As previewed earlier, the biggest event this week - perhaps even more important than the FOMC decision at 2pm on Wednesday - is the CPI report due just a few hours before Powell takes the mic. And with so much attention falling on the latest inflation number, markets were understandably curious what the latest Inflation Expectations disclosed by the NY Fed's Consumer Survey would reveal, if only to set the stage for Wednesday's print.

Here is what the latest Survey of Consumer Expectations for the month of May revealed: inflation expectations declined at the short-term horizon, remained unchanged at the medium-term horizon, and increased at the longer-term horizon. Specifically, median inflation expectations at the one-year horizon declined to 3.2% in May from 3.3% in April, were unchanged at the three-year horizon at 2.8%, and increased at the five-year horizon to 3.0% from 2.8%.

The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at the one-year horizon, increased at the three-year horizon, and remained unchanged at the five-year horizon.

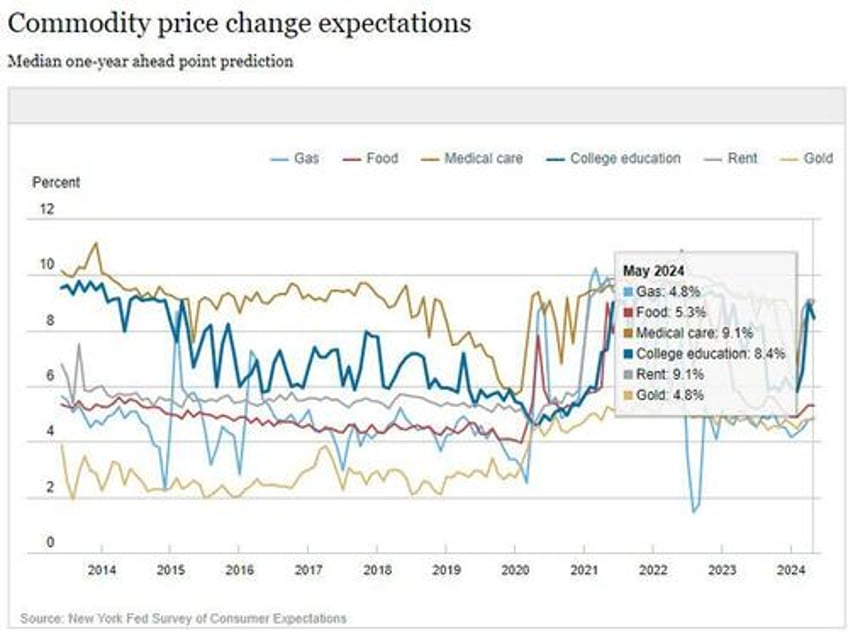

Taking a closer look, over the next year consumers expect gasoline prices to rise 4.85%; food prices to rise 5.3%; medical costs to rise 9.07%; the price of a college education to rise 8.45%; rent prices to rise 9.08%. They also expect gold to post a 4.8% increase in the next 12 months, which is amusing as that would trail all other inflation categories, and indicates that all the data point may every well be rigged by the survey organizers to present a more palatable picture.

Turning to the labor market, expectations were mixed with median one-year-ahead expected earnings growth unchanged at 2.7%, just below its 12-month trailing average of 2.8%.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased to 38.6% from 37.2%, and is now above the 12-month trailing average of 37.8%.

- The mean perceived probability of losing one’s job in the next 12 months decreased by 2.7 percentage points to 12.4%, falling below the 12-month trailing average of 13.2%. The mean probability of leaving one’s job voluntarily in the next 12 months increased slightly, to 19.6% from 19.4%, remaining slightly above the 12-month trailing average of 18.9%. In other words, almost nobody is afraid of losing their (low-paying) job. You know what that means.

- The mean perceived probability of finding a job if one’s current job was lost increased by 1.3 percentage points to 52.2%, after reaching the lowest level since April 2021 last month.

Finally, turning to household finance expectations, respondents also more optimistic about their financial situation a year from now as the median expected growth in household income increased by 0.1 percentage point to 3.1%, remaining within the narrow range of 2.9% to 3.2% the series has maintained for the past year. Here are some more details:

- Median household spending growth expectations declined by 0.2 percentage point to 5.0%. The series has moved within a narrow range of 5.0% to 5.2% since November 2023, remaining well above its February 2020 level of 3.1%.

- Perceptions of credit access compared to a year ago were largely unchanged, while expectations about future credit access deteriorated, with a larger share of respondents expecting tighter credit conditions a year from now, and a smaller share expecting easier conditions.

- The average perceived probability of missing a minimum debt payment over the next three months decreased by 0.9 percentage point to 12.0%, a level comparable to those prevailing just before the pandemic.

- The median expected year-ahead change in taxes at current income level declined by 0.4 percentage point to 3.9%.

- Median year-ahead expected growth in government debt decreased to 9.3% from 9.6%.

- Median home price growth expectations were unchanged at 3.3%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 1.5 percentage points to 27.0%, the highest reading since November 2023.

- Perceptions about households’ current financial situations improved, with more respondents reporting being better off than a year ago and fewer respondents reporting being worse off. Year-ahead expectations also improved, with a smaller share of respondents expecting to be worse off and a larger share of respondents expecting to be better off a year from now. The share of respondents expecting to be financially the same or better off 12 months from now is 78.1%, the highest level since June 2021.

- A smaller percentage of consumers, 11.99% of consumers vs 12.93% in prior month, expect to not be able to make minimum debt payment over the next three months

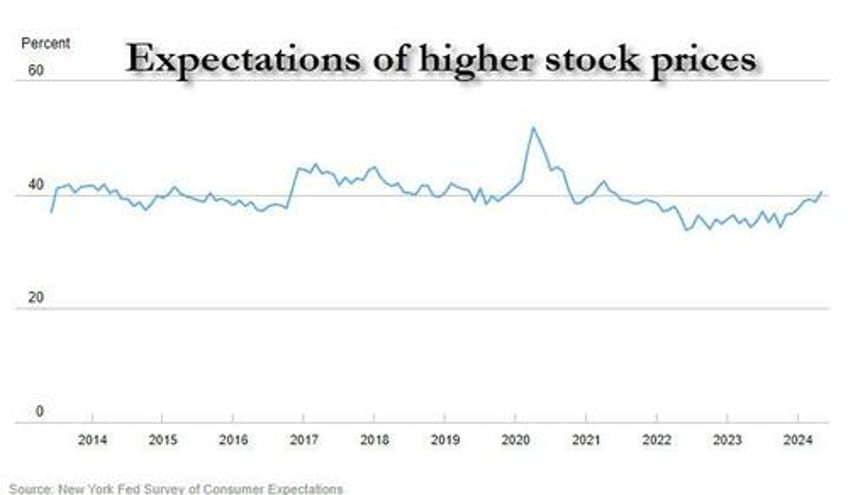

Last but not least, the average perceived probability that U. stock prices will be higher 12 months from now increased by 1.8 percentage points to 40.5%, the highest level since May 2021. As a reference, this series previously peaked in April 2020 when stocks crashed by about 30%.

What is remarkable is that none of the survey respondents realize that one year from today is also 6 months into the next Trump admin, which is when the Fed and Congress will finally allow stock prices to crash as the catastrophic economic reality is no longer masked by various Dept of Commerce and Labor apparatchiks. In short: we would take the under.