Nothing good - all bad... and new record highs for stocks.

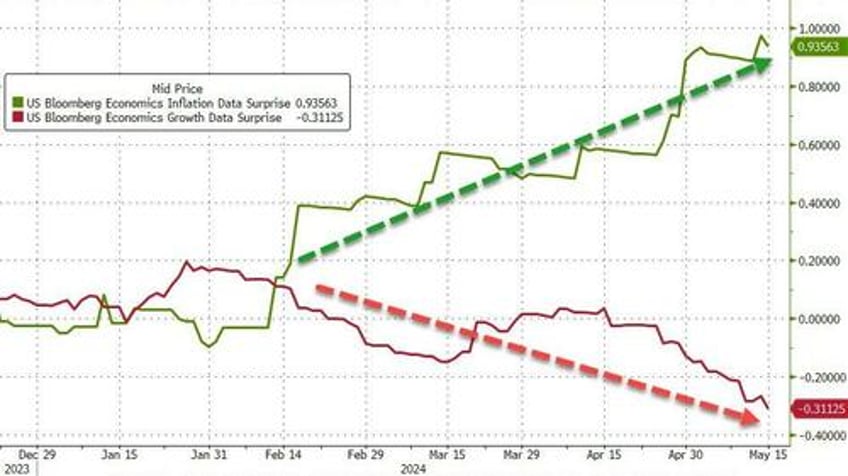

SuperCore CPI hotter than expected (but headline and core CPI in-line/small miss), Retail sales way uglier than expected (but gas station spending surged), homebuilder sentiment slumped, and Empire Fed Manufacturing ugly...

Source: Bloomberg

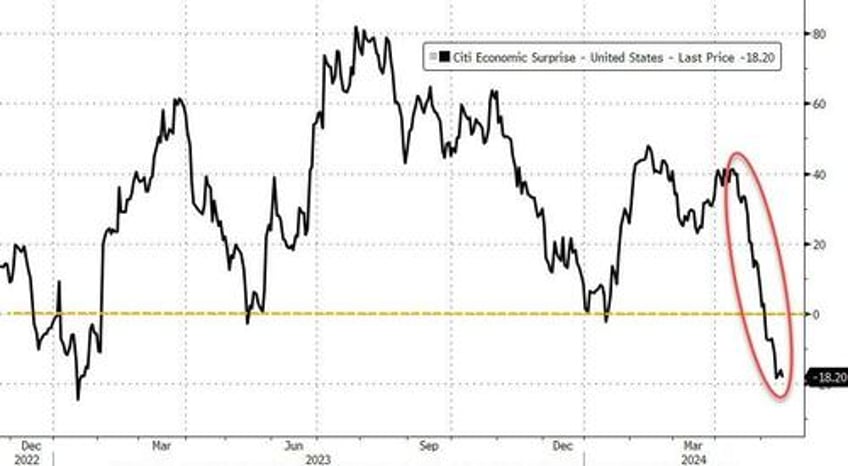

Both 'soft' and 'hard' data is now falling...

Source: Bloomberg

...and the stagflationary threat continues to grow...

Source: Bloomberg

...but the market doesn't care about growth - it spiked rate-cut expectations on the 'cool' CPI (two cuts fully priced in for 2024 and three more cuts - at least - in 2025)...

Source: Bloomberg

And that lifted stonks across the board with Nasdaq leading the way to new record highs (Dow & S&P first new record close since March)

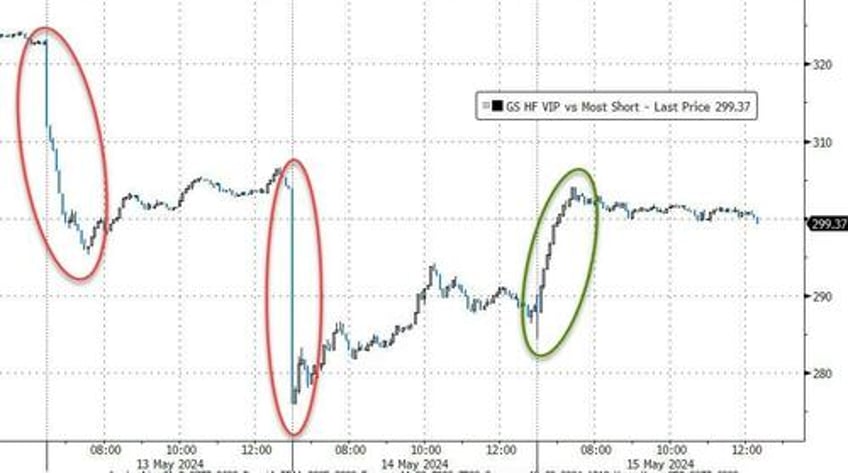

Market volumes were dramatically elevated today, according to Goldman's trading desk (+45% vs the trailing 20 days), as hedge funds (on an illustrative basis) recovered half the losses from the last two nasty days...

Source: Bloomberg

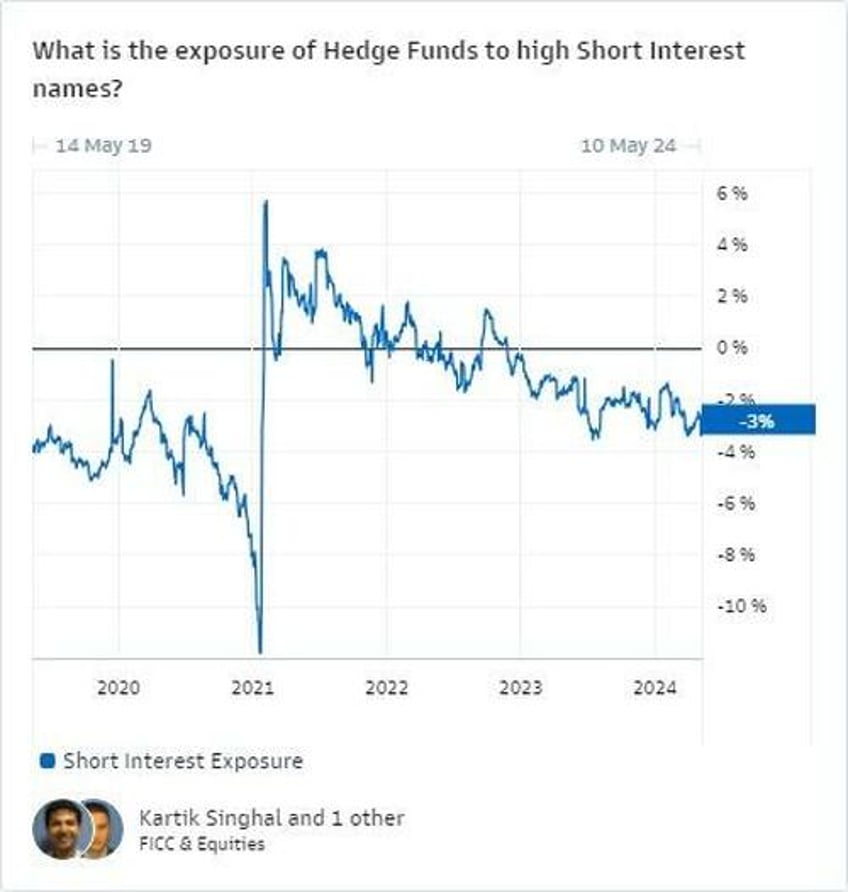

Goldman trader John Flood highlighted the fact that it feels like sentiment during the last “meme” craze was one of confusion and bewilderment where some funds were willing to hold on and trying to wait out the retail crowd. This time around, HFs collectively are just not nearly as exposed to high SI/float stocks as they used to be, so the risk is a lot more manageable, and funds tend to react much more quickly given past lessons.

Source: Goldman Sachs

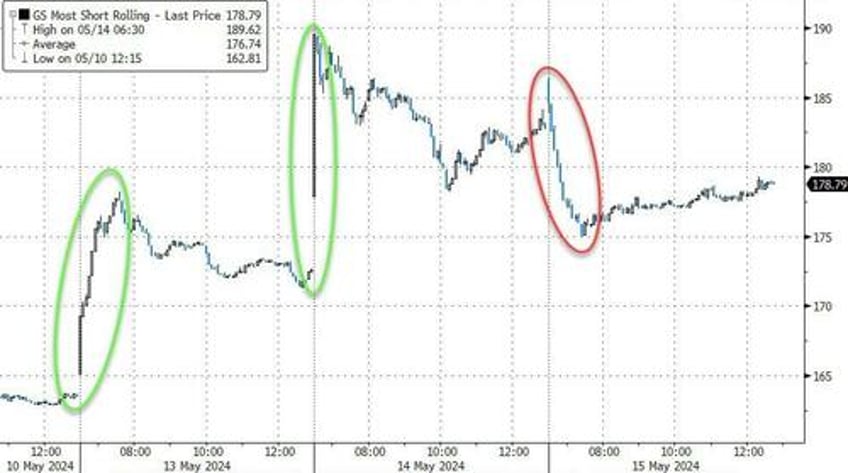

'Most Shorted' stocks dumped back yesterday's gains today as the meme-stock mania stalled...

Source: Bloomberg

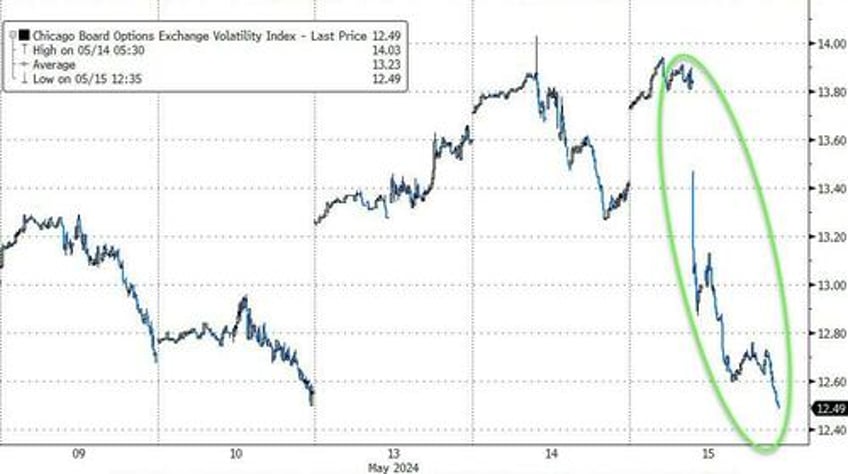

VIX plunged back to a 12 handle today...

Source: Bloomberg

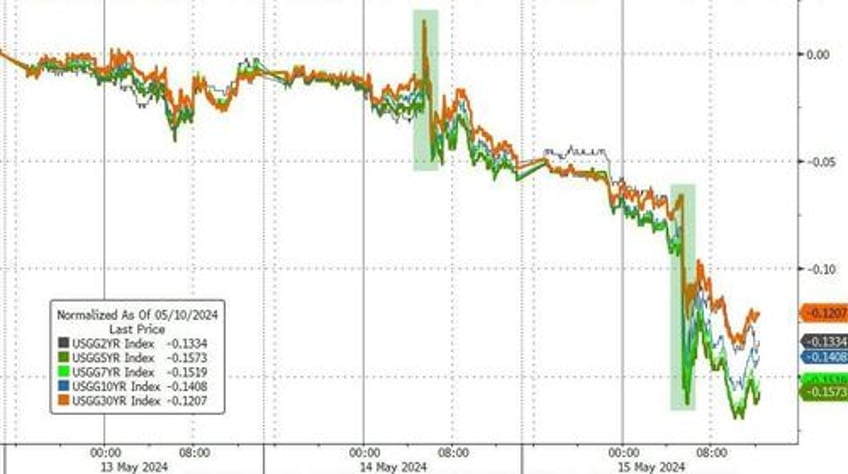

Treasuries were bid today with yields down 8-10bps across the curve (with the belly slightly outperforming the wings)...

Source: Bloomberg

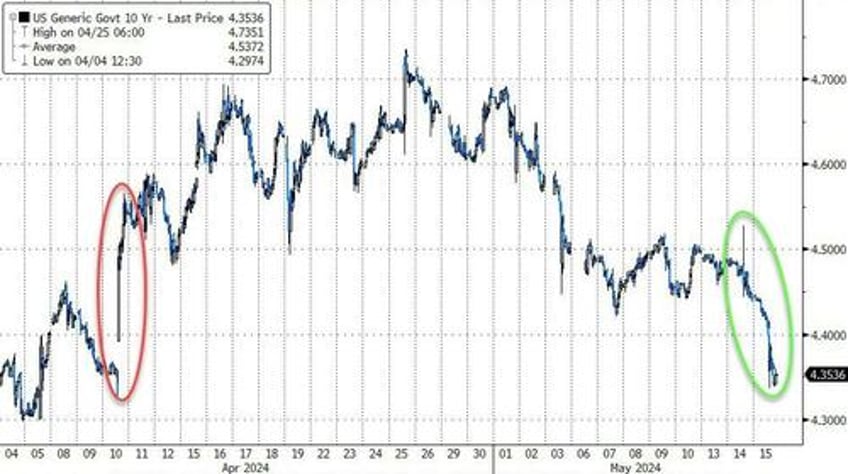

With the swing lower in 10Y yields erasing all the increase in yields since April's CPI print...

Source: Bloomberg

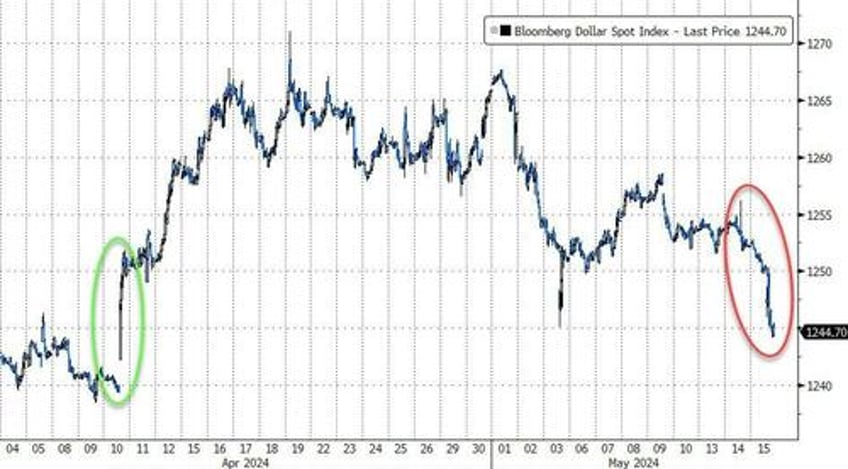

The dollar followed a similar pattern to yields, erasing all of the post-April CPI gains...

Source: Bloomberg

Gold surged back near record closing highs ($2392). Interestingly, gold was trading at exactly the same level it was before April's CPI ahead of today's CPI...

Source: Bloomberg

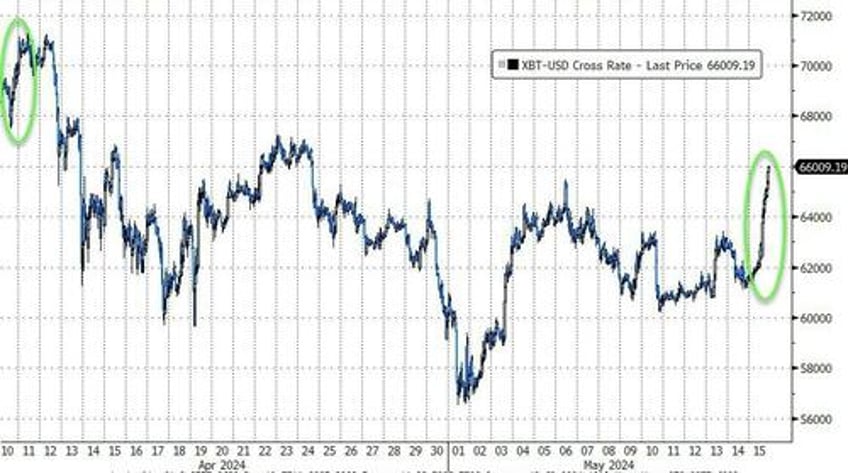

Bitcoin soared back above $66,000 - this was Bitcoin's best day since March 2023!...

Source: Bloomberg

Crude prices rebounded strongly today after early weakness (following inventory draws). The 100DMA once again acted as support with WTI closing back above it...

Source: Bloomberg

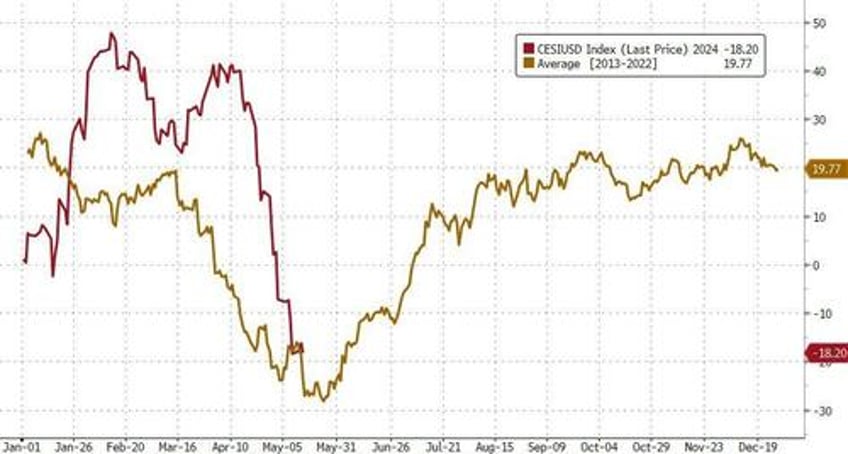

Finally, we noted at the start how ugly the US Macro data was, but there is a potential silver lining...

Source: Bloomberg

The Citi US Macro Surprise Index has a very regular seasonal pattern and 2024 is following it closely... with the positive surprises set to come from here as fiscal year-end looms. Is the 'no landing' narrative about to be realized?