While almost all other auto manufacturers, especially those from Japan, are mulling exits from China (where domestic brands are starting to dominate the EV market), Stellantis is doing the opposite and investing in an EV startup.

The U.S. based auto manufacturer who makes Jeep and Dodge brands said it would be investing 1.5 billion euros ($1.58 billion) into Chinese EV startup Leapmotor, CNBC reported this week.

Stellantis CEO Carlos Tavares said on Thursday morning: “Through this strategic investment, we can address a white space in our business model and benefit from Leapmotor’s competitiveness both in China and abroad."

Analyst Abhik Mukherjee of Couterpoint Research told CNBC: “This deal presents clear synergies for both Stellantis and Leap Motor. Stellantis stands to benefit by strengthening its presence in the Chinese market, while Leap Motor gains an easier entry into the European market.”

Stellantis is forming the Leapmotor International joint venture with a 51% majority stake to enhance the Chinese brand's electric car sales globally.

The investment also grants Stellantis about a 20% equity in Leapmotor and two board seats. Amid stiff competition from companies like BYD and Tesla in China's leading EV market, traditional automakers like Stellantis, which holds a mere 0.3% market share in China, are accelerating their shift to electric vehicles.

Recall we just wrote days ago about how Mitsubishi was exiting China and how other Japanese automakers were considering following suit.

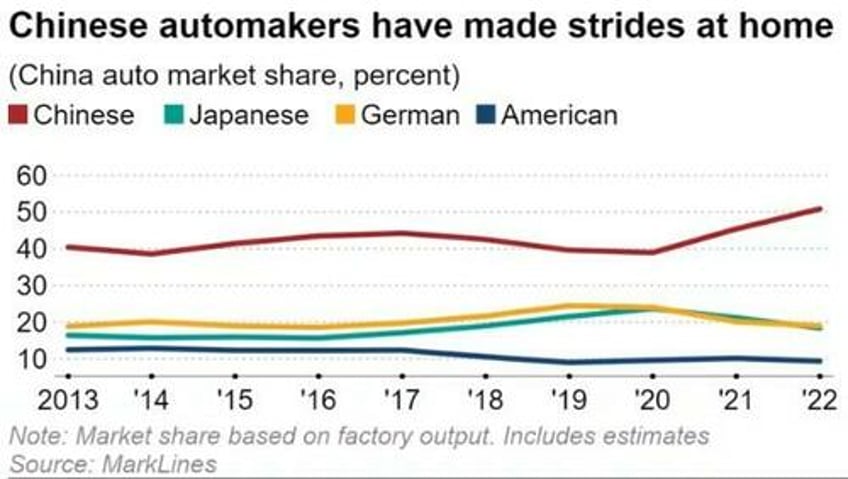

According to research by MarkLines cited by Nikkei this week, Japanese car manufacturers such as Toyota, Honda, and Nissan are lagging in the Chinese market this year. In the first three quarters of 2023, the trio's combined new vehicle sales were 1.29 million, a 26% year-on-year decrease. Both Toyota and Nissan experienced declines in the ballpark of 30%.

The rise in China's EV adoption and the dominance of local brands like BYD and Great Wall Motor are challenging Japanese automakers. Electric vehicle sales in China soared 80% to 5.36 million last year, capturing about 20% of the new car market.

Japanese companies, traditionally strong in gas-fueled cars, are falling behind in the fast-paced EV sector led by Chinese firms.

Facing challenges, Japanese automakers are reorganizing their Chinese operations. Mazda plans to cut its dealership network by about 10% from 2022 levels, while Toyota terminated contracts for roughly 1,000 workers at a joint venture. Honda and Nissan have reduced local production, with Nissan's output reportedly at half its peak. Estimates suggest Toyota, Nissan, and Honda have a combined 40% excess capacity in China, based on current sales forecasts.