Submitted by QTR's Fringe Finance

Just days ago, I released my latest take on macro and the markets, including two new long positions I like, heading into the second half of 2024.

As I wrote then, there are a number of negative catalysts still just waiting to play out for markets: numerous potential wars, a fiscal situation in the U.S. that is completely untenable (listen to this interview with James Lavish and read this report from Mark Spiegel to understand) and uncertainties with the 2024 election.

Long story short, the entire world is begging, pleading, hoping and setting all of their models around the idea of a Fed rate cut being the savior for markets this year.

But we shouldn't be so sure that'll be the case.

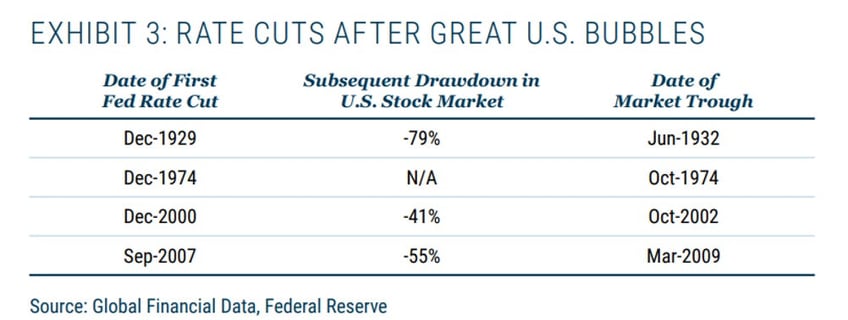

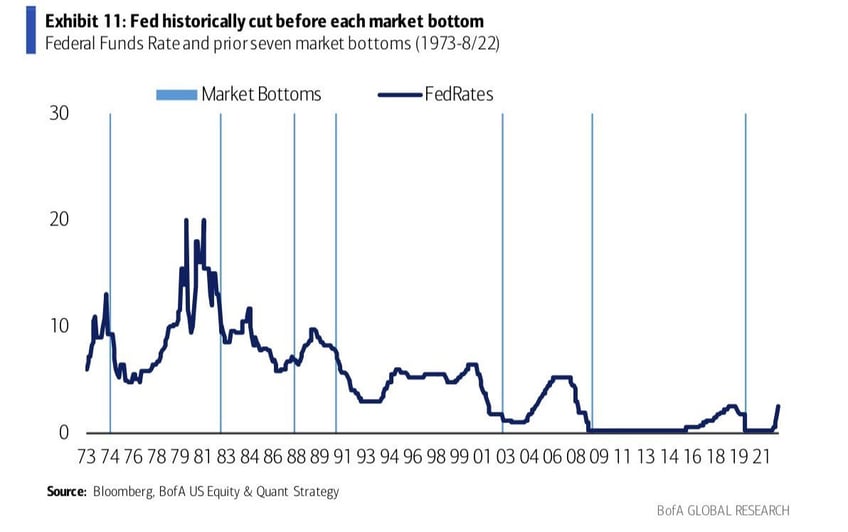

Rate cuts don't mean the market is going to rip higher. In fact, if history is any guide, they mean just the opposite.

So while the market is anticipating rate cuts and the economic data that could portend a Fed pause or cuts as positives, they really could instead be the alarm that indicates the market could be setting up for a marked move lower.

As you can see in the charts above and below, market bottoms generally follow Fed rate cuts. Cuts usually come just after hikes have made their way through the economy and are set to manifest in the economy (this usually takes 18 months to 24 months, something I wish I had been clearer about when I took my bearish stance on markets 18 months ago, only to be proven very wrong thus far).

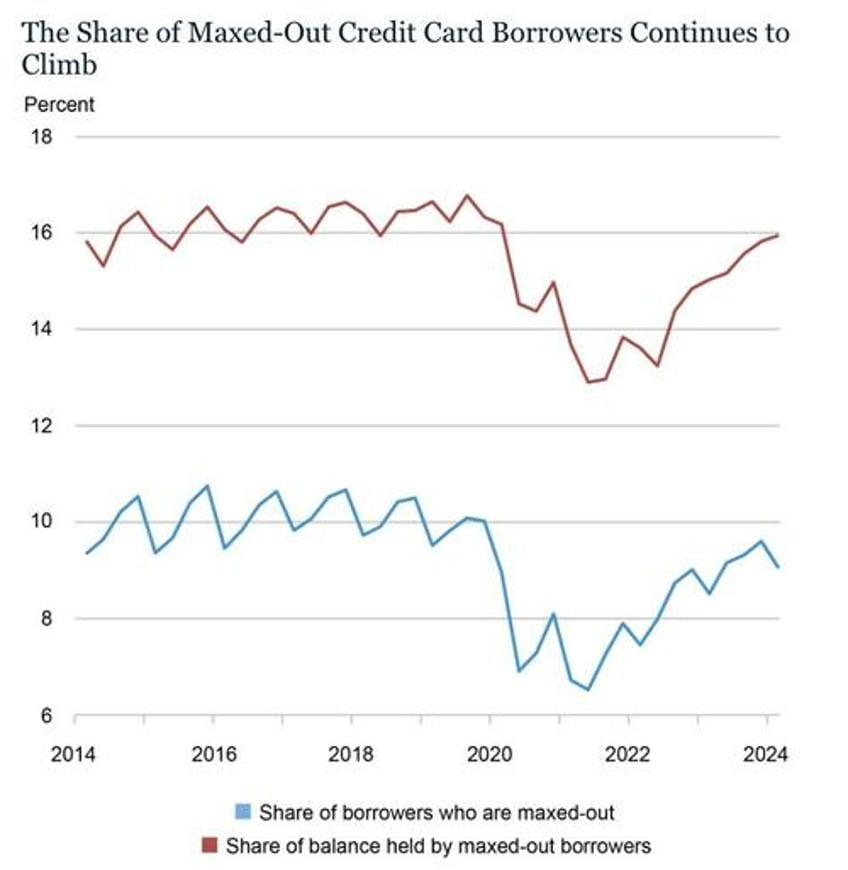

But don’t let rate cuts be the only signal that the market could be ready to tank. The macroeconomic data behind the scenes continues to pile up like a wreck on a highway. With the Fed in QE mode, bad news is still looked at as good news.

But with the Fed engaged in quantitative tightening, make no mistake about it, bad news is simply just bad news. Want some proof?

🔥 Zero Hedge readers take 50% off a Fringe Finance annual subscription for life by using this link: ZH50

Regional banking and commercial real estate are showing major cracks, consumers are completely tapped out as reflected in retail companies' recent earnings, and unemployment is now ticking higher to 4.1%, the highest it's been since November 2021, this past week.

Per the NY Fed, in 2024, more people are maxing out their credit cards compared to 2023. The New York Fed’s latest report shows household debt increased by $184 billion in the first quarter of 2024, with credit card balances dropping by $14 billion, typical for the period. However, credit card delinquency is rising, with 18% of borrowers using at least 90% of their credit limit, indicating a higher rate of maxed-out cards.

Here’s the coming cycle in a nutshell, even if we cut rates.

Debt delinquencies indicate borrowers are unable to meet their obligations. Most immediately, financial institutions that have issued these debts may experience liquidity constraints, as their expected flow of income is interrupted. In an environment of rising delinquencies, it's natural for lenders to become more cautious, tightening lending criteria or increasing interest rates to offset the higher risk. This might not only inhibit entrepreneurship but also decrease consumer spending, as both individuals and businesses find it harder to obtain credit.

When consumers spend less, businesses see reduced revenue and profits, making them less attractive investments. Lower earnings can then lead to a decline in stock prices (via multiples or fundamentals or both).

And so yes, there will be a time between when the Fed decides to pause and cut rates.

But if history is any indicator, stocks will tank, not go up. It’s only in the quarters or years following this move that the market may find its bottom. That’s why rate cuts should not necessarily be looked at as an immediate signal to buy stocks, in my opinion.

As they say in London, mind the gap between rate cuts and a market bottom.

Now read:

- Bitcoin: My thoughts on Bitcoin's recent move lower

- Equities I Like: 2 new stocks I'm buying in 2024 for the long term

- 24 Names I Like For This Setup: How my 24 names I'm watching for this year are performing and why I own them

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.