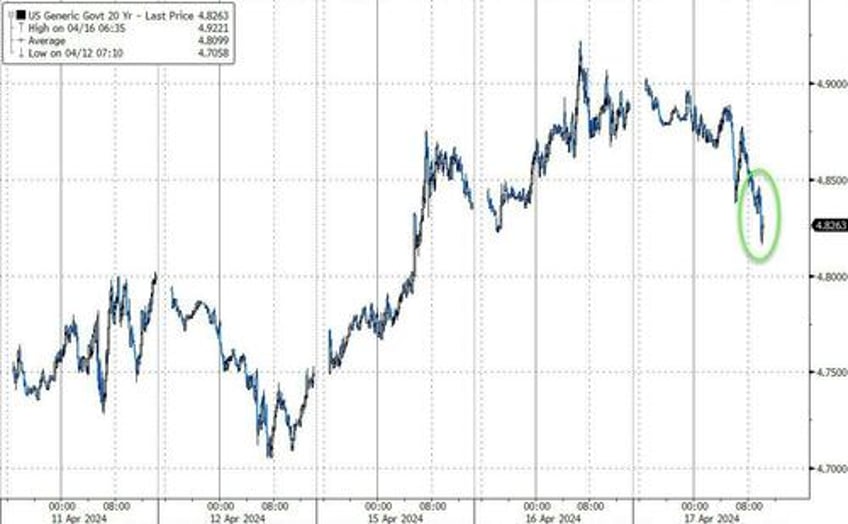

With yields surging yesterday to a 2024 high in a move which sent stocks sliding for a 3rd consecutive day, a dump which extended today as more CTA selling kicked in, but unlike yesterday it is now also manifesting in a flight to bond safety which has pushed yields sharply lower, moments ago the Treasury sold $13BN in 19-Year 10-month reopening of 20Y Treasury cusip TZ1 in what was a stellar auction.

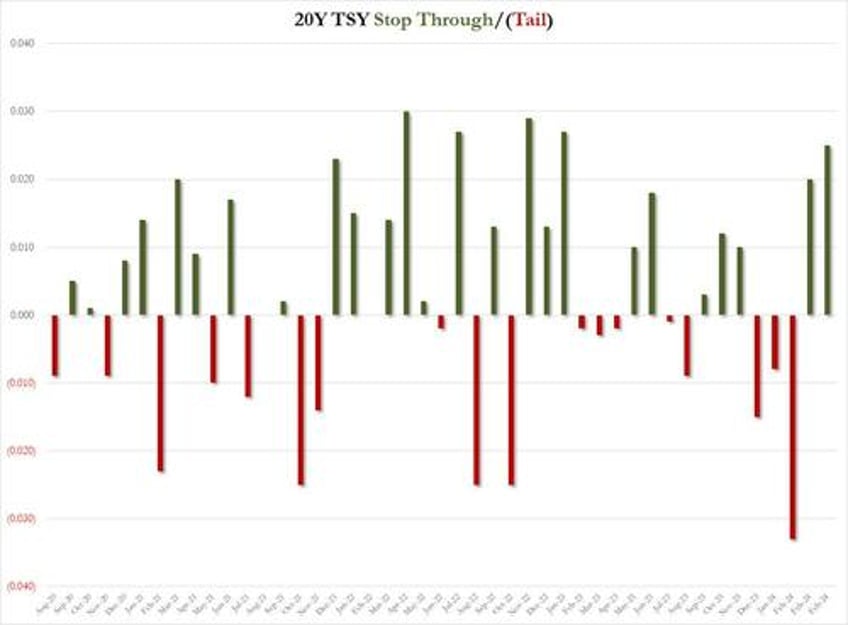

The high yield of 4.818% was 28bps higher than March's 4.542% ad the highest since October's record high 5.257%, but it also stopped through the 4.843% When Issued by 2.5bps, the biggest stop through since Jan 2023.

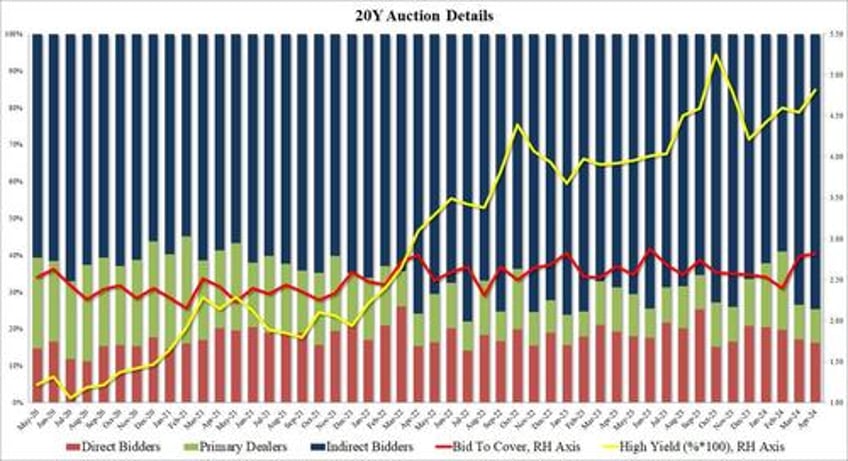

The bid to cover was also impressive, rising from 2.79 to 2.82, the highest since June 2023 and clearly well above the six-auction average.

The internals also impressed with Indirects awarded 74.7%, up from 73.5% last month and the highest since February 2023. And with Directs awarded 16.2%, just below the 18.3% six-auction average, dealers were left holding just 9.1%, the lowest since June 2023.

Overall this was a stellar auction, and one which pushed 10Y yields to session lows of 4.58%, down nearly 10bps on the day, before giving up some of the gains.