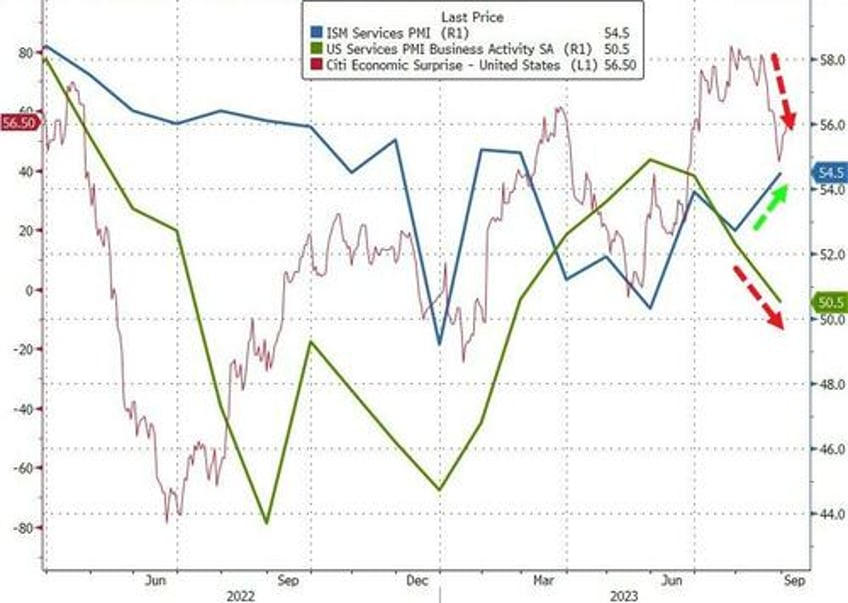

With manufacturing surveys still in contraction, and underlying components screaming stagflation as orders drop and prices pop, all eyes are on the 'bigger' Services sector surveys this morning which are expected to slip lower in August (but remain in expansion - above 50).

The S&P Global US Services PMI disappointed, declining from 52.3 (July) to 50.5 (final August), and below the 51.0 preliminary August print - weakest since January

BUT

The US ISM Services soared from 52.7 to 54.5 (well above the 52.5 exp) - strongest since February

Source: Bloomberg

In case you wonder why these surveys can be so completely opposed, it is survey responses like this...

A Real Estate worker said that:

"Overall conditions seem quite good, although there is definite slowdown in residential construction driven by rapidly increasing interest rates.”

A Government worker said that:

“Prices have settled. Warnings of a possible recession in 2024 are not being taken very seriously by top management. The same experts warned that the country would be in a recession by now. Our general feeling is that the (Federal Reserve’s) strategy for taming inflation and building a soft landing for the economy is working better than expected. The city has proposed reducing its municipal tax for the fiscal year beginning October 1.”

So a total joke with surveys pointing in completely different directions, but the message was similar under the hood with prices soaring...

Source: Bloomberg

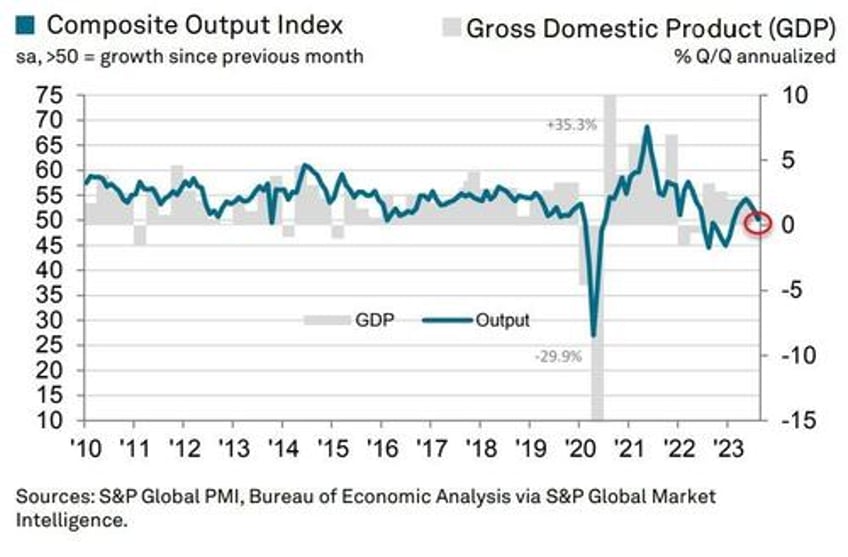

The final S&P Global US Composite PMI Output Index posted 50.2 in August, down from 52.0 in July, to signal only a fractional increase in business activity at US private sector firms. The slowdown in growth stemmed from a weaker service sector expansion and a renewed decrease in manufacturing output.

"The survey data send a hint of rising stagflation risks, as stubborn price pressures are accompanied by a near-stalling of business activity.

"The PMI numbers for the third quarter so far point to a faltering of economic growth after a robust second quarter, as a renewed manufacturing downturn is accompanied by a deteriorating picture in the service sector. "

Not a pretty picture:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

"While a post-pandemic revival of travel, recreation and hospitality spend contributed to an improved economic performance in the spring and early summer, this tailwind is losing momentum. Companies increasingly report customers to have become reticent to spend amid gloomier prospects as higher interest rates and the increased cost of living take their toll. However, financial services and business services providers are also increasingly feeling the pinch from weakening demand.

"Persistent wage growth is meanwhile being accompanied by renewed upward pressure on energy, fuel and transport costs, as well as some broader firming of materials prices, driving cost growth higher. Competitive forces have kept a lid on selling price inflation, but the rate of increase of service sector charges remains elevated to the extent that consumer price inflation is likely to remain stubbornly above the Fed's target in the coming months.

"The key data to watch in the coming months will be the degree to which any further waning of demand for services translates into lower pricing power and reduced inflation."

It looks like we're gonna need more 'Bidenomics'.