Was that it for the Atlanta Fed recession (which as we described, managed to fool everyone into believing the US economy is crashing because of... surging gold imports)?

One month after the March Beige Book reported that in the first full month of Trump's presidency, economic activity actually "rose slightly since mid-January" and that "six districts reported no change, four reported modest or moderate growth, and two noted slight contractions", moments ago the Fed released the April Beige Book report according to which economic activity was.... shockingly not falling off a cliff as one would expect listening to liberal media, but instead was "little changed since the previous report" even though uncertainty around international trade policy was pervasive across reports. Similar to last month, five districts saw slight growth, three districts noted activity was relatively unchanged, and the remaining four Districts reported slight to modest declines. And just as importantly, contrary to expectations of runaway prices, the Beige Book found that prices increases (described equally as modest and moderate) were not galloping higher but instead were "similar to the previous report."

In short, the sky is not falling. Here are some more details:

- While non-auto consumer spending was lower overall, most Districts saw moderate to robust sales of vehicles and of some nondurables, generally attributed to a rush to purchase ahead of tariff-related price increases.

- Both leisure and business travel were down, on balance, and several Districts noted a decline in international visitors.

- Home sales rose somewhat, and many Districts continued to note low inventory levels.

- Commercial real estate (CRE) activity expanded as multifamily propped up the industrial and office sectors.

- More importantly, loan demand - a key proxy for overall economic activity - was flat to modestly higher, on net.

- Several Districts saw a deterioration in demand for non-financial services.

- Transportation activity expanded modestly, on balance.

- Manufacturing was mixed, but two-thirds of Districts said activity was little changed or had declined.

- The energy sector experienced modest growth.

- Agricultural conditions were fairly stable across multiple Districts.

- Cuts to federal grants and subsidies along with declines in philanthropic donations caused gaps in services provided by many community organizations.

In short, much of the same inertia as last month. Where there was some notable change, was in the outlook: recall last month, "overall expectations for economic activity over the coming months were slightly optimistic." No more: courtesy of the concerted media campaign to spin Trump's economic policies in the worst possible light, the latest Beige Book described the outlook in several Districts as having "worsened considerably as economic uncertainty, particularly surrounding tariffs, rose."

Taking a closer at the labor market, the April Beige Book found that employment was little changed to up slightly in most Districts, with one District reporting a modest increase, four reporting a slight increase, four reporting no change, and three reporting a slight decline. This was a slight deterioration from the previous report with a few more Districts reporting declines. That's the bad news; the great news is that DOGE is working: according to the report, "the most notable declines in headcount were in government roles or roles at organizations receiving government funding." Which is precisely what most people voted for. Some more details:

- Hiring was generally slower for consumer-facing firms than for business-to-business firms.

- Several Districts reported that firms were taking a wait-and-see approach to employment, pausing or slowing hiring until there is more clarity on economic conditions.

- In addition, there were scattered reports of firms preparing for layoffs.

- Most Districts and markets reported an improvement in overall labor availability, although there were some reports of constraints on labor supply resulting from shifting immigration policies in certain sectors and regions.

- Wages generally grew at a modest pace, as wage growth slowed from the previous report in multiple Districts.

Turning to inflation, not surprisingly (to anyone who shops) prices increased across Districts, with six characterizing price growth as modest and six characterizing it as moderate, similar to the previous report.

- Most Districts noted that firms expected elevated input cost growth resulting from tariffs.

- Many firms have already received notices from suppliers that costs would be increasing.

- Firms reported adding tariff surcharges or shortening pricing horizons to account for uncertain trade policy.

- Most businesses expected to pass through additional costs to customers.

- However, there were reports about margin compression amid increased costs, as demand remained tepid in some sectors, especially for consumer-facing firms.

Here is a snapshot of highlights by Fed District:

- Boston: Economic activity increased slightly, as the outlook became more pessimistic on tariff-related concerns. Prices rose modestly, but contacts perceived new upside risks to inflation. Employment edged up, although hiring plans became more cautious in response to increased uncertainty. IT services contacts experienced strong revenue growth and were expected to be relatively unaffected by tariffs.

New York: Economic activity contracted modestly as heightened uncertainty weighed on businesses and consumers. Employment was steady to up slightly. Price increases picked up to the higher end of the moderate range. Businesses expressed significant concern about tariffs. Outlooks darkened, with many businesses anticipating declining activity and rising prices.

Philadelphia: Business activity declined modestly during the current Beige Book period after a slight decrease in the last period. Nonmanufacturing activity fell moderately. Employment declined slightly; wages and prices again grew modestly. Generally, sentiment fell, and firms grew less optimistic about future growth amid rising economic uncertainty.

Cleveland: Reports suggested that Fourth District business activity continued to be flat in recent weeks, and contacts expected activity to remain flat in the months ahead. Consumer spending declined, though some auto dealers noted customers pulling forward purchases ahead of potential tariffs. Employment levels increased slightly, and wage pressures remained moderate.

Richmond: The regional economy grew slightly in recent weeks despite some pockets of weakness tied to federal staffing and contract spending. Consumer spending was flat. Residential and commercial real estate activity picked up slightly. Non-financial service providers reported a modest decline in demand and hesitation from customers to make investment decisions. Employment was little changed and price growth remained moderate amid upward price pressures from tariffs.

Atlanta: The Sixth District economy grew slightly. Employment was flat. Wages, nonlabor costs, and firms' prices increased modestly. Retail sales fell slightly, and travel and tourism declined modestly. Home sales rose modestly. Commercial real estate conditions softened. Transportation activity grew slowly. Loan growth was moderate. Manufacturing declined. Energy activity rose slowly.

Chicago: Economic activity was little changed. Consumer spending increased modestly; employment and construction and real estate activity were up slightly; manufacturing was flat; business spending declined slightly; and nonbusiness contacts saw a slight decline in activity. Prices increased modestly, wages rose slightly, and financial conditions tightened. Prospects for 2025 farm income were unchanged.

St. Louis: Economic activity has remained unchanged, but the outlook has slightly deteriorated. Heavy rains negatively impacted neighborhoods, farms, and businesses. Contacts expressed a lot of uncertainty and an elevated effort in estimating the impact of tariffs and ways to reduce cost increases and supply disruptions.

Minneapolis: District economic activity was lower. Employment declined and labor demand continued to soften. Wage growth was modest, and price increases were moderate. Consumer spending was lower with some exceptions. Manufacturing experienced modest improvements. Construction activity fell overall. Commercial real estate was mostly unchanged, and home sales declined. Agricultural conditions remained weak.

Kansas City: Economic activity in the Tenth District grew slightly, but expectations about business activity and consumer spending weakened considerably. Amid shifting conditions, businesses indicated they were most likely to adjust pricing to adapt. Expectations of price growth rose at a robust rate, most pronounced in goods sectors. Employment levels were stable but hiring stalled.

Dallas: Growth in the Eleventh District economy slowed to a slight pace. Nonfinancial services activity stalled. Retail sales dipped while manufacturing and oil field activity rose modestly. Lending growth moderated. Commercial real estate activity was steady, while housing demand remained tepid. Employment increased, and input cost pressures accelerated. Outlooks deteriorated as heightened uncertainty surrounding domestic and trade policy hindered firms' ability to plan.

San Francisco: Economic activity slowed slightly. Employment fell slightly. Wages grew slightly, and prices rose modestly. Demand for business and consumer services and for retail goods weakened. Activity in manufacturing and residential and commercial real estate markets softened slightly. Lending activity and conditions in agriculture were stable. The economic outlook worsened materially.

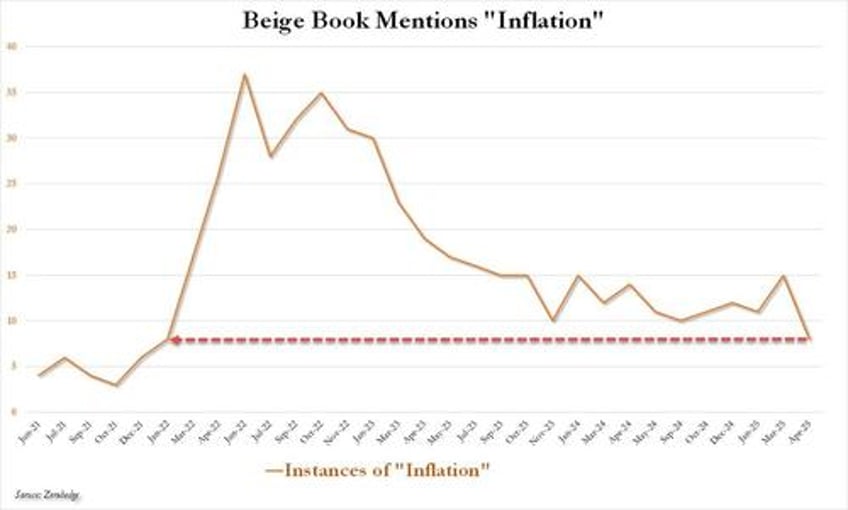

Confirming that contrary to conventional wisdom the economic picture was largely unchanged since April, the latest February Beige Book saw just 2 mentions of recessions, the same as March, and down sharply from 6 two months prior. Where there was some concern is that mentions of "slow" rose from from 35 in March (which was down from 38 in January) to 50. But the biggest surprise is that contrary to prevailing media narratives, mentions of inflation actually tumbled from a two year high of 15, to just 8- the lowest in three years, specifically since the start of the Fed's post-Covid inflationary tsunami...

... suggesting that the US economy - while hardly on fire as it was during the hyperinflationary period of Biden's admin - continues to chug along and is hardly collapsing as so many Trump foes would like to see; and it certainly is not seeing prices explode higher.