By Eric Peters, CIO of One River Asset Management

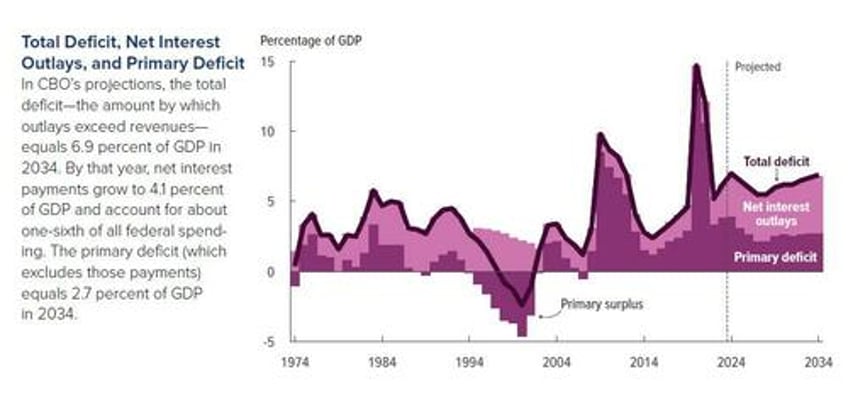

“The 2024 deficit will account for 7% of gross domestic product while the 2034 deficit will account for 6.9% of GDP,” wrote the non-partisan Congressional Budget Office (CBO) in its latest report.

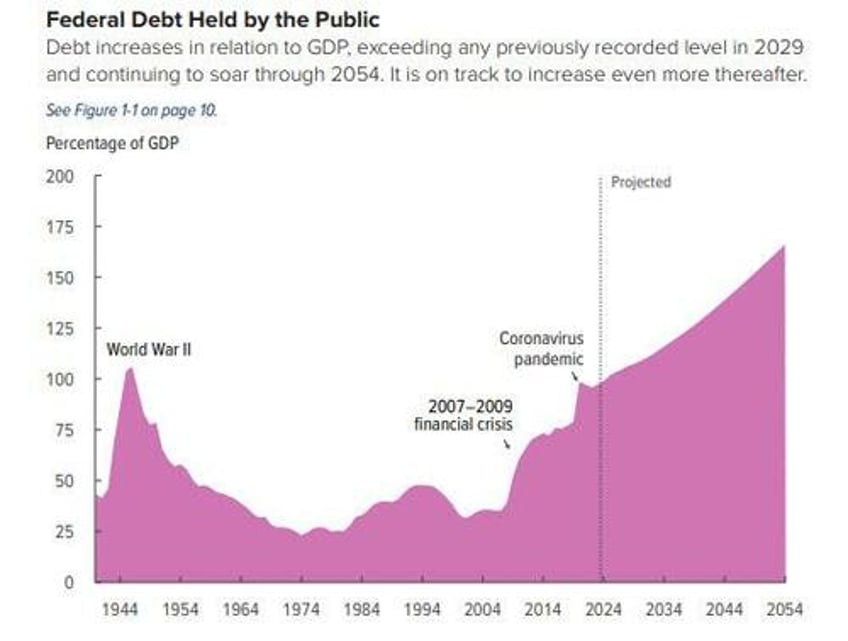

That makes it easy: 7% compounded for a decade roughly doubles your money. The CBO now forecasts this year’s deficit at $2trln, a revision from its $1.5trln February estimate.

A new $95bln in aid for Ukraine, Israel and the Indo-Pacific region played a part. Over the coming decade, the legislation authorizing that aid will add $900bln in new spending, which of course will be funded with debt, that in turn will compound (the CBO expects at a 3.2% rate).

But the US is not alone. The European Central Bank said pressure on public finances across Eurozone countries required to cope with the demands of ageing populations, climate change, and higher defense spending between now and 2070 will require nations to tighten fiscally by 3% of GDP on average.

To reduce debt to the EU limit of 60% of GDP by 2070 will require nations to tighten an additional 2%. Makes it simple. 3% plus 2% equals 5% of annual fiscal tightening.

“These developments will be challenging enough in isolation, and countries will face all of them simultaneously,” admitted the ECB. “Consequently, action needs to be taken today – especially in high-debt countries facing elevated interest rates and the associated risks.”

There is literally no way Europe will make such cuts in the absence of an existential crisis. Were they to, it would almost surely cause an immediate depression and a break-up of the EU.

But still, policy makers for some odd reason feel obligated to make such statements. And on cue, Italy’s parliament approved a law paving the way for the devolution of fiscal powers to regional governments.

You see, as we approach the endgame in a multi-decade debt super cycle, all sorts of self-serving strategies will come into view, as various nations, regions, states and cities fight for survival.