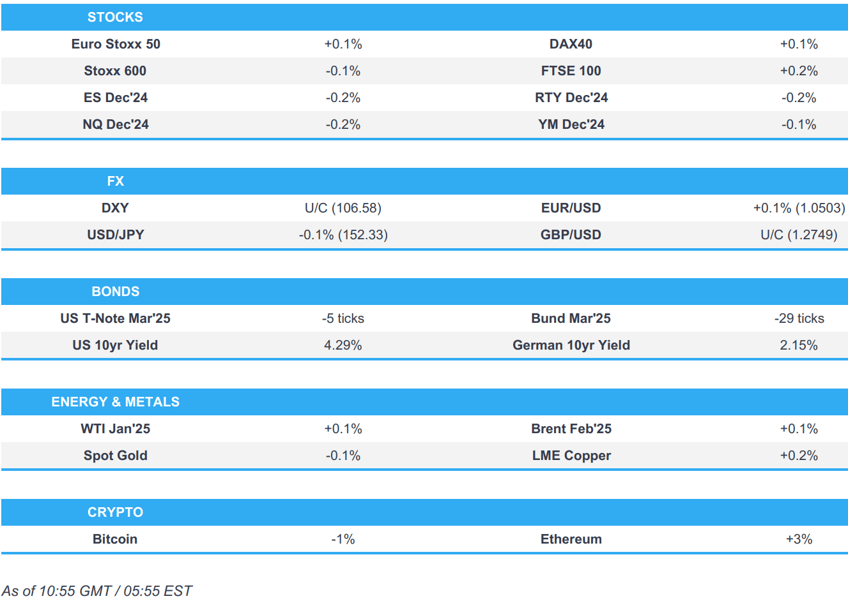

- European bourses are mixed into the ECB, SMI outperforms post-SNB. US futures are modestly softer.

- SNB delivered a larger-than-expected 50bps cut and reiterated a willingness to intervene in the FX market as necessary.

- USD steady with peers and for the most part contained aside from CHF underperformance and Antipodean outperformance, AUD driven by jobs data.

- Fixed benchmarks are at/towards session lows into the ECB and US data thereafter, stateside yields are bid and the curve steeper.

- Crude in the green but only modestly so, base metals are little changed overall.

- Looking ahead, ECB Policy Announcement, ECB Press Conference, US PPI, US Initial Jobless Claims, Japanese Tankan Survey, Supply from the US, Earnings from Broadcom, Costco.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the session entirely in the green, albeit modestly so. As the morning progressed, some indices slipped into negative territory to display a slightly more mixed picture in Europe.

- European sectors began the session with a strong positive bias, but in a turn of fortunes now display a mostly negative picture. Autos lead, followed by Energy/Basic Resources; the pair lifted by gains in the underlying. Retail is the clear underperformer, continuing the pressure seen in the prior session.

- US equity futures are very modestly on the backfoot, with the NQ paring back some of the hefty gains seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is steady after an early bout of weakness that didn't appear to be driven by any particularly obvious catalyst. Looking ahead, focus remains on price data following yesterday's CPI report with PPI metrics due on deck. DXY remains within yesterday's 106.26-80 range.

- EUR/USD is just about holding above the 1.05 mark in the run-up to today's ECB rate decision. Consensus looks for the ECB to deliver a 25bps rate cut with just an 18% chance of a deeper 50bps cut. EUR/USD currently sits within yesterday's 1.0480-1.0539 range.

- USD/JPY is a touch higher after a choppy APAC session which saw initial JPY strength fade following source reporting via Reuters that the BoJ is leaning towards keeping rates steady next week, albeit, there is no consensus within the bank on the final decision. Currently sits towards the top end of yesterday's 151.00-152.86 range.

- GBP is relatively contained vs. the USD as UK-specific drivers remain light. Tomorrow's monthly GDP print unlikely to be a gamechanger for the BoE. Cable briefly eclipsed yesterday's best, printing a session peak at 1.2787 before settling into yesterday's 1.2714-1.2782 range.

- AUD is at the top of the G10 leaderboard following the Aussie jobs report which saw Employment Change topping forecasts (driven by full-time employment) whilst the Unemployment Rate surprisingly fell to 3.9% despite forecasts of an uptick to 4.2% from 4.1%, although the Participation Rate surprisingly dipped. AUD/USD saw a boost nonetheless and moved back onto a 0.64 handle.

- CHF is on the backfoot after the SNB surprised markets by pulling the trigger on a deeper 50bps cut vs. expectations of a smaller 25bps move. The decision was accompanied by a reiteration that the Bank remains willing to intervene in the FX market as necessary whilst 2024 and 2025 inflation forecasts were lowered.

- PBoC set USD/CNY mid-point at 7.1854 vs exp. 7.2438 (prev. 7.1843)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in the red, but only modestly so. Action which came after a selloff emerged at the end of Wednesday’s US session into settlement, no specific driver behind this at the time. Currently at a low of 110-16 and continuing to slip from an initial 110-24 high print.

- Bunds are a little softer in-fitting with peers but ultimately awaiting the ECB later. Macro drivers otherwise have been somewhat light aside from the SNB which delivered a 50bps move. An announcement which sparked some modest EGB upside. As it stands, Bunds are at a 135.56 base having faded from an SNB-driven peak of 135.85, downside which was marginally added to by SNB’s Schlegel remarking that they do not like negative rates and the likelihood of a return to NIRP is small.

- OATs are a little softer with President Macron expected to announce his new PM today. As it stands, it is unclear who Macron will propose with the likes of former Justice Minister Bayrou and current Defense Minister Lecornu among those touted.

- Gilts are in-fitting with peers. Lost the 95.00 mark early doors and has since slipped to a 94.89 base.

- Italy sells EUR 8.5bln vs exp. EUR 6.75-8.5bln 2.70% 2027, 3.15% 2031, 3.35% 2035, 4.30% 2054 BTP:

- Click for a detailed summary

COMMODITIES

- WTI and Brent are incrementally firmer on the session, though only modestly so in comparison to the action seen on Wednesday. Nonetheless, benchmarks continue to advance on the USD 70/bbl and USD 73/bbl handles respectively; in recent trade, prices have almost entirely pared overnight strength. Downside was seen following the IEA OMR, where it cut its 2024 world oil demand growth forecast.

- Gold is essentially unchanged at the USD 2715/oz level. Unable to gain any traction amid ongoing USD strength and yield advances, though the metal has avoided a move into the red seemingly on the back of the tepid/mixed European risk tone.

- Base metals generally hold a positive bias; copper is a little more contained, with 3M LME just above the USD 9.2k mark.

- Saudi crude supply to China is to rise to around 46mln barrels in January, via Reuters citing sources (around 36.5mln in Dec., around 46mln in Nov).

- IEA Monthly Oil Market Report: cuts 2024 world oil demand growth forecast to 840k BPD (prev. 920k BPD); raises 2025 forecast to 1.1mln BPD (prev. 990k BPD), citing Chinese stimulus measures. World oil market looks comfortably supplied next year. Current balances suggest a 950k BPD overhand in 2025 if OPEC+ begins unwinding voluntary cuts as of the end of March 2025.

- India is reportedly to decide soon on whether to impose curbs on the imports of steelmaking raw materials, via Reuters citing sources.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish CPIF YY (Nov) 1.8% vs. Exp. 1.9% (Prev. 1.9%); CPIF MM (Nov) 0.5% vs. Exp. 0.5% (Prev. 0.5%)

NOTABLE EUROPEAN HEADLINES

- UK RICS Housing Survey (Nov) 25.0 vs. Exp. 19.0 (Prev. 16.0); highest since September 2022.

- India-UK Free Trade Agreement talks to commence at the end of January, according to an Indian government source cited by Reuters.

- Swiss SNB Policy Rate (Q4) 0.50% vs. Exp. 0.75% (Prev. 1.00%); "also remains willing to be active in the foreign exchange market as necessary". Click for full details.. SNB's Schlegel says development of CHF is still the important factor. Remains willing to intervene as necessary. Rate cuts remain the main policy instrument if further easing is required. Uncertainty on future inflation path is high, inflationary pressure has decreased markedly over the medium term. SNB still has room for further interest rate moves. Main instrument is policy rate, with that can influence the economy and exchange rate. This step us intended to stabilise inflation between 0 and 2%. Can tolerate weakening of inflation below 0-2% target range, as long as it is temporary. SNB Chair Schlegel says the SNB does not like negative interest rates; the likelihood of negative interest rates has become small.

- German Economy expected to stagnated in 2025 (prev. forecast 0.5%); German GDP expected to expand by 0.9% in 2026.

- Ifo institute forecasts Germany's growth between 0.4 - 1.1% in 2025. If German economy fails to overcome structural challenges, only 0.4% growth compared to the 1.1% if the right economic policy course is set. Expects 2.3% inflation in 2025 and 2.0% in 2026, in both scenarios

GEOPOLITICS

MIDDLE EAST

- Israeli troops have entered Syria buffer zone on a temporary basis, according to Bloomberg

- "Hamas agreed to the presence of Israeli forces in Gaza after a ceasefire goes into effect", according to Kann News.

- "Israeli army announces the withdrawal from the tents area in southern Lebanon in accordance with the ceasefire agreement ", according to Al Arabiya.

OTHER

- China's President Xi says China is willing to strengthen strategic alignment with Russia, and tap into the intrinsic driving force of bilateral cooperation, via state media.

- Russia's Navy Chief says that NATO has increased its military activity in the arctic region, via Ria; naval grouping of Russian nuclear forces has been completely renewed, via Tass.

- US President-elect Trump is reportedly considering ex-intelligence chief Richard Grenell as Special Envoy for Iran, according to Reuters sources; the article suggests consideration of a key ally for the position sends a signal that Trump may be open to talks.

- US House of Representatives passed USD 895bln defence policy bill, according to Reuters.

CRYPTO

- Bitcoin is a slightly softer footing, but still resides above the 100k mark.

LATAM

- Brazilian Selic Interest Rate 12.25% vs. Exp. 12.0% (Prev. 11.25%); decision unanimous; in light of more adverse inflation scenario, the committee sees hikes of the same magnitude at the next two meetings.

- Brazilian Finance Minister Haddad said BCB decision was a surprise but pricing pointed to a move like that; and added there is no decision about changing the fiscal package, according to Reuters.

- Banxico financial stability report: Mexico's financial system has a resilient and solid position; stress tests confirmed that the banking system as a whole has the capacity to absorb significant shocks.

APAC TRADE

- APAC stocks eventually mimicked the sentiment on Wall Street and traded mostly higher following a slow start to the session and despite a lack of macro news flow.

- ASX 200 saw its earlier gains hampered after a strong Aussie jobs report which followed the dovish RBA yesterday, in which Governor Bullock said the Board will be watching all data including employment.

- Nikkei 225 reclaimed the 40,000 level for the first time since mid-October with gains driven by the Industrial and IT sectors, although at one point, the upside was capped by the firmer JPY.

- Hang Seng and Shanghai Comp were somewhat lethargic at the start, but momentum picked up, although there was little notable reaction seen on reports that US President-elect Trump invited Chinese President Xi to attend his inauguration next month, whilst it was not clear whether Xi has accepted the invitation. Participants now await the outcome of the Central Economic Work Conference.

NOTABLE ASIA-PAC HEADLINES

- South Korean opposition files a second motion to impeach President Yoon, via Bloomberg

- China's Commerce Ministry say China is open to contact and communication with the Trump administration's economic and trade team

- US President-elect Trump has invited Chinese President Xi to attend his inauguration next month, multiple sources told CBS News; it was not clear whether Xi has accepted the invitation.

- BoJ is reportedly leaning toward keeping rates steady next week, according to Reuters sources; there is no consensus within the bank on the final decision, some believe conditions have been met for a December hike; BoJ could hike if FOMC decision triggers JPY selloff. Many policymakers appear in no rush to pull the trigger with little risk of inflation overshooting, sources added.

- Japanese companies are reportedly worried about tariff hikes and US-China relations, according to a Reuters survey; Nearly three-quarters of Japanese companies expect Trump's next term to have a negative impact on the business environment.

- South Korean Finance Minister said they will closely monitor financial markets and respond to boost investor sentiment if needed, according to Reuters.

- South Korean President Yoon said he will fight until the last moment, according to Reuters.

DATA RECAP

- Australian Employment (Nov) 35.6k vs. Exp. 25.0k (Prev. 15.9k); Unemployment Rate 3.9% vs. Exp. 4.2% (Prev. 4.1%)

- Australian Participation Rate (Nov) 67.0% vs. Exp. 67.1% (Prev. 67.1%)

- Australian Full Time Employment (Nov) 52.6k (Prev. 9.7k)

- New Zealand Elec Card Retail Sale MM (Nov) 0.0% (Prev. 0.6%, Rev. 0.7%); YY (Nov) -2.3% (Prev. -1.1%)