outlook following a slump that dates back to the Covid-19 pandemic, with TSMC last week projecting strong revenue growth in 2024."

Not so fast, we countered and as we clearly warned in a January article titled "Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders... There's Just One Problem"...

Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders... There's Just One Problem https://t.co/ScGoWO2Ayy

— zerohedge (@zerohedge) January 24, 2024

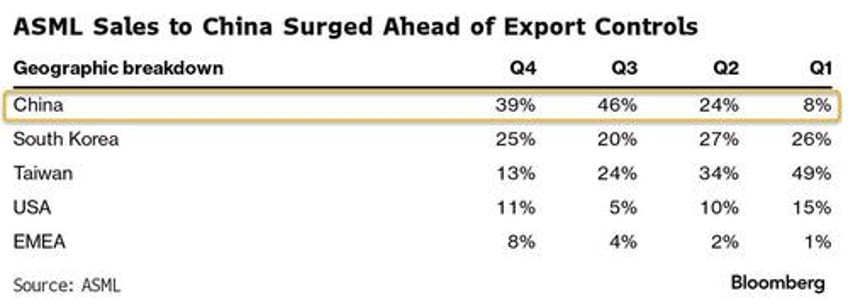

... the reason for the surge in ASML orders was that China, and its proxies in Taiwan and other Asian countries, has been flooding the market with chip purchase orders ahead of Biden's escalating China chip sanctions, knowing that the door is closing amid a barrage of sanctions limiting exports of high tech chips - and chipmaking devices - and that it needs to buy today what it may need for the next few years, if not indefinitely. (as explained in "Behind The Tech Meltup: A One-Time Chinese Chip Buying Frenzy To Frontrun Export Curbs").

And sure enough, China accounted for 39% of ASML’s sales in the fourth quarter and became the Veldhoven-based company’s largest market in 2023! Before speculation of chip sanctions, China accounted for only 8% in January to March.

So what? Well, such one-time buying spurts are - as the name implies - one-time... and as we reported 3 months ago, ASML has been targeted by the US effort to curb exports of cutting-edge technology to China, and Bloomberg reported that ASML exports to China have now effectively been halted, vaporizing whatever portion of the order backlog is thanks to China. This led us to conclude the following:

And so with China now scrubbed from the list of ASML clients - forget being its top customer - the question is who will fill the void. Luckily, demand for AI is keeping the chip sector afloat... or so the experts say, the same experts who fawned over ASML's result today which sparked a buying frenzy in the shares, which soared over 9% today, the biggest increase since November 2022, and hitting an all time high.

Good luck keeping that all time high with your largest customer now barred from future purchases by the State Department. As for "record AI chip demand", this quarter will prove very informative how much is real and how much is vapor once the volatility from China's erratic orderflow is finally removed.

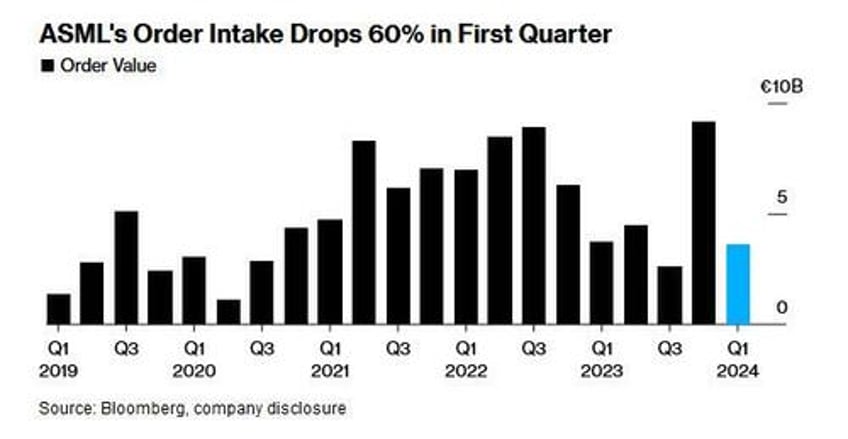

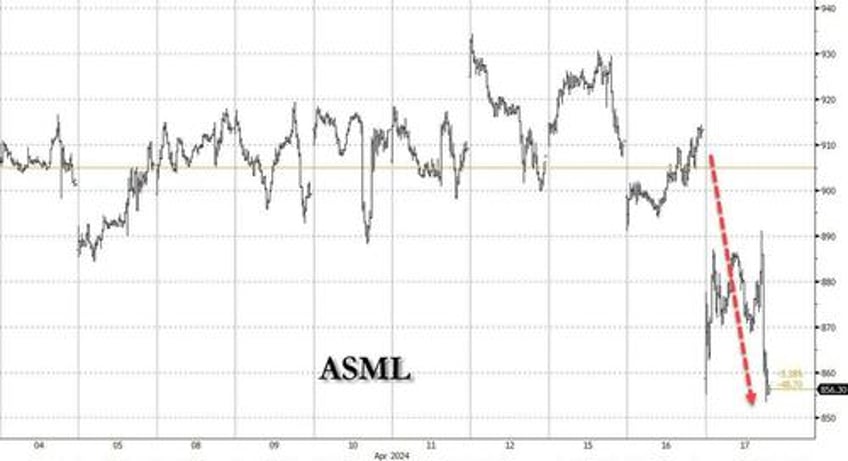

So fast forward three months when "this quarter" is now in the history books, and this morning we got confirmation that everything we said was correct (and that the market, in its infinite stupidity wisdom, was wrong. Case in point: on Wednesday, ASML stock was one of the worst performers among the European tech sector, after the largest European company posted orders that fell short of analysts’ expectations, as Taiwanese chipmakers held off buying the Dutch firm’s most advanced machines.

Bookings at Europe’s most valuable technology firm fell 61% in the first quarter from the previous three months to €3.6 billion ($3.8 billion), wildly missing the market's ridiculous estimates of €4.63 billion, just as we said it would.

As Bloomberg notes, the world's top chipmakers like Taiwan Semi and Samsung Electronics held off new orders as manufacturer clients work through stockpiles of hardware used in smartphones, computers and cars. That’s hurting ASML, which also forecast sales this quarter below analyst expectations. And why did TSMC and Samsung over-order? Simple: they too, were expecting the flood of Chinese last-ditch orders, and were looking to frontrun it.

Well they did... and now everyone has a huge surplus of equipment!

Investors had expected TSMC to book significant EUV tools in the first quarter, according to Redburn Atlantic analyst Timm Schulze-Melander (but not according to ZeroHedge). The disappointment in orders leaves earnings and revenue for next year “vulnerable,” he said, confirming what we said one quarter ago when everyone was rushing to buy the stock on a one-off surge in orders.

The level of EUV orders is “extremely low,” indicating major ASML clients like TSMC, Samsung and Intel didn’t increase investments in the high-end equipment, Oddo BHF analyst Stephane Houri said. ASML saw the biggest slump in demand for its top-end extreme ultraviolet machines. Orders for them plunged to €656 million in the period from €5.6 billion in the previous quarter.

In other words, the frontrunning of China's order book is now dead and buried.

And now comes the hangover, ASML now sees sales in the current quarter between €5.7 billion and €6.2 billion, missing estimates of €6.5 billion before demand picks up. And while the company scrambled to reassure the market that "nothing is fucked here", and pushed demand into the second half as every company does when it misses quarterly expectations...

“Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry’s continued recovery from the downturn,” Chief Executive Officer Peter Wennink said in a statement Wednesday. “We see 2024 as a transition year.”

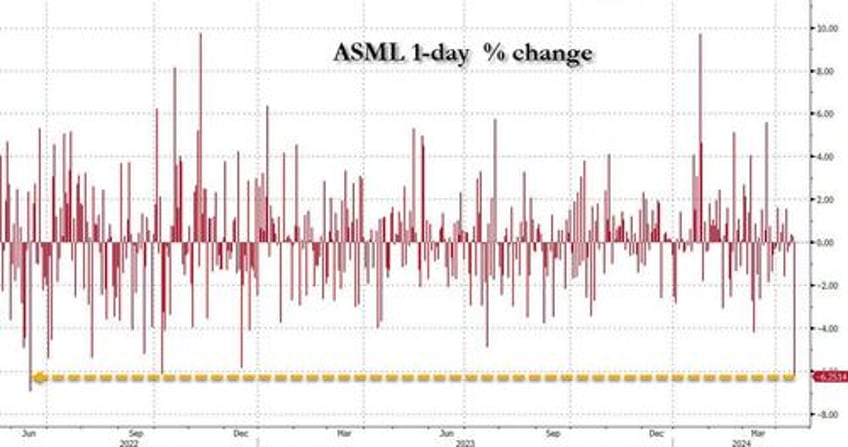

... the market was less than willing to buy the BS this time, and with the company admitting that as much as 15% of China sales this year will be affected by the new export control measures - 50% is a more realistic number - the stock finally tumbled as the hangover finally arrives, if with a three month delay, and today the stock tumbled more than 6%....

... the biggest one day drop since last June.