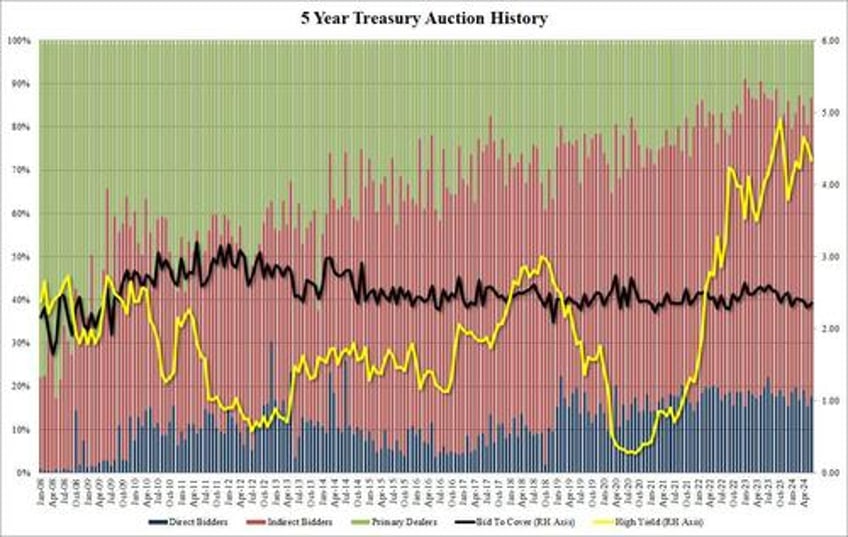

After yesterday's solid 2Y auction stopped through with the best Bid to Cover in one year, moments ago the Treasury sold $70BN in 5Y paper in another very strong auction.

The high yield of 4.331% stopped through the When Issued 4.335% by 0.4bps, the third consecutive stop through in a row, and also the lowest high yield since the 4.235% in march.

The bid to cover rose to 2.35 from last month's 2.30, but it was still well below the six-auction average of 2.39 and was the second lowest this year.

The internals were more remarkable: Indirects took down 68.9% which was the highest portion going to foreign buyers since the 70.5% in march; it was also above the 66.0% recent average. And with Directs taking down 17.7%, up from 15.4% last month and just above the 17.5% average, Dealers were left with just 13.4% of the auction, the second lowest since September with just March below today's print.

Overall, this was a solid auction if not stellar, and while yields did drop about 1basis point in the secondary market after the break, the 10Y was still near session highs, rising to 4.30%, up about 7bps from yesterday's close.