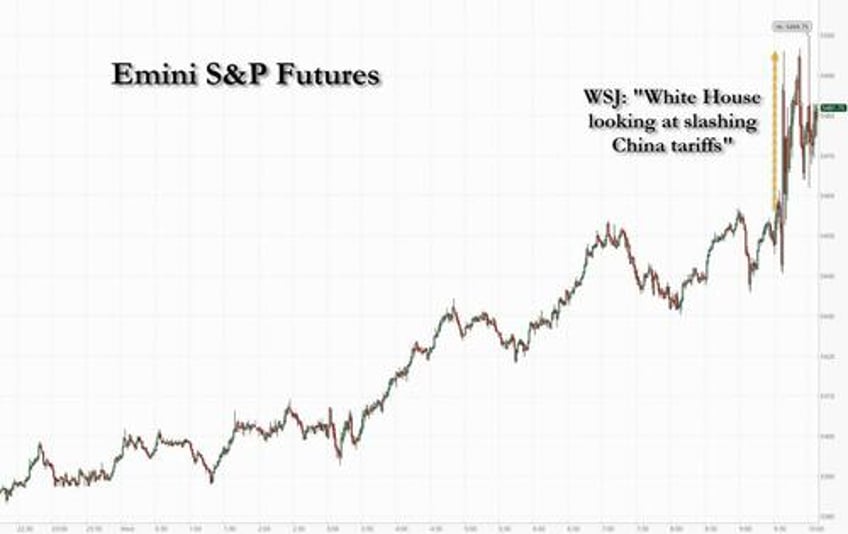

Stocks are spiking higher, and extending premarket gains, after the WSJ reported that the Trump administration is considering slashing its steep tariffs on Chinese imports - in some cases by more than half -in a bid to de-escalate tensions with Beijing that have roiled global trade and investment, according to people familiar with the matter.

According to the report, China tariffs were likely to come down to between roughly 50% and 65%, about half of their current levels. The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year: 35% levies for items the U.S. deems not a threat to national security, and at least 100% for items deemed as strategic to America’s interest. The bill proposed phasing in those levies over five years.

In retrospect, the WSJ report said nothing new - and appears to be an attempt to merely stay in the newsflow - after Trump said Tuesday he was willing to cut tariffs on Chinese goods, saying the 145% tariffs he imposed on China during his second term would come down. “But it won’t be zero,” he said. The announcement sent stocks surging afterhours.

On Wednesday, China signaled it was open to trade talks with the U.S., though Beijing warned it wouldn’t negotiate under continued threats from the White House. In China’s policymaking circles, Trump’s comments Tuesday were viewed as a sign of him folding, the WSJ reported citing people who consult with Chinese officials said.

The expressions of openness to a deal from both sides represent a shift from much of the past month, as the world’s two largest economies exchanged reciprocal tariff increases and testy words, helping push stock markets around the world to their worst weeks in many years.

President Trump hasn’t made a final determination, the people said, adding that the discussions remain fluid and several options are on the table.

Separately, and at almost the exact same time, the WSJ also piled in on the other key topic du jour, namely the "explanation" why Trump decided not to fire Jerome Powell - as Trump also revealed he would not do yesterday. According to the WSJ, the White House had engaged lawyers to see how Chair Powell could be removed from office. However, Treasury Secretary Bessent and Commerce Secretary Lutnick are said to have stepped in and raised concerns about the market implications of such a move. Some more details:

As Trump’s criticism of the Fed chair ramped up over the last week, White House lawyers privately reviewed legal options for attempting to remove Powell, including whether they could do so for “cause,” according to people familiar with the matter. The laws that created the Federal Reserve say Fed governors can only be removed before their term ends for cause, which courts have generally interpreted to mean malfeasance or impropriety. Finding a pretext for dismissing Powell would have edged the White House closer to a dramatic escalation with the central bank.

Those discussions came to a halt early this week when Trump told his senior aides that he wouldn’t try to oust Powell. His decision came after interventions from Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, who warned Trump that such a move could trigger far-reaching market chaos and a messy legal fight, the people said. Lutnick also told the president that efforts to fire the Fed chair likely wouldn’t lead to any practical change on interest rates because other members of the Fed’s board would likely approach monetary policy similarly to Powell, one of the people said.

While there was nothing actually new in the WSJ reports, they validated the good news that had pushed stocks up sharply higher overnight, and the result was further gains this morning which sent the S&P up more than 3% and fast approaching the first key CTA buy trigger around 5460.