Shares of gunmaker Smith & Wesson Brands plunged in premarket trading after reporting adjusted earnings per share for the second quarter of fiscal 2025, which ended on October 31, that missed consensus estimates tracked by Bloomberg. This comes as firearm demand has cooled after the Covid frenzy. Furthermore, with President-elect Trump entering the White House next month, Americans are at ease that far-left Democrats and their radical non-profits funded by progressive billionaires will have a tougher environment to undermine the Second Amendment over the next four years.

Smith & Wesson's dismal second-quarter earnings resulted from sliding gun demand in the US.

Here's a snapshot (courtesy of Bloomberg) of the earnings that missed the average analyst estimates:

Adjusted EPS 11c, estimate 17c (Bloomberg Consensus) (2 estimates)

Net sales $129.7 million, estimate $133.7 million

Adjusted operating income $7.91 million, estimate $9.59 million

Gross margin 26.6%, estimate 29.8%

CEO Mark Smith commented on the earnings, blaming cash-strapped consumers and inflation for the industrywide downturn:

"Second quarter results came in below our expectations as overall demand for firearms normalized late in the quarter. We believe that the primary driver of the demand pressure continued to be inflation. The consumer cautiousness with discretionary spend that we observed in recent quarters was more pronounced during the second quarter than we anticipated."

Smith noted that despite the headwinds, Smith & Wesson outperformed the market and gained market share in the quarter.

He warned about a "challenging demand environment" and flexed how the gun company has been able to navigate rough environments "many times before."

CFO Deana McPherson said: "Net sales for our second quarter were nearly 4% above the prior year comparable quarter on the strength of our new Bodyguard 380 pistol and lever action rifles. Based on the softer demand trends we have seen across the industry in recent months, we have reduced our expectations for the second half of fiscal 2025, and for our third quarter, we expect our top line to be approximately 10-15% lower than fiscal 2024."

Craig-Hallum analyst Steve Dyer told clients that the weaker consumer demand and lackluster "firearm-buying frenzy" in the election were the main drivers behind the dismal earnings report.

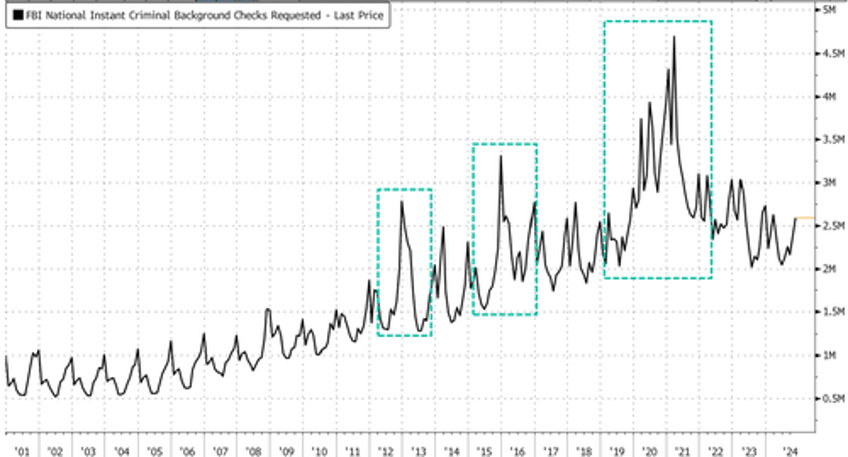

Dyer pointed out that the firearms market has "entered a digestion period" after years of multiple buying panics, noting demand surges after strict regulation in the 2010s and riots and social unrest several years ago.

Based on this, he slashed the price target of the stock to $13 from $18.

Shares plunged 15% in premarket trading. As of Thursday's close, shares have been flat on the year.

None of this comes as a surprise to readers, considering we have already covered the great gun bust, with the recent note that includes:

However, suppressor demand appears to be rocketing higher.

Firearm Suppressor Demand Explodes At Historic Rate https://t.co/WujDmXSts2

— zerohedge (@zerohedge) November 16, 2024

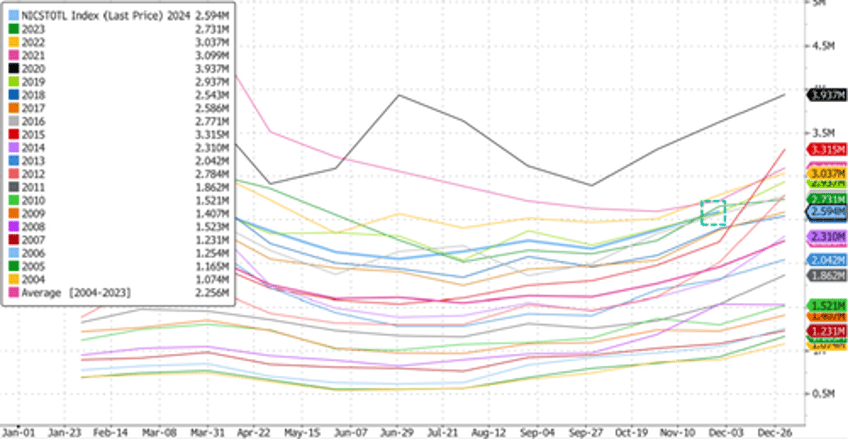

The latest National Instant Criminal Background System (NICS) data shows the boom and bust cycle of gun buying. Keep in mind that NICS checks are a proxy for the number of guns sold and are not exact because the background checks are performed on the buyer rather than the gun.

NICS checks are still well above a 20-year trend and seasonally rising into the end of the year.

Our view is that under Trump's second term, the gun-buying panic days under anti-gunner Democrats will be over for now, and this will create deals, as gun companies like Smith & Wesson will have to push promotions to clear inventory.