By John Jemp, Senior Energy Analyst

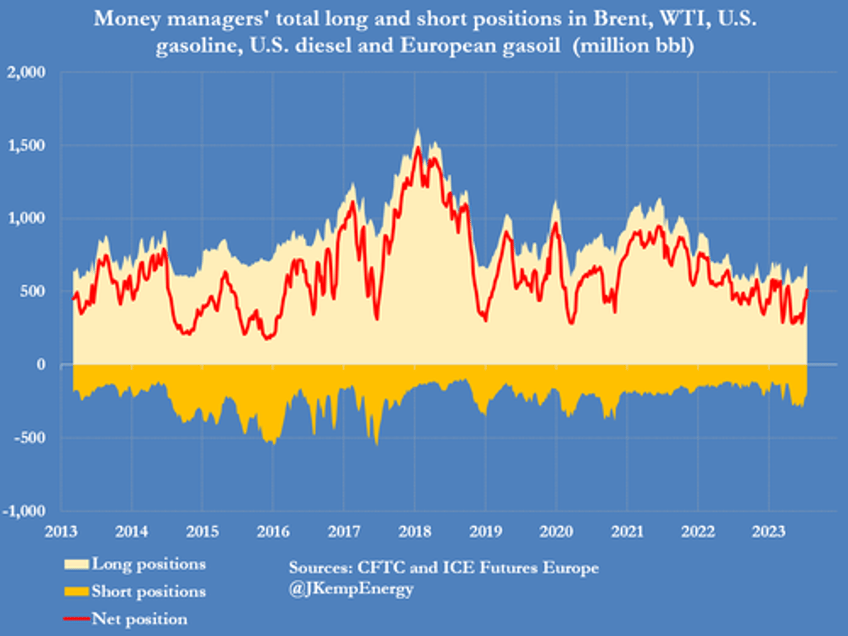

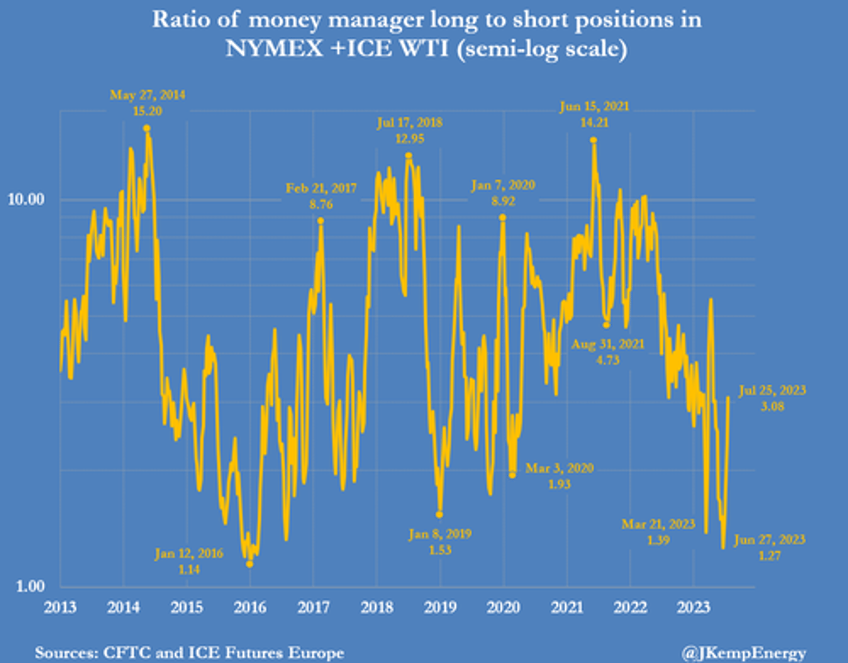

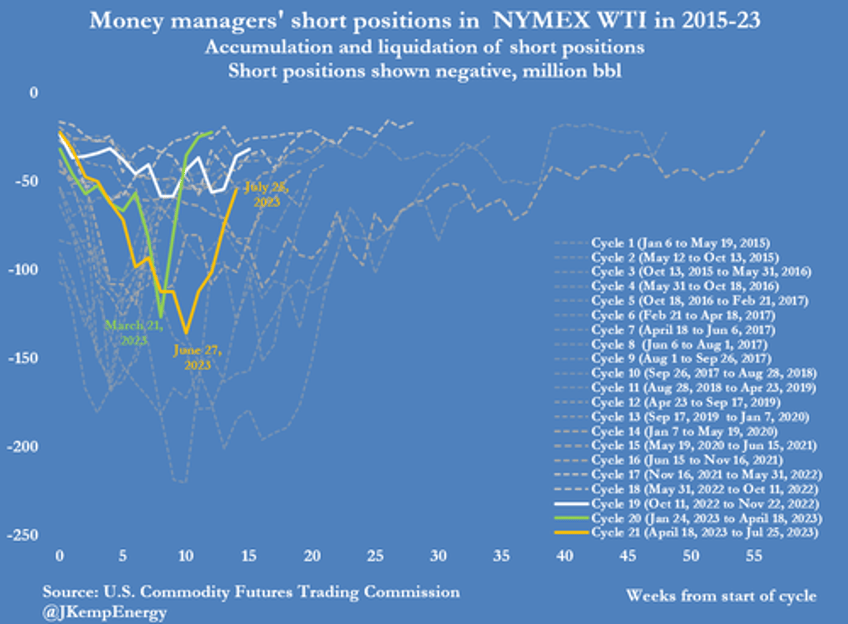

Benchmark crude oil prices have risen to the highest level for three months after the extension of production cuts by Saudi Arabia and its allies in OPEC+ sparked a rush to cover bearish short positions by investors.

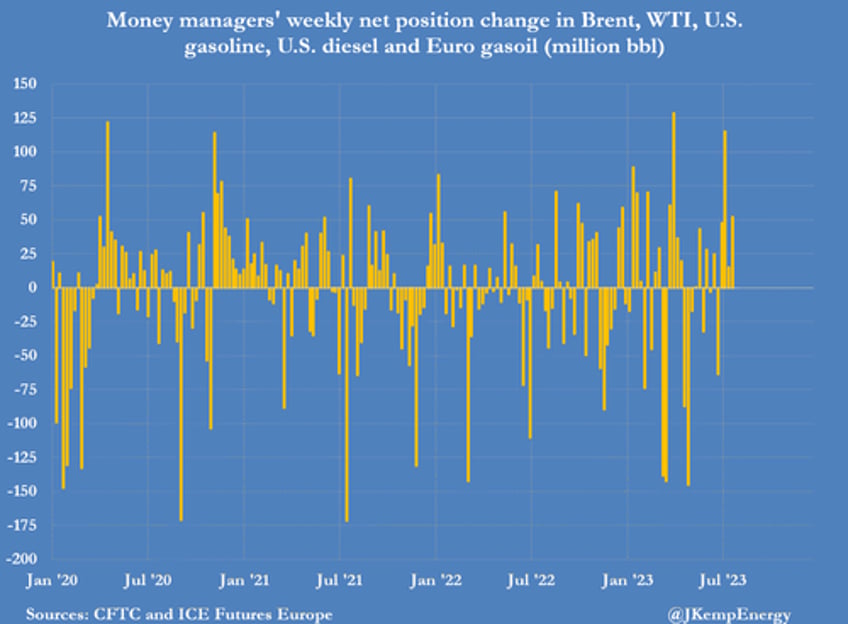

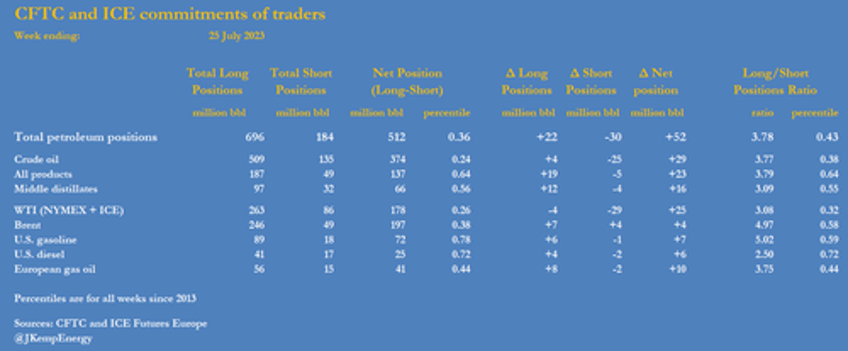

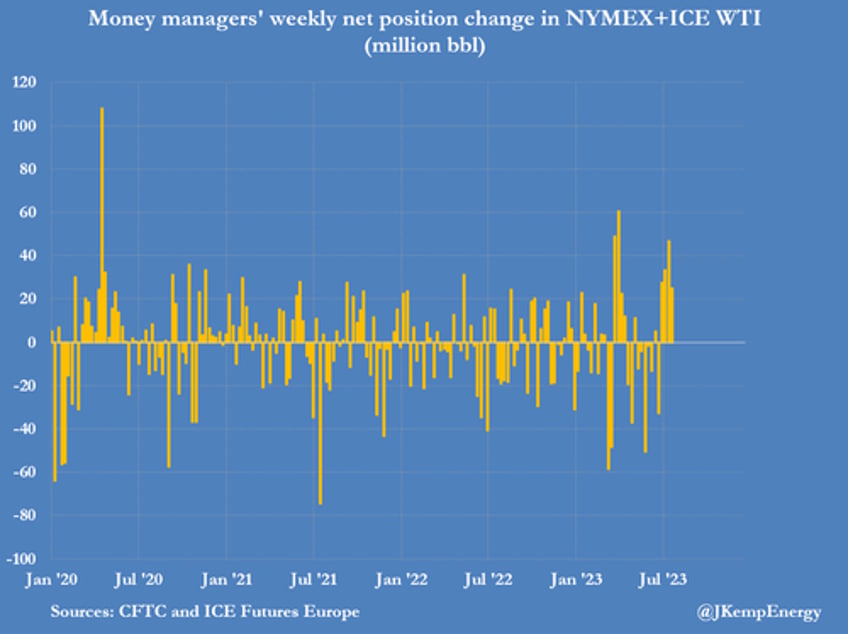

Hedge funds and other money managers purchased the equivalent of 52 million barrels in the six most important petroleum futures and options contracts over the seven days ending on July 25.

Fund managers had purchased a total of 229 million barrels over the four weeks since June 27, according to reports filed with the U.S. Commodity Futures Trading Commission and ICE Futures Europe.

Most of the buying was in contracts linked to crude oil (+169 million barrels) with a particular emphasis on NYMEX and ICE WTI (+132 million).

Saudi Arabia’s output cut coupled with increased optimism about the prospects for an economic soft landing in the United States lifted some of the pessimism that had depressed WTI positions.

Bearish short positions were cut by 104 million barrels while bullish long positions increased by 65 million across the NYMEX and ICE WTI contracts.

Short-covering has helped lift front-month WTI futures prices to over $81 per barrel on August 1 from less than $68 on June 27.

Across WTI and Brent, the combined position increased to 374 million barrels (24th percentile for all weeks since 2013) on July 25, up from a record low of just 205 million barrels on June 27.

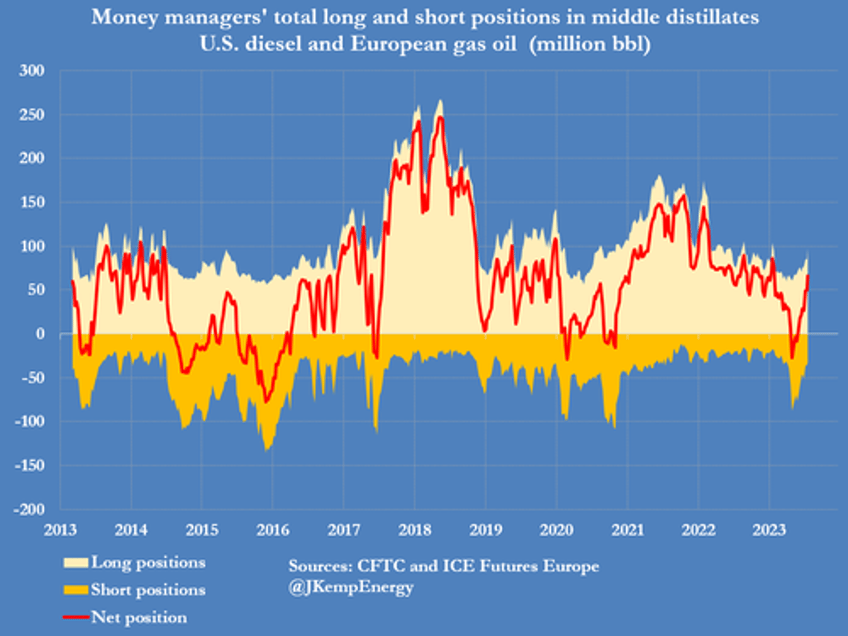

Over the same four weeks, position-building was also evident in contracts tied to the price of refined fuels (+60 million barrels) with a particular focus on middle distillates (+37 million).

Fund managers have become increasingly optimistic about fuel prices given that inventories remain well below normal despite the industrial recession in North America, Europe and China over the last 6-9 months.

In the event of a soft-landing and subsequent return to expansion, increasing fuel consumption could tighten already-depleted fuel supplies quickly.

European gas oil futures and options have experienced an especially rapid increase in positions over the last four weeks (+29 million barrels).

As a result, the net position rose to 41 million barrels (44th percentile) on July 25 from just 12 million barrels (18th percentile) on June 27.

Europe’s industrial economy is currently experiencing its worst slowdown since the first wave of the coronavirus pandemic in 2020 and before that the recession associated with the financial crisis in 2008/09.

But inventories are well below the long-term seasonal average and supplies will tighten rapidly if the U.S. economy expands again soon after a soft landing.

U.S. NATURAL GAS

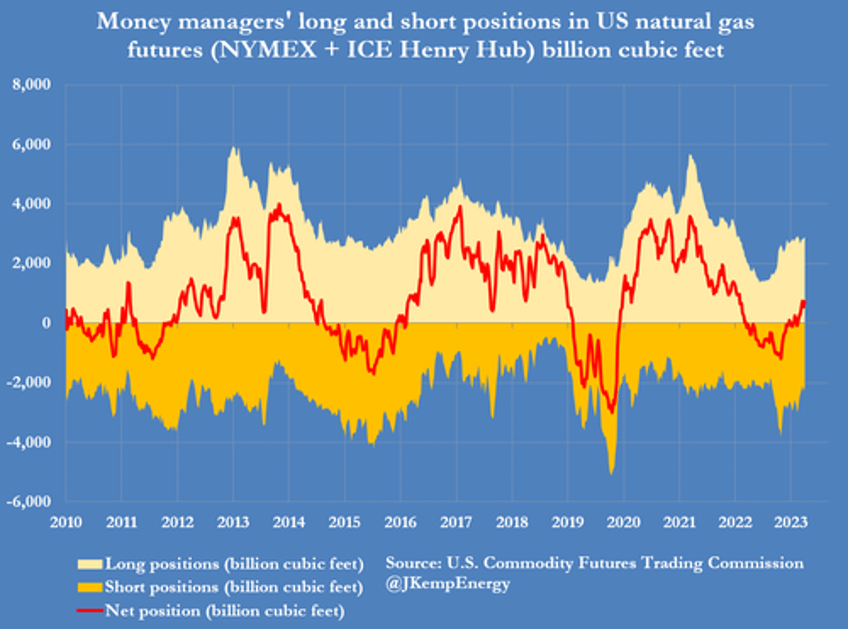

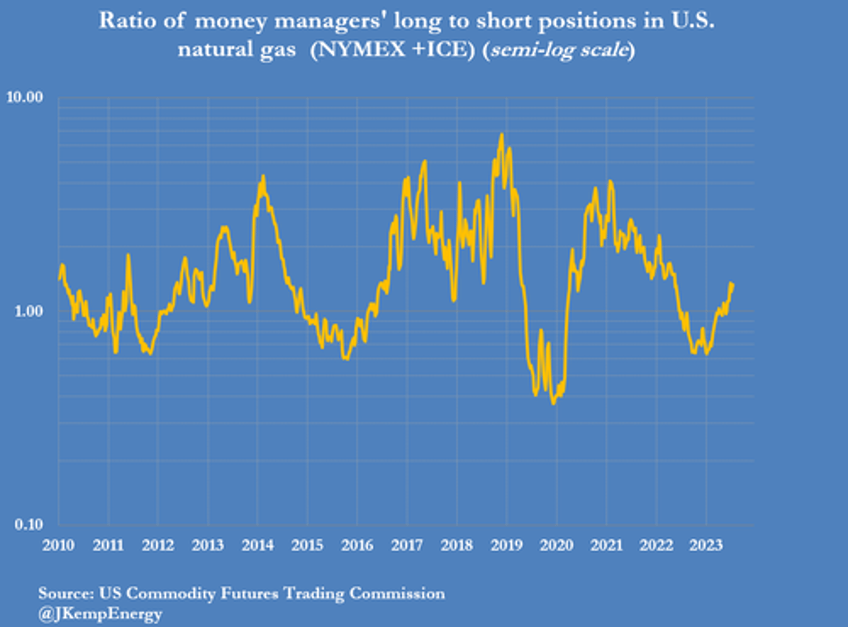

Portfolio investors are trying to become bullish about U.S. natural gas despite inventories remaining stubbornly above the long-term average and only slight signs of the surplus eroding.

Hedge funds and other money managers purchased futures and options equivalent to 176 billion cubic feet over the seven days ending on July 25.

The net position increased to 723 billion cubic feet (47th percentile for all weeks since 2010) from a net short of 1,061 billion cubic feet (7th percentile) on January 31.

Working gas inventories in underground storage were still +248 billion cubic feet (+9% or +0.72 standard deviations) above the prior 10-year seasonal average on July 21.

But the surplus has narrowed from +299 billion cubic feet (+12% or +0.81 standard deviations) on June 30, which suggests the production-consumption balance may be moving into a small deficit.

The number of rigs drilling for oil and gas fell by more than 100 (-14%) in July 2023 compared with the recent cyclical peak in December 2022.

Slower drilling is likely to translate into less production of gas-well and associated gas from the third quarter of 2023 through until at least the first quarter of 2024, which could quickly erode surplus inventories.

From a positioning and fundamental perspective the balance of price risks is tilted to the upside, encouraging investors to start rebuilding a bullish position, albeit cautiously.