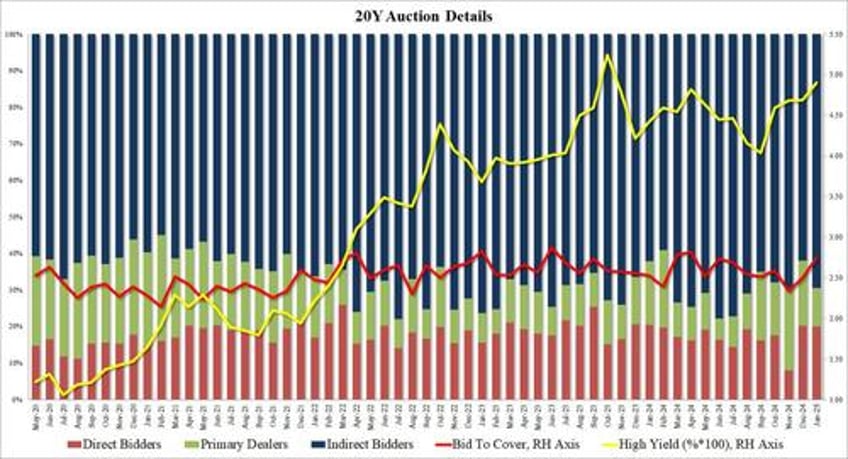

The When Issued yield on the 20Y auction ahead of today's 19Y, 10M reopening was a whopping 24bps higher than December and an even more whopping 90bps from the September auction (when the Fed cut rates by 50bps), and it also happened to be the reason why demand for 20Y paper today was off the charts.

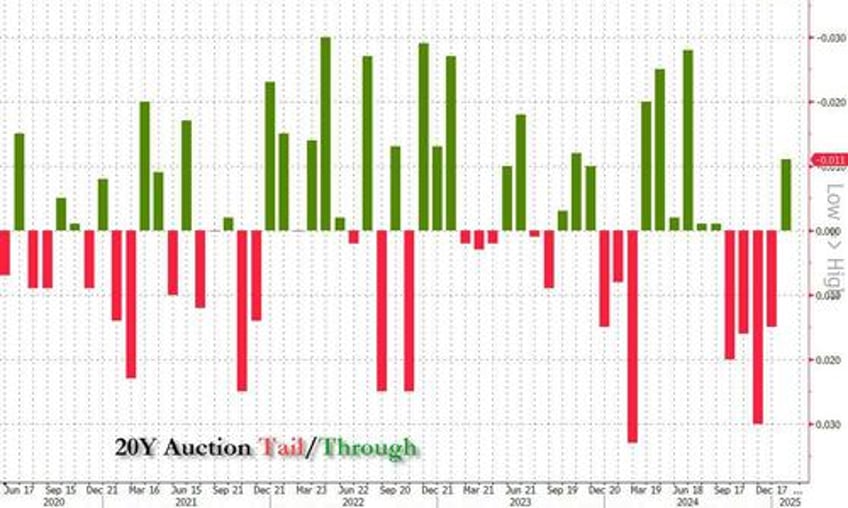

The high yield on today's $13BN reopening of 20Y coupons was 4.900%, stopping through the WI 4.911% by 1.1bps, which was not only the first non-tailing 20Y auction since August, but the biggest stop through since June (when it was 2.8bps).

The Bid to cover was also notable: surging from 2.50 to 2.75 (vs a six-auction average of 2.53), this was the highest BTC since April and one of the highest on record.

The internals were also impressive, with Indirects spiking from 62.0% to 69.5%, the highest since August.

Overall, this was stellar auction, one of the strongest sales of 20Y paper since mid-2024, and one which was made possible by the recent dramatic selloff across the long end. Yet despite the huge demand, the reaction in the second market was muted, with the 10Y barely moving 1bp lower from session highs to 4.61%, roughly where it closed last week.