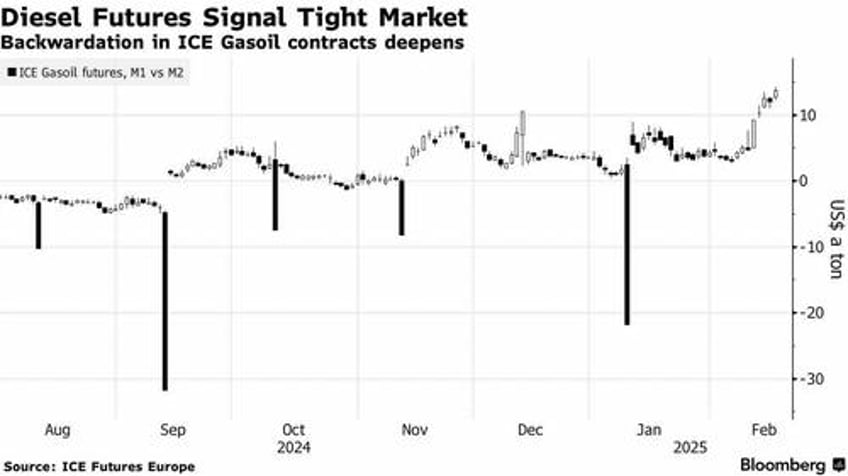

Europe’s diesel markets are flashing signs of tightness, with near-term diesel contracts on Tuesday hitting the steepest backwardation--a situation where futures contracts for prompt delivery are more expensive than those further down the curve--since March.

Backwardation is often interpreted as a sign of limited supply, with traders now willing to pay a premium for fuel that’s available sooner.

In contrast, Europe’s natural gas prices have pulled back sharply, with Title Transfer Facility (TFF) natural gas futures falling to €47.94 per megawatt-hour on Tuesday, down almost 20% from a two-year high of €59 hit on February 10th as shortage concerns eased.

Last week, Germany, France and Italy came up with a proposal to ease EU gas storage requirements in a bid to normalize the market. Under the current European Commission regulation mandates, all EU nations are required to refill their storage caverns to 90% capacity by November, with interim targets set for February, May, July, and September. EU gas storage is currently under 45% full, making it difficult to meet the requirement of 90% by November 1. That’s well below last year's 67% mark at a corresponding point and the 10-year average of 51% for the same period.

The continent’s seasonal draw has been bigger than in the previous two winters due to colder weather, lower wind power generation due to low wind speeds and the termination of Russian gas imports via Ukraine. The situation is even more dire in Germany, Europe’s largest economy, with its underground sites currently only 48% full, a significant decrease from the 72% recorded at the same time last year, according to data from Gas Infrastructure Europe (GIE). However, warmer temperatures in northwest Europe coupled with a surge in LNG imports are now helping slow withdrawals.

Further, the markets are beginning to price in a potential return of more Russian gas to Europe. According to Tyler Richey, co-editor at Sevens Report Research, a ceasefire to the Russia-Ukraine war could be bearish for oil and gas prices if Trump pushes for removal of sanctions on the Russian energy industry.

The latest sanctions by the Biden administration roughly tripled the number of directly sanctioned Russian crude oil tankers, enough to affect around 900,000 barrels per day (bpd). Whereas it’s highly likely that Russia will try to circumvent the sanctions by employing even more shadow fleet tankers and ship-to-ship transfers, StanChart predicted 500,000 bpd of displacements over the next six months.