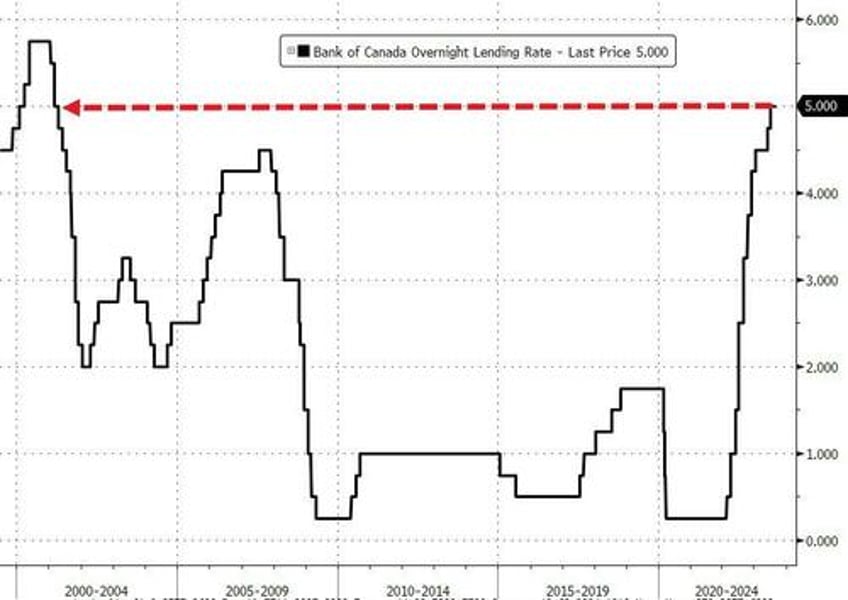

In a day when we have seen some unexpected monetary policy decisions, including a surprise outburst from Erdogan who flip-flopped on Erdoganomics and said that Turkey may "reduce inflation with tight monetary policy" something he refuse toa accept for much of the past decade, as well as a surprise rate cut from Poland, which slashed rates by 75bps to 6.00%, much more than the 25bps expected, which was odd considering Poland still has 10% inflation, moments ago the Bank of Canada did not surprise markets when it kept policy rate unchanged at 5%, the highest level in 22 years (and up 475bps since March 2022) as expected.

“With recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy, governing council decided to hold,” the bank said. Officials, however, remain “concerned about the persistence of underlying inflationary pressures” and are “prepared to increase the policy rate further if needed.”

While the rate pause and the accompanying statement suggested policymakers are comfortable waiting to assess whether the deteriorating economy will restore price stability, officials remainedd worried about persistent momentum in inflation and the statement sounded hawkish enough by keeping the language saying the Governing Council remains concerned about the persistence of underlying inflationary pressures, and is "prepared to increase the policy interest rate further if needed."

Keeping that hawkish bias may allow Macklem to avoid a repeat of January’s explicit pause signal, which led markets to quickly price in future rate cuts and rekindled Canada’s housing market.

Regarding inflation, the central bank said there has been little recent downward momentum in underlying inflation. The longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability. Canada 2y yield is higher by 2bp after the decision.

Some other commentary from the BOC decision, first on the economy:

- Remains concerned about the persistence of underlying inflationary pressures.

- There has been little recent downward momentum in underlying inflation.

- The Canadian economy has entered a period of weaker growth, which is needed to relieve price pressures.

- The tightness in the labour market has continued to ease gradually.

And on policy:

- Decided to stand pat on rates due to recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy

- The Bank is also continuing its policy of quantitative tightening.

- Prepared to increase the policy interest rate further if needed.

According to Bloomberg, with many central banks globally nearing or at their terminal point for rates, Wednesday’s decision suggests Canada’s six-member panel may soon transition the debate to how long they need to hold, instead of how restrictive policy should be.

Earlier on Tuesday, the Reserve Bank of Australia also kept its key interest rate unchanged and maintained a tightening bias. Consecutive pauses in that country imply a higher hurdle for any further hikes and suggest a surprise shift in economic data will be needed to prompt additional tightening.

After its January declaration, the Bank of Canada moved to the sidelines for five months, but resumed hiking in June and July after surprisingly strong economic growth. Still, there’s ample evidence the central bank has now done enough to cool excess demand.

Canada’s economy contracted in the second quarter, far below the bank’s estimate for a 1.5% annualized expansion. The labor market is loosening — job vacancies are falling and the unemployment rate continues to tick up — and the housing market has slowed.

“The Canadian economy has entered a period of weaker growth, which is needed to relieve price pressures,” the bank said. “This reflected a marked weakening in consumption growth and a decline in housing activity, as well as the impact of wildfires in many regions of the country.”

That said, with wage growth stuck around 4% or 5%, and inflationary pressures remaining broad-based, policymakers are seeing difficulty in the "last mile" of returning inflation to the 2% target. “The longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability.”

The bank also kept the last three sentences of the rate statement the same, laying out key metrics policymakers will be monitoring, including the evolution of excess demand, inflation expectations, wage growth and corporate pricing behavior.

Macklem will shed more light on his team’s thinking and its outlook for the Canadian economy in a speech to the Calgary Chamber of Commerce on Thursday. The governor is scheduled to speak to reporters afterward.

The central bank’s next decision is due Oct. 25, after double releases of jobs, inflation and retail data, as well as gross domestic product numbers for July and an August estimate.

In response to the BOC hood, the Canadian dollar fell, reversing gains seen earlier in the session (which however may have also been driven by the stronger than expected Services ISM which sparked a surge in the Dollar index). USDCAD gained as much as 0.3% to 1.3676 before paring the advance, leaving the loonie near its March lows. Swaps market prices in roughly 29% chance of a rate increase at BOC’s October meeting, compared to 25% Tuesday prior to the decision.