By Philip Marey, Senior US Strategist at Rabobank

In the US House of Representatives, Republicans can’t seem to agree on a continuing resolution to keep the government funded beyond September 31. Failure to pass this stopgap measure would lead to a government shutdown on October 1. The continuing resolution is needed because the necessary appropriations bills for fiscal year 2024 (which starts on October 1) have not yet been approved in the House. Sunday’ s proposal by the Freedom Caucus and the Main Street Caucus of the House Republicans is unacceptable to the Democrats because of spending cuts attached to the continuing resolution, so passage depends on Republicans who have a narrow 221-212 majority. However, even some members of the Freedom Caucus oppose the bill, so it is still unclear whether this proposal will be adopted. Consequently, some Republicans are now raising the possibility of making a temporary deal with the House Democrats.

Meanwhile, in the real world, US housing starts saw a steep decline in August (-11.3%), extending the downward trend since April. On the bright side, building permits grew by 6.9%, but they have been zigzagging this year. The interest-rate sensitive housing market has been a casualty of the Fed’s hiking cycle from the start. Given the Fed’s focus on fighting inflation, a sustained recovery of the housing market should not be expected anytime soon.

Day ahead

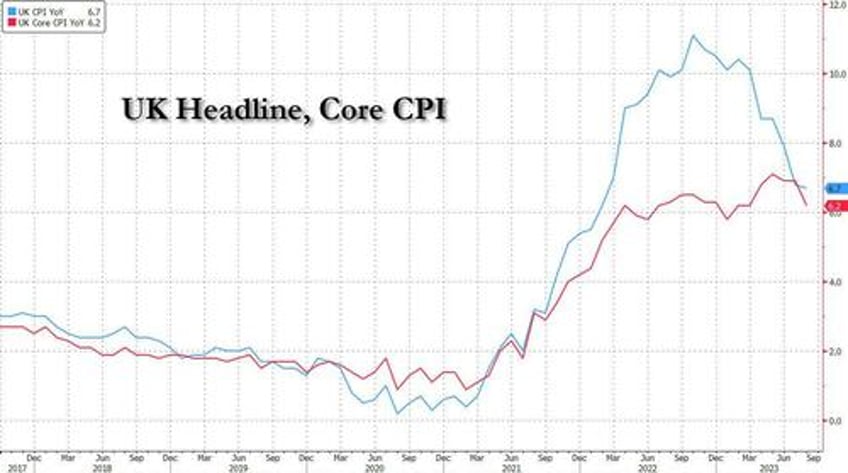

This morning, UK inflation data were weaker than expected with a 0.3% month-on-month increase in the price level in August (against 0.7% expected), leading to 6.7% year-on-year, not only below the expected 7.0%, but even lower than July’s 6.8%. So even headline inflation unexpectedly continues to fall. Meanwhile, core CPI inflation fell to 6.2% from 6.9%. The largest downward contributions to the monthly change in CPI annual rates came from food, where prices rose by less in August 2023 than a year ago, and accommodation services, where prices can be volatile and fell in August 2023.

Today, the FOMC will conclude its two-day meeting with a policy rate decision, fresh economic projections and a press conference by Powell. As explained in our FOMC Preview, we expect the FOMC to remain on hold in September because of the gradual decline in core inflation and the improving balance in the labor market.

The formal statement is likely to repeat that economic activity has been expanding at a moderate pace, but we may see some acknowledgement that the labor market is softening. For example, according to the Beige Book “job growth was subdued.”

Regarding monetary policy, the FOMC is likely to repeat that “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments” and that “The Committee would be prepared to adjust the stance of monetary policy as appropriate.”

At the press conference, Powell is likely to repeat his Jackson Hole performance, stressing that the FOMC remains data-dependent, but underlining the upside risks to the outlook and the Fed’s willingness to act if warranted by the incoming data. We also expect him to continue his battle against expectations of an early pivot.

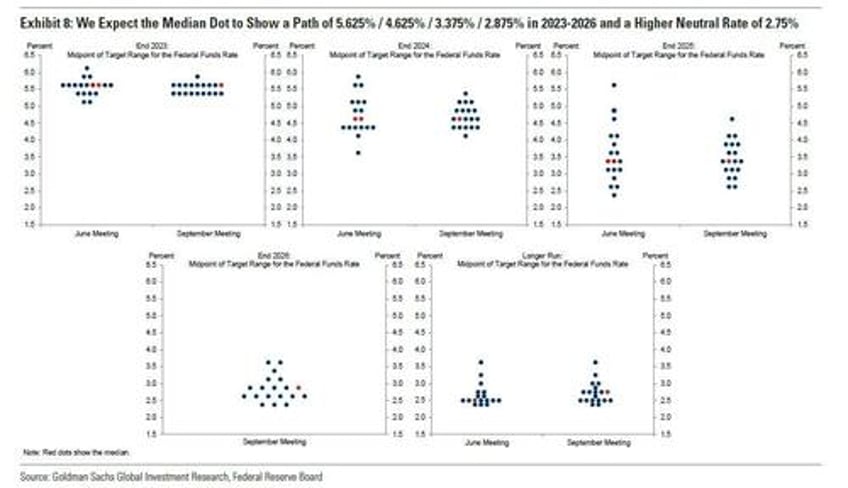

The new economic projections, featuring the dot plot, are likely to imply another 25 bps hike before the end of the year, similar to the June dot plot. This would underline the Fed’s willingness to deliver another 25 bps hike before the end of the year if warranted by the incoming data. Meanwhile, the projections will be extended through 2026.

However, we still expect the economic data to deteriorate before the November meeting and avert additional rate hikes. In fact, we expect the US to slip into a recession in the final quarter of the year. Although a soft landing is possible, we find it less likely. The Fed has no reliable model to forecast inflation (remember they initially thought that the current episode of inflation was transitory and did not warrant a monetary policy response), and at Jackson Hole Powell admitted there is considerable uncertainty regarding the lags of the impact of monetary policy and the precise level of monetary policy restraint (for a given level of the federal funds rate). Therefore, we think it will be very difficult for the Fed to engineer a soft landing. If they succeed, it will probably be luck