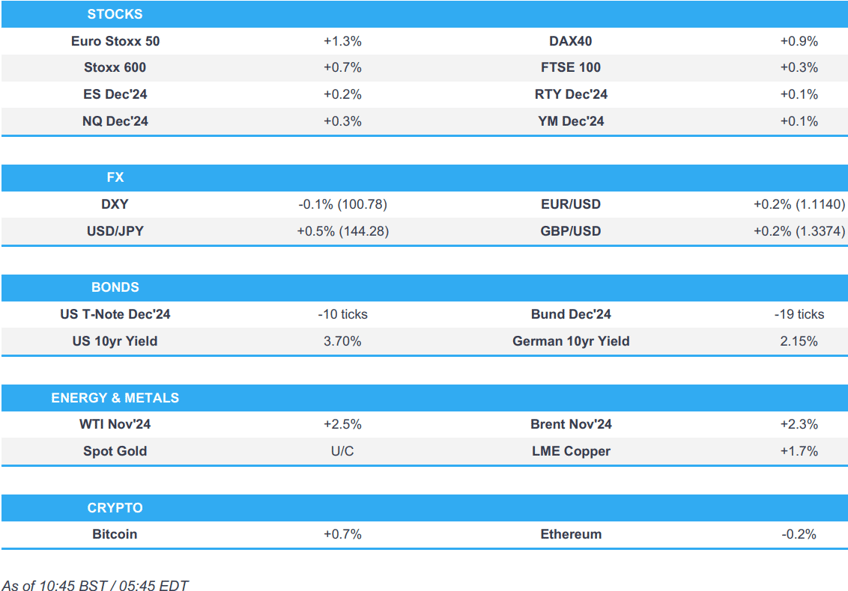

- European bourses are entirely in the green, with US futures also modestly firmer with sentiment lifted after China’s flurry of stimulus efforts

- PBoC Governor Pan announced to cut RRR by 50bps which will provide CNY 1tln worth of long-term capital and cut the 7-day reverse repo rate by 20bps to 1.50%, while he said they will guide LPRs lower and reduce the mortgage rate for existing mortgages

- Dollar is softer, EUR gains despite poor German Ifo data & JPY underperforms; AUD fails to benefit from the Chinese stimulus efforts and despite a hawkish hold, but with Governor Bullock noting that a hike was not discussed at the meeting

- Bonds hold a bearish bias given the risk tone; Bunds were unreactive to the German Ifo

- Crude and base metals are firmer benefiting from the raft of Chinese stimulus announcements

- Looking ahead, US Richmond Fed Index, NBH Policy Announcement, Speakers including Fed's Bowman & BoC's Macklem, Supply from the US, Earnings from Autozone

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.9%) began the session on a very strong footing, taking impetus from a strong APAC session overnight, which was sparked by a flurry of Chinese stimulus efforts. As it stands, European indices are firmer across the board and near session highs.

- European sectors hold a strong positive bias, with the best performers in Europe largely a beneficiary of the aforementioned Chinese stimulus efforts; Basic Resources, Consumer Products (particularly Luxury) and Tech all top the pile. Real Estate and Utilities are found towards the foot of the pile.

- US Equity Futures (ES +0.2% NQ +0.4% RTY +0.2%) are modestly firmer across the board, taking impetus from a strong European session which has digested and benefited from China’s stimulus bazooka.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is showing a mixed performance vs. peers in the current risk environment; stronger vs. JPY and CHF but softer vs. EUR, CAD, GBP. DXY is currently contained within yesterday's 100.71-101.22.

- EUR is able to gain against the USD despite more dismal data from Germany which saw a miss across the board on IFO metrics. EUR/USD has been able to hold above the 1.11 mark throughout the session and has climbed as high as 1.1139 but is yet to challenge Monday's 1.1167 peak.

- Cable has once again eked out another marginal YTD high, this time at 1.3375. There hasn't been anything fresh during today's session to drive the move and instead looks to be more a continuation of the current trend. UK PM Starmer is to speak at the UK Labour Party Conference at 14:00BST.

- JPY is struggling alongside the current pro-risk sentiment seen overnight in China and in Europe. Ueda spoke earlier but comments did not look particularly dovish and in-fact could be seen as slightly more hawkish vs his prior comments. USD/JPY has been able to eclipse last week's 144.49 peak with focus now on a test of the 145 mark.

- AUD/USD is unable to benefit from the Chinese stimulus efforts with greater attention on events at the RBA. The Bank delivered what was seen as another hawkish hold. However, AUD/USD was subsequently dragged lower by comments from the RBA Governor stating that, unlike the prior meeting, the board did not discuss a rate hike.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are weighed on by the broader risk tone and down to a 114-13+ base. Support comes in at Monday’s 114-11+ trough before the figure. Fed's Bowman and US 2yr supply.

- Bunds are softer below 134.50 but still clear of Monday’s 134.02 base, potentially weighed on by somewhat hawkish remarks from Ueda (vs his post-policy announcement speech) and the strengthening risk tone more generally given substantial Chinese stimulus overnight. Poor German Ifo data spurred no real reaction in the complex.

- Gilts are pressured and moving in-line with peers; BoE's Bailey spoke earlier, but added little. Gilts initially opened higher by 13 ticks but have since faded and lost the 99 handle to a 98.73 trough.

- UK sells GBP 1.5bln 0.75% 2033 I/L Gilt: b/c 3.17x (prev. 2.94x) and real yield 0.486% (prev. 0.462%).

- Germany sells EUR 3.708bln vs exp. EUR 4.5bln 2.70% 2026 Schatz: b/c 2.4x (prev. 2.5x), average yield 2.14% (prev. 2.41%) and retention 17.6% (prev. 16.93%).

- Click for a detailed summary

COMMODITIES

- A firm session thus far for the crude complex amid the overnight raft of Chinese stimulus announced which takes some sting out of the Chinese demand woes which has plagued the crude markets for much of this year and amid the heightened geopolitical environment in Lebanon/Israel.

- Upward bias across precious metals but to varying degrees. Spot gold sees the shallowest gains, potentially amid less demand for havens in a risk-on environment. XAU overnight printed yet another fresh All-time-high at USD 2,640.18/oz (vs low 2,622.68/oz).

- Base metals are higher across the board as the raft of Chinese stimulus announced overnight boosts demand prospects for the sector. 3M LME copper topped USD 9,700/t.

- BP (BP/ LN) cut oil and gas production at two US Gulf of Mexico platforms and curtailed output at two others, while it is removing non-essential staff from five US Gulf of Mexico platforms ahead of a predicted hurricane.

- Chevron (CVX) announced it was evacuating non-essential personnel from all Gulf of Mexico platforms including Anchor, Big Foot, Blind Faith, Jack/St. Malo, Petronius and Tahiti.

- NHC says Hurricane John is just inland over southern Mexico. Life-threatening winds, storm surges and flash flooding continues in the warning area; more recently, John has been downgraded to a tropical storm, moving north-westward; life threatening flash flooding to continue along southern Mexican coast for the next few days

- Ukrainian President Zelensky said he held talks with Japanese PM Kishida on energy supplies in light of Russian attacks.

- Click for a detailed summary

CENTRAL BANKS

- RBA kept its Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target and is not ruling anything in or out. RBA also repeated that inflation remains above target and is proving persistent, as well as stated that returning inflation to target is the priority. Furthermore, it said inflation is still some way above the midpoint of the 2–3% target range and the Board will rely upon the data and the evolving assessment of risks to guide its decisions.

- RBA Governor Bullock says recent data has not materially affected policy outlook; reiterates rates to remain on hold for the time being; Did not explicitly consider a rate hike at the meeting (vs "board did consider a rate rise" at August's meeting). Headline CPI could come within 2-3% band. The message is that the board does not see rate cuts in the near term.

- BoJ Governor Ueda says appropriate to increase rates if trend inflation heighten in line with our forecast. Will raise interest rate if economy and price move in line with forecasts shown in quarterly outlook report. Uncertainty surrounding the economy and prices is high. BoJ must conduct monetary policy in a timely and appropriate fashion without having a pre-set schedule, taking into account various uncertainties. Will watch with strong sense of urgency of US and overseas economic outlook, still unstable market developments. One-sided JPY falls have been reversed since August, and rise in import prices moderating. Can afford to spend time scrutinising market moves and overseas developments behind market developments. Must prevent a return to deflation.

- BoE's Bailey says inflation has come down a long way, still have to get it sustainably to target and their is an unbalanced mix of components currently, via KentOnline; adds, encouraged the path for inflation is downward.

NOTABLE DATA RECAP

- German Ifo Expectations New (Sep) 86.3 vs. Exp. 86.3 (Prev. 86.8); Ifo Business Climate New (Sep) 85.4 vs. Exp. 86.0 (Prev. 86.6); Ifo Current Conditions New (Sep) 84.4 vs. Exp. 86.1 (Prev. 86.5, Revised 86.4); IFO's Fuest says "We can't exclude that the German economy is shrinking this year".

NOTABLE EUROPEAN HEADLINES

- ECB President Lagarde says the ECB is almost at the 2% target, wants to make sure they reach the target and remain there, according to comments on The Daily Show.

- ECB's Muller says "it's reasonable to expect more cuts if outlook holds".

- UK PM Starmer is to argue that tough decisions are needed for the UK national renewal and say in his speech on Tuesday that there are no easy answers, according to FT. It was also reported by Huffington Post that PM Starmer is to warn of more pain to come as he pledges a new Britain.

- French Finance Minister Armand says they are working on the latest estimates for the 2024 budget deficit, aiming to be able to present "something credible".

NOTABLE US HEADLINES

- China's Commerce Ministry is to launch an investigation into US PVH Group (PVH) for suspected violations of market trading principals regarding Xinjiang related products

GEOPOLITICS

MIDDLE EAST

- IDF Radio, citing military sources, say "We have a long way ahead and we are still at the beginning", via Al Arabiya.

- "Senior Israeli official says a ground operation in Lebanon could be considered if political track does not lead to the return of the Israeli residents to the north", according journalist Soylu.

- Hamas armed wing said field commander Mahmoud Al-Nader was killed in an Israeli strike on southern Lebanon on Monday.

- US President Biden and UAE's leader said after their meeting that a two-state solution is the only framework for resolving the conflict, while it was also reported that the UAE expressed deep concern over Israeli attacks on southern Lebanon.

- US State Department senior official said the US has been working hard in recent days to find a diplomatic solution to the spike in fighting between Israel and Hezbollah, while the key focus for Secretary of State Blinken's discussion with allies is on finding an off-ramp to prevent further escalation and the US has some "concrete ideas" that it is going to be discussing to prevent escalation in the region.

- US Deputy Treasury Secretary told the Bank of Israel Governor of US concern about threats by some within the Israeli government to sever correspondent banking relationships between Israeli and Palestinian banks, while the Deputy Treasury Secretary insisted these relationships should be extended for at least a year and stressed these relations would be critical to preventing an economic crisis in the West Bank.

- EU's Borrell said the escalation in Lebanon is extremely worrying and that they are almost in a full-fledged war, while he added that they are still working to stop escalation in Lebanon but the worst expectations are becoming reality.

- Iran’s President said US policies support and encourage Israel in its open war and Washington's actions contradict its words, while Iran reaffirms that an open regional war will not be in the interest of anyone in the region and the world. Furthermore, he said Iran has sufficient capacity to strike Israel and their response will be at the right time and in the appropriate way, while he added that Israel's assassination of Haniyeh will not be without a response and their reply is coming.

- Iran’s President said at the UN Summit of the Future that Tehran aspires to “a world free of nuclear weapons and a Middle East free of weapons of mass destruction, without any preconditions”, according to journalist Abas Aslani via X.

- Iran's Foreign Minister denied statements attributed to Iran's President about a willingness to reduce tensions with Israel, while the Foreign Minister added that Israel will receive a response to attacks in due course, according to Al-Arabiya.

- "The response to the new air force airstrikes in Lebanon would not only come from Lebanon, but from other resistance axes such as Yemen", according to Houthi sources cited by Lebanese newspaper Al-Akhbar.

OTHER

- Ukrainian President Zelensky said Ukraine's war with Russia is 'closer to the end' and separately commented that US decisive action now could hasten an end to Russian aggression next year, according to ABC News and Reuters.

- EU's Borrell said it is clear that Russia has been receiving new weapons in particular, missiles from Iran, while he added that G7 will hold talks about providing long-range missiles to Ukraine to strike Russian territory.

- Venezuela's highest court approved an arrest warrant for Argentine President Milei who is a vocal critic and ideological rival of Venezuelan President Maduro, according to AFP News Agency. Argentine Justice requests international arrest of Venezuelan President Maduro for alleged human rights violations

CRYPTO

- Bitcoin takes a breather after its recent advances, and holds just avove USD 63k.

APAC TRADE

- APAC stocks traded mostly higher following gains on Wall St. and China's various stimulus measures.

- ASX 200 was subdued amid the RBA rate decision where the central bank unsurprisingly opted for a hawkish hold.

- Nikkei 225 gapped above the 38,000 level as it played catch up on its return from the long weekend.

- Hang Seng and Shanghai Comp were boosted after the PBoC, NDRC and NRFA press briefing where PBoC Governor Pan announced a cut in the RRR by 50bps and the 7-day reverse repo rate by 20bps to 1.50%, while it will reduce the MLF rate and guide the LPR lower. Furthermore, support measures were also announced for the property industry and China will create new tools to support the stable development of the stock market, as well as allow funds and brokers to tap PBoC funds to buy stock.

CHINA STIMULUS

- PBoC Governor Pan announced to cut RRR by 50bps which will provide CNY 1tln worth of long-term capital and cut the 7-day reverse repo rate by 20bps to 1.50%, while he said they will guide LPRs lower and reduce the mortgage rate for existing mortgages in which the average reduction in the interest rate of existing mortgages will be about 0.5 percentage points. PBoC also lowered downpayments for second homes to 15% from 25% and will no longer distinguish between down payments for first and second homes which will be unified at 15%. Pan said they must support the steady recovery of prices in the economy and must coordinate monetary policy and fiscal policy, while he added the financial weighted reserve ratio for large banks will be reduced to 8% after the RRR cut and they might further cut RRR by year-end. Furthermore, he stated the MLF rate will be lowered by 0.3ppts and LPR will be lowered by 0.2-0.25ppts.

- China Securities Regulatory Commission Chairman said they will issue guidance for medium-term and long-term funds to enter the market and will issue measures to promote mergers, acquisitions and reorganisations. China will also release six new measures to support M&A soon and allow funds and brokers to tap PBoC funds to buy stock, while China reportedly plans at least CNY 500bln of liquidity to support stocks and is studying setting up a stock stabilisation plan.

- China NFRA head said China is to increase core tier-1 capital of the country's six largest commercial banks and will broaden the amount and proportion of equity investment restrictions, as well as establish a mechanism for coordinating financing of micro and small enterprises.

- Click for full Newsquawk Analysis

NOTABLE ASIA-PAC HEADLINES

- Former US President Trump said regarding his tariff plans that he doesn't need Congress and would have the right to impose them himself, according to Washington Post's Stein.

- BoJ Governor Ueda says it is desirable for FX to move stability reflecting fundamentals; global market remains somewhat unstable; must watch market developments with strong sense of urgency for the time being. Says the unwinding of short-term speculative JPY positions, which were partially behind the August rout, have likely run their course. Says he wants scrutinise each month's service price data in gauging development in underlying inflation. BoJ natural rate of interest was among the factors taken into account when setting policy. Does not comment on short-term FX fluctuations.