After yesterday's ugly 2Y auction saw a major drop in foreign demand, markets were worried that not only would today's sale of $70bn in 5Y paper be poor received, especially after the brutal whiplash which has seen 10Y yields tumble 10bps then spike right back up, but worse, foreign demand would be even scarcer. In the end, it wasn't quite so bad.

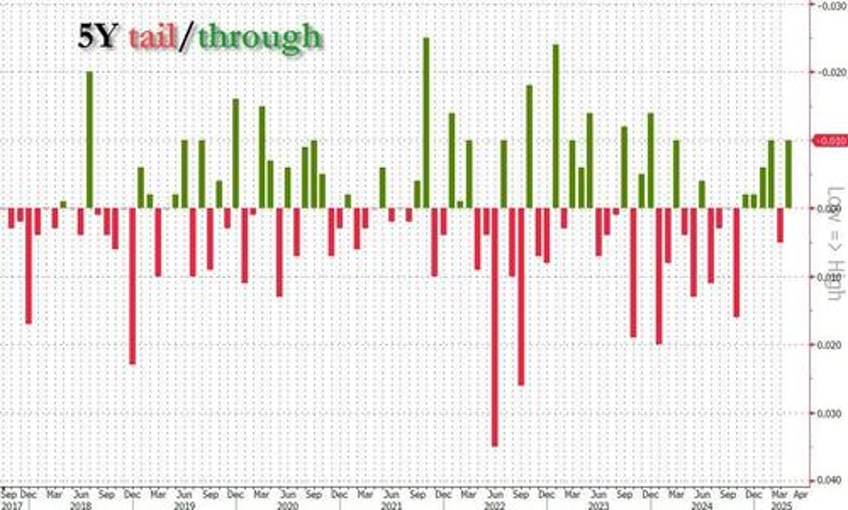

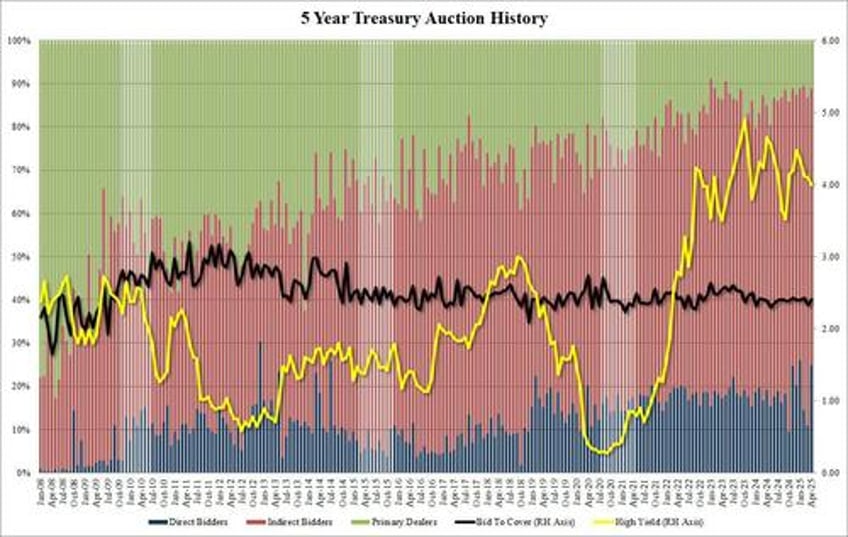

Starting at the top, the auction priced at a high yield of 3.995%, the first sub 4.0% 5Y auction since Sept (and thus, the first sub 4.00% coupon, specifically today's coupon was 3.875%), down from 4.10% last month, but the auction also stopped through the 4.005% When Issued by 1.0bp, the 5th stop through in the past 6 auctions.

The bid to cover was solid at 2.41, above last month's 2.33, and right on top of the 2.39 six-auction average.

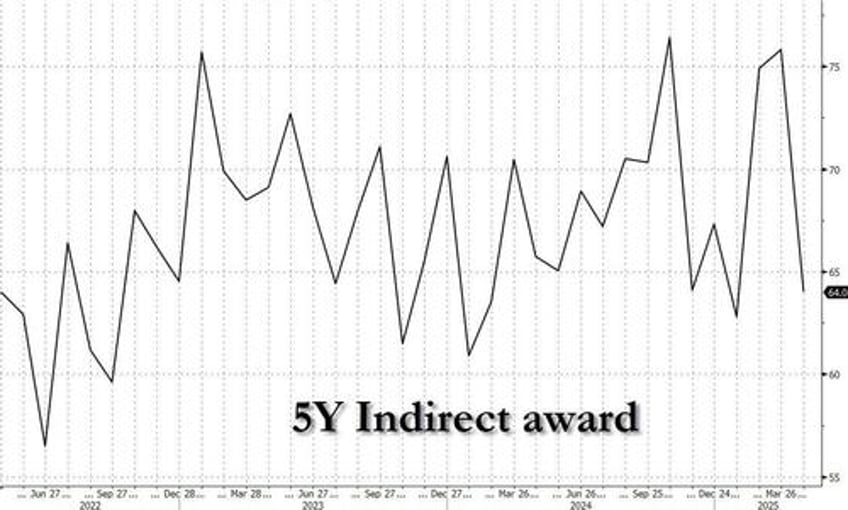

Like yesterday, it's the internals that were most interesting, but unlike yesterday, we did not see a painful tumble in the Indirect award as foreign bidders pulled out. Which is not to say there was a lot of them: the Indirect takedown dropped from 75.8% in March, one of the highest on record, to just 64.0%, low, but not outlandishly so, and in fact January's 62.8% was lower. So while foreigners were skittish, it wasn't as bad as yesterday.

And with Indirects sliding, Directs naturally jumped, from 11.0% to 24.8%, the highest since January, and one of the highest on record. The offset, Dealers, took down just 11.1%, down from 13.2% in March and one of the lowest on record.

Overall, this was a solid auction, and while indirects slumped, the drop was more modest than yesterday's jarring crash to a 2 year low. Still the market reaction showed some indigestion, and 10Y yield were last seen at 4.37% after dropping as low as 4.25% earlier.