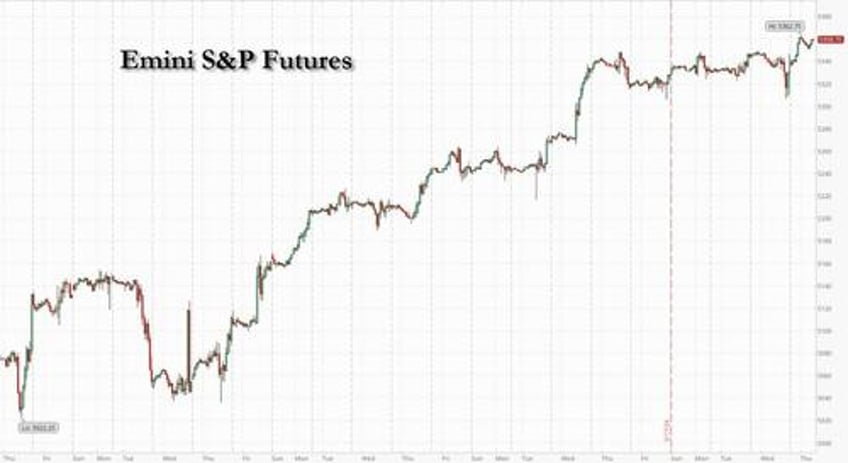

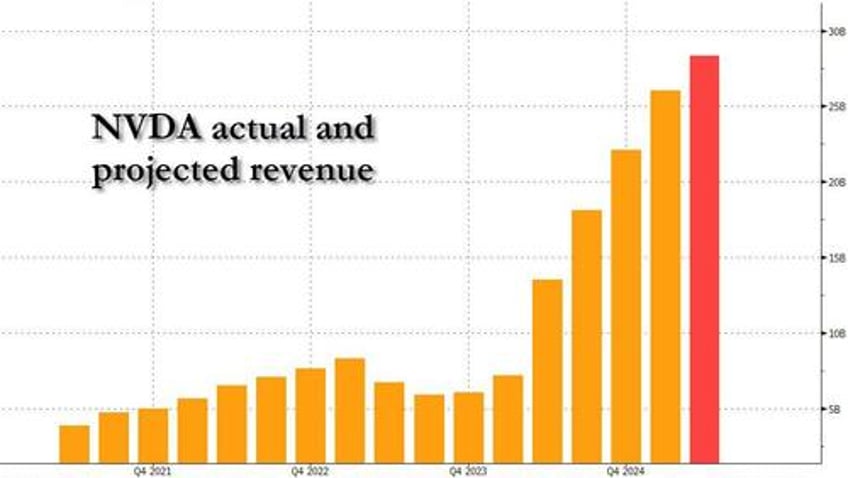

Global markets rallied and US equity futures are sharply higher, poised to push the S&P to a new all time high, after blowout earnings from Nvidia reassured investors that the global artificial-intelligence juggernaut will keep powering equity markets. As of 7:30am, S&P futures were 0.6% higher and Nasdaq futs gained 1.0% entirely on the back of Nvidia's stunning results which saw the company not only hike its Q2 revenue guidance to a consensus-busting $28BN but also announced a 10:1 forward stock split. Elsewhere, the Bloomberg’s dollar index retreated after touching a one-week high while US Treasuries inched higher after losses on Wednesday; European bond markets showed little reaction to the latest PMI report that revealed private-sector business activity at its highest in a year in the euro area, suggesting an economic rebound is taking hold. Oil was flat; bitcoin traded around $70k while Ethereum looked poised to break above $4,000 on today's SEC approval of an ETH ETF. It's a busy day on the macro front with data from the Chicago Fed, jobless claims, Mfg and Service PMIs and New Home Sales on deck.

In premarket trading, it was all tech and all thanks to Nvidia, whose shares rose 7% adding nearly $200 billion to its market cap and poised to add to its 90%-plus year-to-date rally after it reported first-quarter results that beat expectations and gave an outlook that was seen as strong. The company also announced a stock split and increased its dividend. The optimism also lifted peers such as Super Micro Computer and AMD (AMD +2.7%, Dell +5.7%, Super Micro Computer +4.4%, Intel +0.5%). Here are the other notable premarket movers

- DuPont shares climb 5% after the chemical company announced plans to split into three publicly traded companies. Morgan Stanley said this was a “logical decision,” while Ke

- Elf Beauty shares advance 0.6% after the cosmetics company reported fourth-quarter adjusted earnings per share and net sales that came ahead of consensus estimates. Although the company also issued annual projections for sales and profit that didn’t meet expectations, analysts are generally positive on the print.

- Greenwave shares soar 28% after the metal recycling facilities operator announced that it had eliminated all convertible debt.

- Hasbro shares rise 3.4% after an upgrade to overweight at JPMorgan,

- Live Nation shares slide 8.3% after Bloomberg reported that the US Justice Department and a group of states will sue the entertainment company for antitrust violations related to Ticketmaster’s unrivaled control of concert ticket sales, according to people familiar with the case.

- LiveRamp shares rise 14% after the marketing technology company forecast first-quarter an

- Snowflake (SNOW US) shares rise 3.7% after the software company reported first-quarter results that beat expectations and raised its full-year forecast for product revenue. Analysts flagged its margin forecast as a potential concern.

- Under Armour (UAA US) shares drop 1.3% after Oppenheimer downgrades the sportswear company to market perform to await clearer signs of improvements.

- VF Corp. (VFC US) shares plummet 15% after the owner of the Vans and North Face brands reported a loss and a seventh consecutive quarter of falling sales.

- Zuora (ZUO US) shares gain 6.5% after the cloud-based software developer boosted its adjusted earnings per share guidance for the full year; the guidance beat the average analyst estimate.

“This is another important milestone in the AI journey,” said Guy Miller, chief market strategist at Zurich Insurance Company. “Top-performing companies have to deliver and Nvidia has delivered.” The earnings offer clear evidence of the growing importance of AI, and “that’s going to keeping this juggernaut going,” Miller said.

The Nvidia result overshadowed Wednesday’s release of somewhat hawkish Federal Reserve minutes, which showed officials are in no rush to cut interest rates.

European stocks also rose but losses in utilities, real estate and telecommunication names have capped gains. The Estoxx 50 gains 0.5% in early London session with info tech names leading the move higher as NVDA boosted the region’s semiconductor sector. Meanwhile, UK utilities and homebuilders fall after Prime Minister Rishi Sunak unexpectedly announced the general election for July 4 rather than in the autumn. The tech sector leads gains, while utilities post largest declines. Here are some of the biggest European movers Thursday:

- Wizz Air rises as much as 6.8% after issuing income guidance for fiscal year 2025 ahead of expectations, and noted that summer demand is tracking well

- CTS Eventim advance as much as 8.8% after the events ticketing firm reported 12% revenue growth, boosted by an increase of tickets sold online

- Allegro rises as much as 4.8% as 1Q earnings beat showed higher profitability in Poland and reduced losses in international markets

- Mips surges 11% after an ABG Sundal Collier upgrade to buy from hold, saying it looks set for a strong growth acceleration in the second half of 2024

- Tate & Lyle gains as much as 5.8% after announcing its full-year results and the sale of its remaining stake in the Primient joint venture

- Hargreaves Lansdown gains as much as 18% after rebuffing a £4.7 billion takeover proposal. The stock rose above bid value, though Citi says the price is already “rich”

- Embracer falls as much as 11% after reporting weak cash delivery in 4Q. The group also announced that Johan Ekström will step down from his roles as CFO and deputy CEO

- National Grid falls as much as 9.5% after the UK utility said it plans to raise £6.8 billion to fund its £60 billion network spending plan over the next five years

- Orlen drops as much as 7.4% as 1Q earnings missed expectations and amid uncertainty over the new management’s strategy

- Dometic falls as much as 7% after Nordea double-downgrades to sell from buy, giving the RV and outdoor equipment maker its only negative analyst rating

- Julius Baer falls as much as 3.2% after reporting net new money of only CHF 1b, which is weak and well below consensus, according to Vontobel

Elsewhere, M&A news continues to flow in, with Hargreaves Lansdown the latest UK firm to receive a takeover bid. Shares in the investment platform soared after it rebuffed a $6 billion private equity offer. Anglo American shares inched higher as BHP Group was seen moving a step closer to a $49 billion takeover of its smaller rival. Millicom International Cellular SA’s Stockholm-listed depositary receipts jumped as France’s Atlas Investissement confirmed it’s exploring an all-cash tender offer for the firm.

Earlier, Asian equities were mixed as a selloff in Chinese and Hong Kong shares offset gains in regional semiconductor stocks following Nvidia’s latest bullish sales forecast. The MSCI Asia Pacific Index was little changed as of 5 p.m. Hong Kong time. Chinese tech shares bucked the broader rally in the sector amid concerns about an intensifying price war in the local AI market. Alibaba and Tencent were among the biggest drags on the regional benchmark. Alibaba is considering selling convertible bonds, to raise about $5 billion, that can be converted into US-listed stock. BHP was another big contributor to the declines as Asian mining stocks fell after copper and gold prices retreated. The Hang Seng China Enterprises Index slid 1.7% to lead regional losses on Thursday. Traders attributed the broad declines in indexes in China and Hong Kong to profit-taking amid a lack of fresh catalysts after a months-long rally. Benchmarks in Japan and Taiwan advanced, while South Korea’s Kospi fluctuated after central bank Governor Rhee Chang Yong said the potential for an interest-rate hike was limited.

In FX, The Bloomberg Dollar Spot Index drops 0.1% paring Wednesday’s 0.3% rise, its best gain this month. The gauge climbed the previous three sessions amid Fedspeak that showed officials want more evidence inflation is moving lower before considering a rate cut

- EUR/USD rises 0.2% to 1.0842, snapping a three-day decline; it fell to a day-low of 1.0812 following mixed PMI data out of France yet recovered as the German release beat analyst expectations

- GBP/USD up 0.2% to 1.2738 as UK composite PMI came softer than expected; pound and gilts largely looked past an earlier-than-expected UK election campaign, with analysts and investors citing the similar economic policies of the two main parties among reasons for its lack of impact on markets

In rates, treasuries were little changed on the day, with yields trading within one basis point of Wednesday’s session close following a rangebound overnight. US 10-year yields around 4.42%, close to Wednesday session close with bunds trading cheaper by 1.5bp in the sector and gilts trading richer by 1bp. European bond markets showed little reaction to purchasing managers indexes (PMI) that revealed private-sector business activity at its highest in a year in the euro area, suggesting an economic rebound is taking hold. Bunds were re lower after the PMI data with German 10-year yields rising 1bps; investors still continued to price the first European Central Bank rate cut in June. Gilts have erased an earlier drop after UK services PMI came in below estimates. UK 10-year yields fall 1bps. US session focus includes $16b 10-year TIPS reopening, which follows a decent 20-year bond sale on Wednesday which traded 0.2bp through the WI level.

In commodities, oil edged higher but held near the lowest closing level in three months; WTI gained 0.5% to trade near $77.90. Gold and copper prices slid further off recent record highs.

Bitcoin trades fimer but remains under $70k while Ethereum continues to gain above $3.8. Overnight, the US House voted to pass the FIT21 cryptocurrency regulations bill that creates a path for cryptocurrencies to be exempt from many securities regulations if they achieve a sufficient level of decentralisation.

Looking at today's calendar, US economic data includes April Chicago Fed national activity index, initial jobless claims (8:30am), May S&P global manufacturing PMI (9:45am), April new home sales (10am) and May Kansas City Fed manufacturing activity (11am). Fed officials’ scheduled speeches include Bostic at 3pm

Market Snapshot

- S&P 500 futures up 0.5% to 5,354.75

- STOXX Europe 600 up 0.2% to 522.10

- MXAP little changed at 180.85

- MXAPJ down 0.3% to 566.81

- Nikkei up 1.3% to 39,103.22

- Topix up 0.6% to 2,754.75

- Hang Seng Index down 1.7% to 18,868.71

- Shanghai Composite down 1.3% to 3,116.39

- Sensex up 1.2% to 75,111.22

- Australia S&P/ASX 200 down 0.5% to 7,811.80

- Kospi little changed at 2,721.81

- German 10Y yield little changed at 2.57%

- Euro up 0.2% to $1.0843

- Brent Futures up 0.1% to $81.99/bbl

- Gold spot down 0.8% to $2,359.48

- US Dollar Index down 0.15% to 104.77

Top Overnight News

- Nvidia punched through $1,000 premarket, driving futures higher, after the chipmaker’s bullish sales forecast delivered on AI hopes. Analysts hailed the results as they raised their targets on the stock. Peers AMD, Dell, Super Micro and Intel advanced as well. South Korea set aside $19 billion to bolster its chip industry. BBG

- China announced “punishment” military drills around Taiwan in a bid to send a “warning”, just days following the inauguration of the island’s new president. SCMP

- Israel said it would revive stalled cease-fire talks with Hamas after social media video showing female Israeli soldiers being abducted by the militants on Oct. 7 sparked a public outcry. BBG

- Eurozone wages rose 4.7% in Q1, an uptick from +4.5% in Q4 and a sign that compensation pressures remain elevated (most assumed wages would hold steady at +4.5% or even cool a bit). ECB

- White House support building for allowing Ukraine to utilize American weapons in striking missile and artillery launch sites just over the border in Russia (the UK has already lifted such restrictions). NYT

- Retailers begin cutting prices following years of increases in response to cooler consumer demand – Walmart and Target in the last week talked about how they are cutting prices in a bid to drive traffic. FT

- Jamie Dimon told CNBC there’s a chance the US may see a “hard landing,” adding at a JPMorgan Shanghai summit that stagflation would be the worst outcome for the economy. BBG

- The White House emphasized its backing for the Fed’s independence, following heightened speculation over how Donald Trump may ramp up pressure on the central bank if he wins another term. BBG

- The slump in lithium prices took its toll on SQM, the world’s second-biggest producer, which slid to a quarterly loss. One price measure — for lithium carbonate in China — is about 80% below its peak in 2022, with the market still grappling with inflated inventories. BBG

- Tesla "broke ground" on megapack battery factory in Shanghai on Thursday, according to Chinese state media.

- 300 Boeing planes used by United (UAL) and American Airlines (AAL) have potentially fatal fault that could cause jets to explode, Daily Mail reports

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after the negative performance of cash markets stateside and with US futures boosted after hours owing to Nvidia's earnings which also helped some semiconductor names in Asia. ASX 200 was dragged lower by underperformance in the mining sector after recent declines in underlying metal prices and with industry giant BHP pressured after Anglo American rejected its latest proposal and gave it another 7 days to make an improved offer. Nikkei 225 was underpinned and reclaimed the 39,000 status with the index helped by recent currency weakness and as tech stocks were inspired by Nvidia's strong earnings report. Hang Seng and Shanghai Comp were subdued amid ongoing frictions after the USTR posted details of the proposed tariffs on Chinese imports and China’s took countermeasures against a dozen US firms.

Top Asian News

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision unanimous, while it stated that consumption recovery is modest and it will maintain a restrictive policy stance for a sufficient period of time. BoK said exports are to sustain growth and it is to monitor trends of slowing inflation and risks to financial stability. BoK Governor Rhee said chances of a policy interest rate increase are "limited" and that one board member said the path to a rate cut should be opened for the next three months, while Rhee added it is unclear when they will start discussing interest rate cuts given the uncertainty in inflation path and they have not discussed the size of cuts needed.

- South Korea announced a KRW 26tln support package for the chip industry and President Yoon announced they are to establish a KRW 17tln semiconductor financial assistance program at state-run Korea Development Bank, while they will extend the tax credit for the semiconductor industry set to expire at the end of this year.

- MAS said the current policy stance remains appropriate and the prevailing rate of the exchange policy band is needed to keep restraining imported inflation and domestic cost pressures.

- RBNZ Governor Orr said it is disappointing how stubborn domestic component inflation remains and the biggest risk we run is that we don't get inflation low and stable, according to Reuters. RBNZ Governor Orr also commented in a Bloomberg interview that another rate hike would only be meaningful if they believed inflation was getting away from them and noted that patience on inflation is not exhausted. Furthermore, he said inflation will not hinge on any single piece of data and that they can start to ease before inflation hits 2%.

European bourses (Stoxx 600 +0.2%) hold a modest upward bias, and overall unreactive to the mostly well-received EZ Flash PMI data. European sectors are mixed with no overarching bias. Tech outperforms following NVIDIA's blockbuster earnings and 10-for-1 stock split yesterday. Utilities are dragged lower by National Grid announcing a GBP 7bln rights issue. US Equity Futures (ES +0.5%, NQ +0.8%, YM Unch. RTY +0.2%) are mostly firmer but to varying degrees with the ES and NQ benefitting the most from NVIDIA's (+7% pre-market) blockbuster earnings yesterday.

UBS expects Stoxx 600 year-end target to be 540 (currently 522)

Top European News

- Germany's DIHK expects German GDP to stagnate this year vs. prev. view of a 0.5% contraction; Inflation to fall to 2.3% in 2024 from 5.9%; Exports expected to stagnate this year; Private consumption to increase by 1% this year.

- IMF sees French GDP growth at 0.8% this year and 1.3% in 2025.

- ECB's de Guindos said a prudent approach would back a 25bp cut.

- HSBC and Deutsche Bank now expect the BoE to start cutting rates in August (vs prev. forecast of June).

FX

- Dollar is broadly modestly softer vs. peers after running out of steam ahead of 105 (printing a high at 104.96). FOMC minutes were seen as hawkish, though with focus on the upcoming data releases.

- EUR/USD was initially knocked lower by disappointing French PMI metrics before a better outturn for Germany and (to an extent) EZ undid some of the damage. As it stands, EUR/USD is a touch firmer but shy of yesterday's 1.0863 best. There was limited follow through to Eurozone asset prices following the higher than expected Q1 wages release.

- GBP is softer and towards session lows following a miss on services and composite PMI metrics. Cable currently at 1.2710, and still yet to test 1.2700 to the downside (also yesterday's trough).

- JPY is flat vs. the USD after pulling back from its 156.89 peak overnight; highest level since 1st May; and currently sits around 156.70.

- NZD/USD once again the best performer across the majors in the wake of yesterday's RBNZ hawkish hold decision and despite less hawkish commentary from RBNZ's Orr.

Fixed Income

- USTs are contained with only limited spill-over selling seen in the wake of EZ PMI data with US metrics looming large later in the session; For now, the Jun'24 contract remains tucked within yesterday's 108.28+-109.08 range.

- Bunds initially spiked higher in wake of the French PMIs before it took a tumble lower on account of better-than-expected German PMI metrics which saw beats across all three metrics and the composite measure moving further into expansionary territory; much of the downside has been pared in recent trade. There was limited follow through to Eurozone asset prices following the higher than expected release.

- Gilts remain pressured in the wake of yesterday's hot inflation print and spill over selling from European paper, though was unreactive to the UK PMI metrics. Jun'24 contract had been as low as 96.58 before recovering modestly.

Commodities

- Crude prices were initially subdued though climbed higher following upbeat German Flash PMIs in which now forecasts "solid growth" for Germany. Brent near session highs and just above USD 82/bbl.

- Precious metals are lower across the board in a continuation of the price action seen since the surge after last weekend, with major geopolitical developments light, keeping risk premiums at bay; XAU fell from a USD 2,383.79.oz high to a USD 2,354.98/oz low.

- Base metals are sliding across the board, again in a continuation of the recent losses with 3M LME copper now around USD 10,250/t.

- Russian Energy Ministry said Russian oil production was within OPEC+ guidelines in Q1 and Russia exceeded OPEC+ quota in April due to technical reasons in output cuts, while it added that Russia is to submit a plan soon on compensation to the OPEC secretariat, according to Reuters.

Geopolitics: China-Taiwan

- China's military began joint military drills surrounding Taiwan, according to Chinese state media.

- Chinese state broadcaster said Taiwan President Lai's May 20th speech was a 'complete confession' of Taiwan independence and seriously 'provoked' the One-China principle, as well as undermined peace and stability across the Taiwan Strait. China's state broadcaster stated that Lai's speech was 'extremely harmful' and used 'country' to refer to Taiwan throughout his speech, while Lai has no sincerity in promoting cross-strait exchanges and China's drills around Taiwan are 'punishment' for Lai's provocation.

- Taiwan Defence Ministry said it expresses strong condemnation of Chinese military drills and has dispatched forces, while it will take practical actions to protect freedom and democracy, as well as have the 'ability, determination and confidence to ensure national security'. Taiwan's Defence Ministry said ground forces have reinforced defence coordination and safety of military camps, while air defence and land-based missile forces are collecting intelligence on targets.

- Taiwan's Presidential Office said it is regrettable to see China threatening Taiwan's democratic freedoms and regional peace and stability with unilateral military provocation and Taiwan's consistent position is that maintaining regional peace and stability is the common responsibility and goal of both sides of the strait.

- Senior Taiwanese Security Official said around 30 Chinese military planes and a dozen military ships came close to Taiwan as of midday Thursday, some of which crossed the Taiwan Strait median line and approached close to areas of Taiwan contiguous zone

Geopolitics: Middle-East

- US Defense Secretary Austin advocated during a call with Israeli Defence Minister Gallant for an effective mechanism to deconflict humanitarian and military operations in Gaza, according to the Pentagon.

US Event Calendar

- 08:30: May Initial Jobless Claims, est. 220,000, prior 222,000

- May Continuing Claims, est. 1.79m, prior 1.79m

- 08:30: April Chicago Fed Nat Activity Index, est. 0.13, prior 0.15

- 09:45: May S&P Global US Manufacturing PM, est. 49.9, prior 50.0

- May S&P Global US Services PMI, est. 51.2, prior 51.3

- Global US Composite PMI, est. 51.2, prior 51.3

- 10:00: April New Home Sales, est. 678,000, prior 693,000

- April New Home Sales MoM, est. -2.2%, prior 8.8%

- 11:00: May Kansas City Fed Manf. Activity, est. -7, prior -8

Central Banks

- 15:00: Fed’s Bostic Participates in Student Q&A

DB's Jim Reid concludes the overnight wrap

Markets had an eventful day yesterday, with various headlines that drove swings in both directions. As we go to press this morning, sentiment has turned more positive, with futures on the S&P 500 up +0.65% following an upbeat outlook from Nvidia’s results after the close. However, markets had previously lost ground earlier in the day, with the S&P 500 (-0.27%) falling back after the minutes of the latest Fed meeting were on the hawkish side. Moreover, bonds had already sold off after the UK CPI print surprised on the upside earlier in the day, which served as a reminder that the path back to target may not be a smooth one, and led investors to dial back the chance of rate cuts across Europe. In addition, there was also big news on the political side, as UK PM Rishi Sunak announced a general election would take place on July 4, just six weeks from today. So that’s another election in a busy political calendar this year, particularly with the US presidential election in November.

In terms of how the day developed, it began with that UK CPI release shortly after we went to press yesterday. The print showed headline CPI falling to +2.3% in April, which is the lowest in almost three years, and down from +3.2% the previous month. However, the r eading was above the +2.1% expected by the consensus, and core CPI also surprised on the upside at +3.9% (vs. +3.6% expected). So from a market perspective, the focus was on the upside surprise, and investors pushed back the likely timing of a rate cut from the BoE in response. Indeed, the chance of a June cut fell from 52% the previous day to 12% by the close, so there was a clear shift in expectations. And looking further out, just 38bps of rate cuts were priced in by the December meeting, down from 55bps the day before. Following the release, DB’s UK economist now expects the Bank of England to start cutting rates in August, with just 50bps of cuts this year. See his full update here.

That upside inflation surprise led to a major selloff for UK gilts, with the 10yr yield up by a notable +10.3bps on the day, whilst the 2yr yield was up by an even larger +14.7bps. And this was echoed across Europe, where investors dialled back their expectations for ECB cuts as well. In fact, the amount of cuts priced in by the ECB’s December meeting fell by -4.4bps on the day to 64bps, the fewest so far this year. In turn, that prompted a rise in yields across the continent, with those on 10yr bunds (+3.6bps), OATs (+3.5bps) and BTPs (+3.1bps) all rising as well.

Whilst the CPI print provided the initial focus for markets, there was attention on the UK throughout much of the day, as Prime Minister Rishi Sunak unexpectedly announced that a general election would take place on July 4, just six weeks from today. The move came as a surprise relative to 24 hours ago, since an election didn’t have to be held until January 28 at the latest, and the general consensus was it was more likely to take place in the autumn at some point. In terms of the process, the UK has a parliamentary system, so voters vote for individual Members of Parliament rather than directly for the Prime Minister. But as it stands, Politico’s polling average puts the opposition Labour Party on 44%, with the governing Conservatives behind them on 23%. After the election, the transition of power in the UK is immediate if a new government can be formed, so if Labour won a majority of MPs in the House of Commons, then their leader Keir Starmer would become Prime Minister the following day on July 5.

Otherwise yesterday, the main development for markets came after the close with Nvidia’s results. The company exceeded Q1 estimates and provided stronger-than-expected guidance for Q2. They expect revenue of c.$28bn in the current quarter (vs. estimate of $26.8bn) and see demand for its products continuing to outstrip supply into next year. The company also announced a 10-for-1 stock split, with its shares gaining around +6% in after-hours trading and moving above the $1000 a share level. So Nvidia continued to beat expectations, even if less dramatically than its last set of results in February that saw a +16.4% share price rise the next day. Those results have also prompted a rise in US equity futures, with those on the S&P 500 (+0.65%) and the NASDAQ 100 (+0.97%) pointing higher.

Yet before Nvidia’s results came out, it was actually a weak day for equities, with the S&P 500 (-0.27%) coming off its all-time high from the previous session. That selloff came as a result of some hawkish commentary from the latest Fed minutes. In particular, they said that “various participants mentioned a willingness to tighten policy further” if needed. So that pointed to more hawkish concerns than the market had taken away from Powell at the press conference on May 1. Nevertheless, the minutes had only a modest impact on Treasuries, with yields moving 1-2bps higher in their aftermath. And by the close, 2yr yields were up +4.1bps on the day, with much of this rise coming earlier during the European session, while 10yr yields closed +1.1bps higher at 4.42%.

For equities, that weakness came in part from the Magnificent 7 (-0.61%), which posted its worst performance in three weeks. But there was also broader softness after the Fed minutes, with the small cap Russell 2000 (-0.79%) seeing its largest decline so far in May. Within the S&P 500, energy stocks struggled (-1.83%) as oil prices fell for a third consecutive day, with WTI oil down -2.13% to $77.57/bbl, its lowest level in over two months. And this weakness was also prevalent in Europe, with the STOXX 600 (-0.34%) posting a further decline, which came alongside losses for the FTSE 100 (-0.55%), the CAC 40 (-0.61%) and the DAX (-0.25%).

Overnight in Asia, equities have put in a mixed performance. On the one hand, there’ve been solid gains in Japan, with the Nikkei up +1.15%. That comes as the flash manufacturing PMI was up to 50.5 in May, marking its highest level in a year. And there was also a big milestone for Japanese government bond yields yesterday, as the 10yr yield exceeded 1% for the first time since 2012. Elsewhere in Asia though, there’s been a weaker performance, with the Hang Seng (-1.38%), the Shanghai Comp (-1.00%) and the CSI 300 (-0.89%) all losing ground this morning, whilst the KOSPI is only up +0.18% after the Bank of Korea left interest rates unchanged, in line with expectations.

In terms of other data, we’ll get the flash PMIs for May today, but overnight we’ve also had the Australian numbers, where the composite PMI fell to 52.6, down from 53.0 in April. Otherwise, US existing home sales in April fell to an annualised rate of 4.14m in April (vs. 4.23m expected).

To the day ahead now, and the main data release will be the global flash PMIs for May. Otherwise in the US, there’s the weekly initial jobless claims and new home sales for April, and in the Euro Area there’s the European Commission’s preliminary consumer confidence indicator for May. From central banks, we’ll hear from the Fed’s Bostic, the ECB’s Villeroy, and the BoE’s Pill.