It was another ugly day on Wall Street, with tech stocks slumping and the Nasdaq sliding into correction territory down for the 6th day in the past 8, amid what Goldman called "clear de-gross type of price action today as super cap tech weighed at the index level." Indeed, while regional banks (+3.3%), the most shorted basket (+1.2%), and CRE (+1.5%) all gained, it was Mega Cap tech that stumbled another -2.9%, coupled by that other recent Wall Street obsession, Obesity Drugs, down -2.7%. And extending on the "Brutal Tape" observations from yesterday, today Goldman writes that "risk appetite and sentiment feel as bad as we've sensed in quite some time."

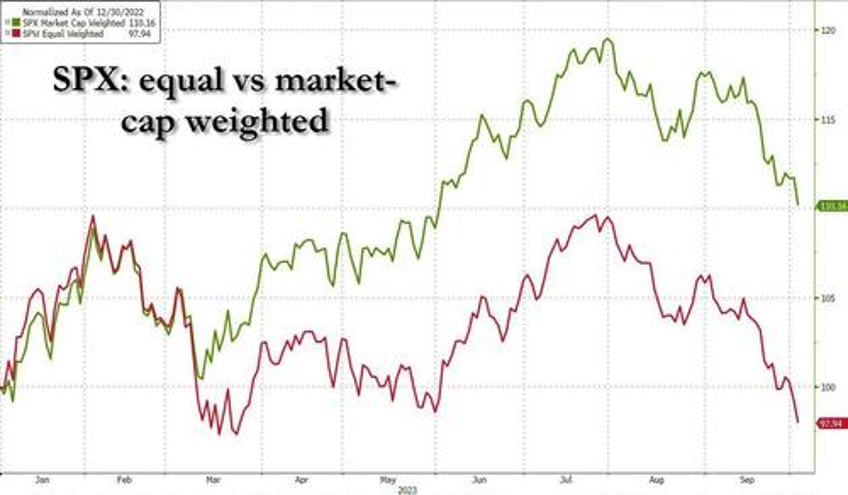

Tech aside, small-caps, pockets of cyclicals, and S&P equal-weighted index (SPW) fared much better today (for reasons touched upon by Charlie McElligott earlier) all against a backdrop of a robust 3Q GDP report and a deluge of earnings updates. And speaking of the equal-weighted S&P, Goldman's Mike Washington agreed with BofA's Michael Hartnett, and said in his end-of-day wrap that the recent price action in supercap tech post earnings prints (which have been fine) is telling us to brace for some convergence between the S&P cap-weighted (SPX) and its equal-weighted index (currently at the widest margin of outperformance in 30+ years).

Moving on: according to Washington, the Goldman trading floor finishing -566bps better for sale vs -70bps 30d avg. The desk saw broad based supply from both L/Os (-9% net sellers) and HFs (-2.3% net sellers), most heavily driven by mega cap tech and other expressions of TMT. Discretionary was also the second most net sold sector by both client types.