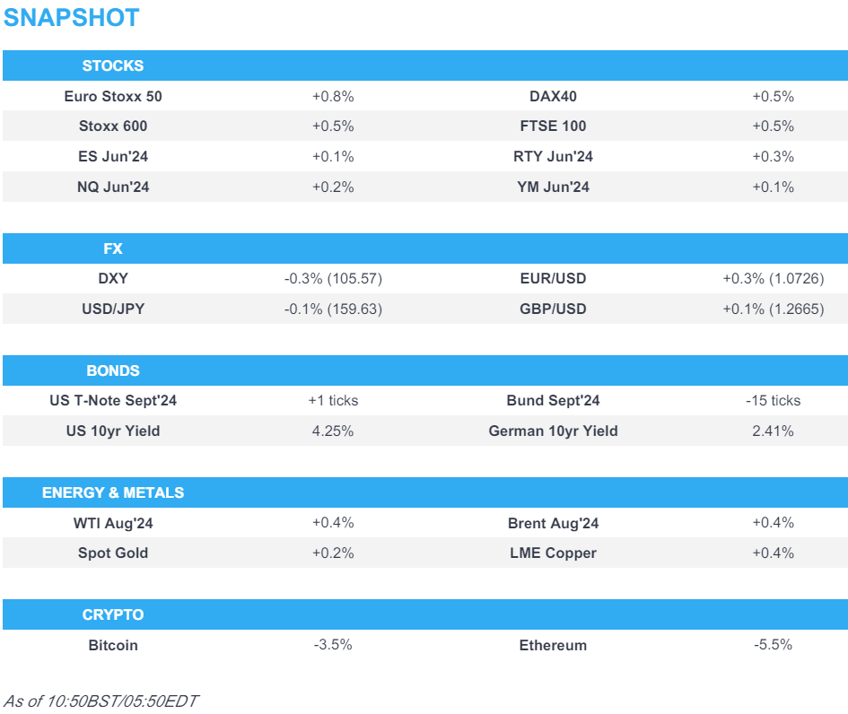

- Equities are entirely in the green, benefiting from a pick-up in sentiment in the European session

- Dollar is softer, EUR is the G10 outperformer, but was initially pressured post-German Ifo, USD/JPY around 159.60

- Bonds are mixed with USTs contained, whilst Bunds slip to session lows

- Crude is incrementally firmer, XAU/base metals benefit from Dollar weakness

- Looking ahead, US Dallas Fed Manufacturing Business Index, Comments from ECB’s Schnabel, BoC Governor Macklem, Fed’s Waller, Goolsbee & Daly

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) are entirely in the green, having initially opened on a tentative footing. Sentiment improved as the session progressed, though was then capped by poor German Ifo data, with indices currently just off best levels.

- European sectors hold a strong positive bias; Autos the clear outperformer, benefitting from EU/China consultations on EV tariffs. Retail is found at the foot of the pile, hampered by losses in Zalando (-6.6%), after a broker downgrade.

- US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.3%) are entirely in the green, with sentiment lifted in tandem to a pick-up in European equities. In terms of pre-market movers, Broadcom (+1.4%) gains on news that it is working with Bytedance to develop an advanced AI processor.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is weaker and trading towards the bottom end of today’s 105.61-90 range, and well within the prior session’s confines. Continued pressure in the Dollar index will bring into play the low from 21st June at 105.53, with not much by way of support until the 50-DMA at 105.19.

- EUR is modestly firmer and holds above 1.07, largely benefitting from broader Dollar weakness. German Ifo data fell short of expectations across the board, which sparked very modest pressure in the EUR, though it has since continued its way higher.

- Cable is incrementally firmer vs the Dollar, and pivoting its 50-DMA at 1.2658. As it stands, markets have ascribed a 88% chance of a cut in September, and near-enough 2 full cuts by year-end.

- USD/JPY is flat after going as high as 159.92 overnight, before edging back towards 159.75. Continued upside in the pair will make traders increasingly more alert to the risk of intervention, particularly around the 160.00 mark.

- Antipodeans are both are firmer vs the Dollar, with very slight outperformance in the Aussie; AUD currently sits above its 20-DMA at 0.6639, though still some way off Friday’s best at 0.6669.

- PBoC set USD/CNY mid-point at 7.1201 vs exp. 7.2647 (prev. 7.1196).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are rangebound with a few fleeting ticks higher emerging on the German Ifo release but with just under 10 ticks to go to re-test Friday's pre-PMI best. Fed's Goolsbee & Daly are scheduled for later today, but this week's focus will reside on US PCE on Friday. USTs currently trading around 110'16.

- Bunds were initially contained as a particularly poor Ifo only inspired a few fleeting ticks higher in Bunds, rising to a 132.72 peak. Since, Bunds have slipped off best levels and towards session lows at 132.33, though without a clear catalyst, but in tandem with a modest pick-up in other safe-haven assets such as the JPY & CHF.

- Gilts are incrementally outperforming but with specifics light. Upside potentially coming as the UK docket is devoid of catalysts and as such Gilts are taking the opportunity to pare some of Friday's downside, whilst USTs and Bunds are mindful of this week's key risk events/supply.

- Click for a detailed summary

COMMODITIES

- Crude is firmer and off worst levels, having traded rangebound overnight and throughout the majority of the European morning. Brent Aug currently holding just above USD 85.50/bbl.

- Precious metals are a touch firmer given the weaker USD and generally slightly soft yield environment; XAU in a USD 2317-2332/oz range, which is capped by the USD 2332/oz 21-DMA.

- Base metals followed the APAC tone and were subdued/lacklustre overnight. A narrative that has dissipated in the European morning given the improved tone and USD pullback.

- Iran set July Iranian light crude price to Asia at Oman/Dubai plus USD 2.60bbl, according to Reuters.

- Ukraine’s Energy Ministry said a Russian air strike on Saturday attacked a Ukrainian infrastructure facility in the west and that Ukraine planned record-high electricity imports following Russia’s air strikes, according to Reuters.

- Phillips 66 (PSX) reports a unit upset at the Wood River, Illinois refinery (173k BPD)

- Click for a detailed summary

NOTABLE DATA RECAP

- German Ifo Current Conditions New (Jun) 88.3 vs. Exp. 88.4 (Prev. 88.3); Ifo Business Climate New (Jun) 88.6 vs. Exp. 89.7 (Prev. 89.3); Ifo Expectations New (Jun) 89.0 vs. Exp. 90.8 (Prev. 90.4); Ifo Head says little trust in the economic developments. Reluctance to invest, via CNBC. Wages are growing by greater than inflation, this has not translated into improved demand; households not spending and firms not investing.

NOTABLE EUROPEAN HEADLINES

- Manchester Airport in the UK was affected by a major power cut on Sunday morning which caused widespread disruption and the cancellation of a quarter of total flights from the airport. It was later reported that the airport was resuming operations and it is working on rescheduling flights in the coming days, while flights scheduled on Monday should be unaffected.

- Ipsos poll found that 25% of respondents had the most confidence that Marine Le Pen’s far-right RN to make the correct decisions on economic issues compared with 22% for left-wing NFP and 20% for French President Macron’s alliance, according to FT.

NOTABLE US HEADLINES

- EU's Breton says they are taking further action against Apple (AAPL) to ensure compliance with the DMA, Co. has been squeezing out innovative companies and denying consumers new opportunities.

- EU Regulators says Apple's (AAPL) requirements fall short of complying with EU tech rules; open investigation into Apple on its new contractual requirements for third-party app developers and app stores; Rules breach EU tech rules prevent app developers from steering consumers to alternative offers.

GEOPOLITICS

MIDDLE EAST

- "Cairo will not restart the Rafah crossing in the presence of Israel ", via Al Arabiya citing an Egyptian source

- Israeli PM Netanyahu said the phase of intense fighting against Hamas is coming to an end but added it does not mean an end to the war in Gaza and stated that once the intense phase of fighting ends in Gaza, it would allow the deployment of more forces to the northern border with Lebanon, according to Reuters.

- Israeli Defence Minister Gallant headed to Washington on Sunday where he will discuss Gaza and Lebanon during his US trip, according to Reuters.

- Security and political talks were reportedly underway in Israel to choose the right timing for action in the north, according to Israel's Channel 12.

- Israel reportedly conducted an air strike on a UNRWA aid centre in Gaza which killed 8 people, according to witnesses cited by the Australian Broadcasting Corporation.

- US top general warned that an Israeli offensive in Lebanon could increase risks of a broader conflict that draws in Iran, according to Reuters.

- Yemen’s Houthis said they carried out two military operations in the Arabian and Red Seas in which it targeted the Trans World Navigator ship in the Arabian Sea and targeted US aircraft carrier Eisenhower in the Red Sea, according to Reuters.

- US Central Command said forces successfully destroyed three Iranian-backed Houthi unscrewed surface vessels in the Red Sea, while it added that Houthis launched three anti-ship ballistic missiles from a Houthi-controlled area of Yemen into the Gulf of Aden but there were no injuries or significant damage reported by US, coalition or merchant vessels.

- UKMTO announced an incident 65NM west of Yemen’s Hodeidah whereby a vessel was reportedly hit by an uncrewed aerial system which resulted in damage. UKMTO also announced an incident 96NM of Yemen’s Nishtun in which a vessel was reported to have suffered flooding that cannot be contained and the crew were forced to abandon ship but have been recovered by an assisting ship.

- Bahrain and Iran agreed to restart talks aimed at resuming political relations between the two countries, according to Bahrain’s state news agency.

OTHER

- Ukrainian President Zelensky said Russia used more than 2,400 guided bombs against Ukraine in June alone including 700 against Kharkiv, while he added that they need the promised defence packages without delay so that their agreements with US President Biden can be carried out, according to Reuters.

- Ukraine said Russia launched an air attack on Kyiv and its region, while air defence systems engaged in repelling the attack. It was separately reported that Russian air defence systems destroyed 12 Ukraine-launched drones over Russia’s Bryansk region, according to the regional governor cited by Reuters.

- Shrapnel from an intercepted US-made missile fired by Ukraine hit a beach packed with sunbathing tourists in occupied Crimea on Sunday, according to The Telegraph. It was separately reported that Russia’s Defence Ministry said that responsibility for the shelling of Crimea’s Sevastopol lies primarily with the US and that there will be a response to the shelling, according to Reuters.

- EU reportedly devises a legal loophole to bypass a Hungary veto on support for Ukraine, according to FT.

- South Korea, the US and Japan said Russian President Putin's visit to North Korea triggered grave concern and they strongly condemn the deepening of North Korean and Russian military cooperation, while they will further strengthen security cooperation to counter threats by North Korea, according to South Korea's Foreign Ministry.

- US envoy for East Asia Kritenbrink said the US-Vietnam partnership has never been stronger and only Vietnam can decide how best to safeguard its sovereignty and advance its interests. Kritenbrink also commented that the current situation is deeply concerning and they will stand with Filipino allies, as well as noted that China’s actions, especially around the Second Thomas Shoal in the South China Sea have been irresponsible aggressive, dangerous and deeply destabilising. Furthermore, he said they have made it clear to Beijing that mutual defence treaty obligations the US has to the Philippines are ironclad, according to Reuters.

- Philippines President Marcos said they are not in the business of instigating war and refuse to play by the rules that force them to choose sides in a great power competition, while he added they would like to settle all issues peacefully and have never yielded to any foreign power, according to Reuters.

- Russia expressed "demarche" to the US envoy over the missile attack on Crimea, via Tass.

CRYPTO

- Bitcoin and Ethereum continues to slip, with the pair both at session lows; BTC looking to test USD 61k to the downside.

- Mt. Gox Trustee is to start Bitcoin & Bitcoin Cash repayments in July.

APAC TRADE

- APAC stocks were predominantly subdued heading closer to month-end and US PCE data later in the week, with sentiment not helped by Friday's mixed performance stateside and the lack of major macro catalysts.

- ASX 200 was led lower by the resources and mining-related sectors amid softer underlying commodity prices.

- Nikkei 225 initially swung between gains and losses as participants digested currency weakness and renewed jawboning but eventually bucked the overall trend owing to exporter strength.

- Hang Seng and Shanghai Comp. declined whereby the former retreated beneath the 18,000 level amid tech and property-related pressure, while the mainland index continued its descent after it recently breached the 3,000 level to the downside to print its weakest level since late February.

NOTABLE ASIA-PAC HEADLINES

- China's MOFCOM said it resolutely objects to US planned curbs on investment in China and urged the US to lift investment restrictions on China.

- China's ByteDance and Broadcom (AVGO) are working on developing an advanced AI processor which would use 5nm technology and manufacturing would be outsourced to TSMC (2330 TT), while it would be compliant with US export restrictions, according to Reuters sources.

- China’s Commerce Minister and EU Trade Commissioner agreed to launch consultations on EV tariffs, according to China’s MOFCOM. It was also reported that China’s state planner hopes that Germany will demonstrate leadership within the EU and do the correct thing, while China will take all measures to safeguard the legitimate rights and interests of Chinese companies, as well as noted that the average price of China’s main EV models overseas is higher than domestic prices.

- Germany’s Economy Minister Habeck said in Shanghai that EU Commissioner Dombrovskis informed him that there will be concrete talks on tariffs with China and their goal is a level playing field between China and Germany. Habeck stated that it is good to be export-oriented but not to use subsidies for it, while he sees some options to reach an agreement but that is the task of the Commission. It was also reported that Habeck said EU tariffs are not a punishment but intend to level the playing field, while he also commented that he does not want tariffs because he believes in open markets and stated there is time for dialogue until November between the EU and China on tariffs, according to Reuters.

- China is to create a fund to rescue financial companies in an effort to avert a financial crisis stemming from the property industry slump, according to Nikkei.

- BoJ Summary of Opinions from the June 13th-14th meeting noted that a member said the BoJ is expected to raise the interest rate if underlying inflation rises as projected and a member said they must consider a further adjustment to the degree of monetary easing given the chance of upside risk to inflation, while there was also the that the BoJ must raise the interest rate in a timely fashion without delay in accordance to heightening chance of achieving the price target. However, one member said BoJ can wait to shift the level of interest rate until it can confirm through data a clear uptrend in inflation and inflation expectations, while a member also said it is appropriate to keep easy policy for the time being due to a lack of strength in consumption and some disruption to auto shipments.

- Japanese Finance Minister Suzuki said he won't comment on forex levels and that it is desirable for currencies to move in a stable manner reflecting fundamentals, while he added that excessive FX changes are undesirable and wants to respond appropriately as needed, while he replied no comment when asked if current FX moves are excessive.

- Japan's top currency diplomat Kanda said he won't comment on daily forex levels and will take appropriate steps if there is an excessive forex move, while he added there is no impact at all from the US report on forex monitoring and the US government suggests there is no problem in Japan's forex intervention. Furthermore, he doesn't have a specific forex level in mind and will respond to rapid forex moves by speculators but won't comment if recent moves are excessive and said Japan is ready to intervene in the currency markets 24 hours a day if needed.

- India’s Finance Minister said they are to consider GST rate rationalisation in the next GST Council meeting in August, according to Reuters.

DATA RECAP

- New Zealand Trade Balance (NZD)(May) 204.0M (Prev. 91.0M, Rev. -3M)

- New Zealand Exports (NZD)(May) 7.16B (Prev. 6.42B, Rev. 6.31B); Imports 6.95B (Prev. 6.32B)